Positive momentum continued to lift risky assets last week, based on a set of proxy ETFs for the major asset classes. For the fourth straight week, the risk-on trade prevailed. The ongoing rally continues to pare the red ink in the trailing one-year-return column, which is inching closer to an even split between winners and losers.

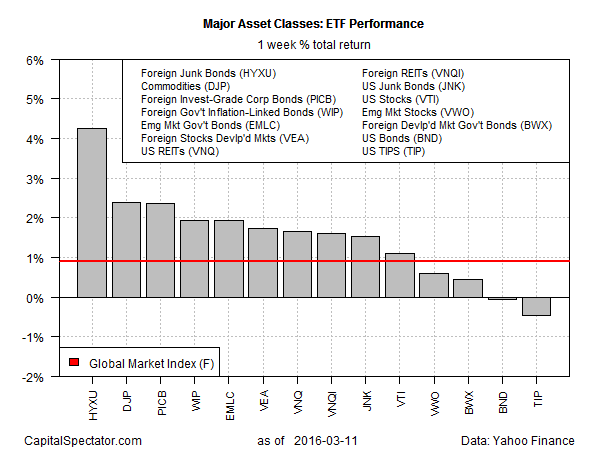

Leading the winners last week: foreign junk bonds via iShares International High Yield Bond (NYSE:HYXU). The latest pop in markets around the world left only two losers last week: investment-grade US bonds Vanguard Total Bond Market (NYSE:BND) and inflation-indexed Treasuries iShares TIPS Bond (NYSE:TIP), which posted fractional declines for the week through March 11.

Last week’s buying spree continued to lift an ETF-based version of the Global Market Index (GMI.F)–a passively managed benchmark that holds all the major asset classes in market-value weights. GMI.F climbed 0.9% for the five trading days through March 11, marking the fourth weekly gain for the benchmark.

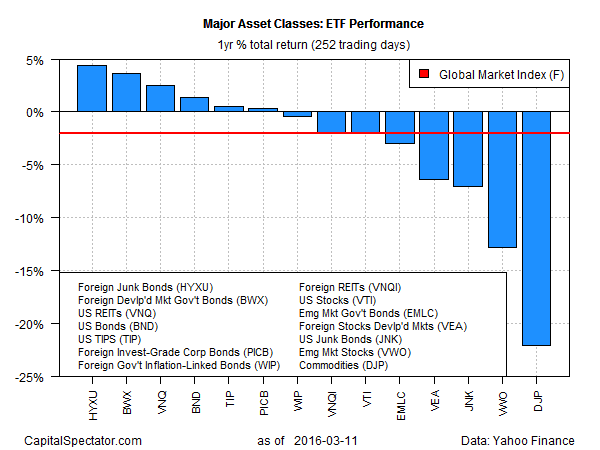

Meantime, the one-year ledger is no longer mired with across-the-board losses. The four-week rally has lifted nearly half of the major classes into positive territory. Foreign junk bonds iShares International High Yield Bond (NYSE:HYXU) are also in first place for the trailing 252-day period, climbing by nearly 5% through Friday vs. the year-earlier level on a total-return basis. But there’s still plenty of red ink, and broadly defined commodities iPath Bloomberg Commodity Total Return Exp 12 June 2036 (NYSE:DJP) are still in last place with a hefty slide in excess of 20%.

Despite the improvement for the one-year profile, GMI.F remains underwater for the trailing one-year period. Although the losses have eased recently, the benchmark remains in the red by 2.0% for the year through Mar. 11.

From a US perspective, the upbeat economic reports of late have thrown cold water on the notion that a new recession is near for the world’s largest economy. But the mood is still weak, according to the latest survey data for investors. The Wells Fargo/Gallup Investor and Retirement Optimism Index slipped to a two-year low in this this year’s first quarter, Gallup reported last week. But as recent market action suggests, the markets are inclined to climb a wall of worry these days.

“While things aren’t great, they’re not the disaster we thought,” Bill Strazzullo, chief market strategist at Bell Curve Trading, told AP on Friday. “We’ve rallied after a horrendous start to the year.”