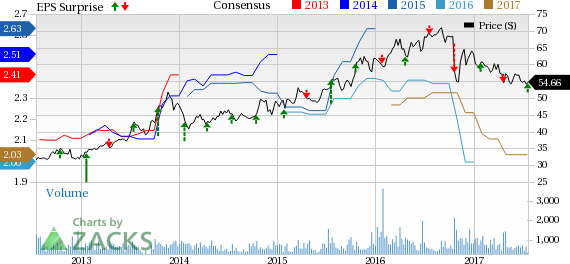

RLI Corp.’s (NYSE:RLI) second-quarter 2017 operating earnings of 61 cents per share surpassed the Zacks Consensus Estimate by nearly 13%.

The bottom line remained flat year over year. The quarter witnessed lower premiums owing to re-underwriting on auto-related exposures, and discontinuation of some products. Nonetheless, the Casualty segment performed strongly.

Including net realized gain of 2 cents, net income declined 9% year over year to 59 cents per share due to adjustment of some one time items.

Operational Performance

Operating revenues for the quarter totaled $197.5 million, up 2.3% year over year due to higher net premiums earned and net investment income. However, revenues missed the Zacks Consensus Estimate of $199 million by 1%.

Gross premiums written declined 4% year over year to $240.9 million due to weaker performance by the Property and Casualty, and Surety segments.

Total expenses increased 6.4% year over year to $168.9 million due to higher loss and settlement expenses, policy acquisition costs and insurance operating expenses.

Underwriting income declined 24% year over year to $19.7 million due to lower underwriting income in the Property and Casualty segment. Combined ratio deteriorated 380 basis points year over year to 89.3%. Nonetheless, the company has been able to deliver underwriting profits for the last 21 straight years.

RLI Corp.’s net investment income improved nearly 1.5% year over year to $13 million. Total return from the investment portfolio was 1.8%, while the bond portfolio retuned 1.7%. The equity portfolio returned 1.8%.

Financial Update

RLI Corp. exited the second quarter with total investments and cash of $2.1 billion, up 4% from year-end 2016.

Book value was $19.93 per share as of Jun 30, 2017, up 6.4% from Dec 31, 2016.

Long-term debt was $148.8 million, reflecting a 0.1% increase from the 2016-end level.

Statutory surplus increased 5.1% year over year to $904 million.

Net cash flow from operations improved 31.1% to $63.3 million in the quarter.

Dividend Payout

On Jun 20, 2017, the company paid out a cash dividend of 21 cents per share, reflecting a 5% year-over-year increase. During the last five years, RLI has paid cumulative dividends of over $632 million.

RLI has been consistently paying dividends for the last 42 years.

Zacks Rank

Currently, RLI Corp. has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry that have reported their second-quarter earnings, the bottom line at Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc. (NYSE:FNF) beat their respective Zacks Consensus Estimate, while The Progressive Corporation (NYSE:PGR) missed the same.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillion Aires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post