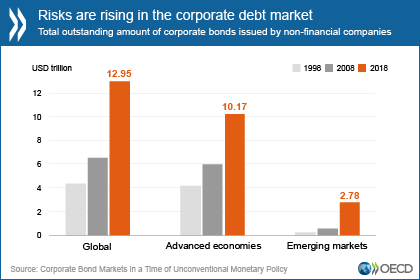

The OECD recently published a paper called “Corporate Bond Markets in a Time of Unconventional Monetary Policy,” which showed that outstanding global corporate debt has surged over the past decade in both advanced and emerging economies alike. Total outstanding corporate debt increased by 70% from $5.97 trillion in 2008 to $10.17 trillion in 2018 in advanced economies, and has soared 395% to $2.78 trillion in emerging economies.

China is the primary driver of the emerging market credit boom. Before 2008, China had very little corporate debt, but had accumulated $590 billion by 2016. The OECD paper also warns about the risks faced by highly leveraged companies in the next economic downturn.

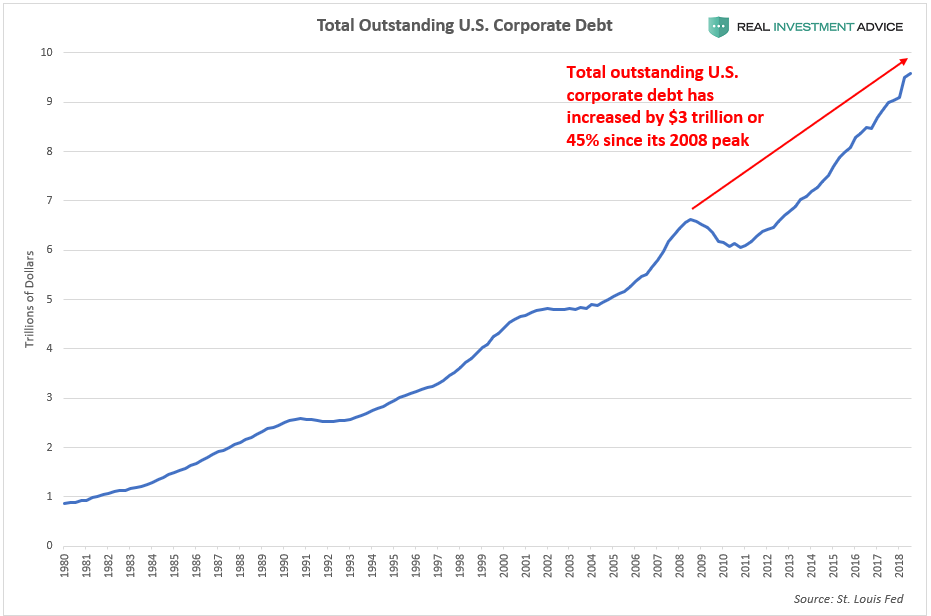

The OECD’s global corporate debt warning echos the warnings I’ve been making in the past year (read my U.S. corporate debt bubble report in Forbes for more detail). To summarize my views, ultra-low bond yields over the past decade have encouraged a corporate borrowing bubble that has also been funding the stock buyback boom. As a result, total outstanding U.S. corporate debt has increased by $3 trillion or 45% since the last peak in 2008:

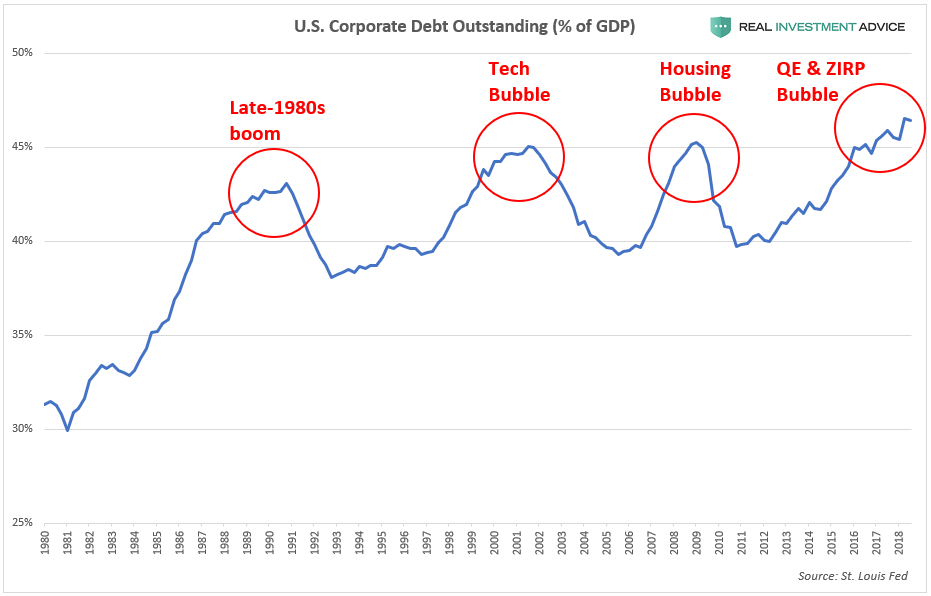

U.S. corporate debt is now at an all-time high of over 46% of GDP, which is even worse than the levels reached during the dot-com bubble and mid-2000s housing bubble:

I recommend watching my presentation about the U.S. corporate debt bubble to learn more:

Because interest rates and bond yields are still at ultra-low levels compared to prior cycles, the U.S. and global corporate debt bubble is likely to grow even larger than it did in the past (relative to GDPs) before it bursts. Of course, that is no reason for relief – the larger the global corporate debt bubble grows, the more malinvestments will accumulate, which will result in an even more powerful bust in the end.