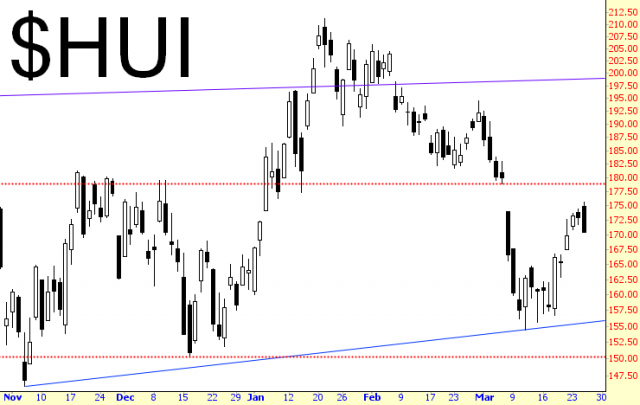

Simply stated, I am aggressively short, with an increase in my exposure on the short side today in the precious metals and energy sectors. That may seem odd, given their strength, but I’m a contrarian, after all.

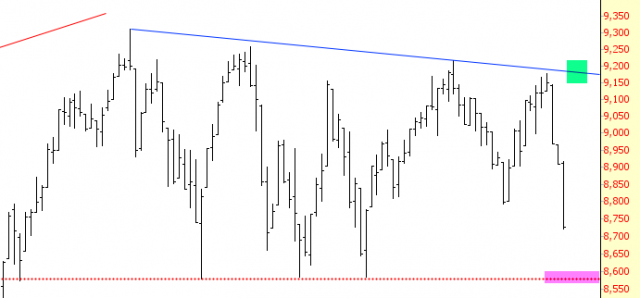

On the Dow Transports, the opportunity is to meet the horizontal line or, even better, break it, whereas the risk, tinted in green, is receding in the distance.

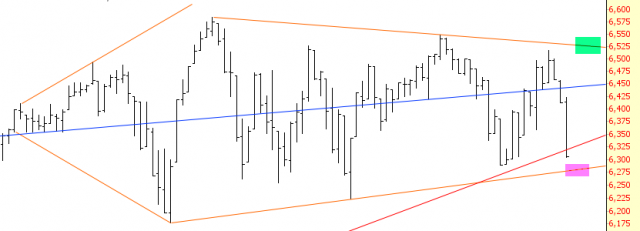

The Dow Jones Composite whose pattern I’ve belabored relentlessly on this blog, remains fish-bound. The opportunity, again, in magenta, is deliciously close, whereas the risk, in green, is way the hell up there at the top of the fish’s body.

The true shining light for me is the ES, since that’s what I’m using as my most ambitious goal. In other words, my most wild-eyed dream would be for a trip down to about 1980. That is VERY ambitious in this totally fake, manipulated, perverse market, but, there, I said it.

My short position on miners, one day old, got augmented today, and the bearish engulfing pattern at day’s end was just what the doctor ordered.

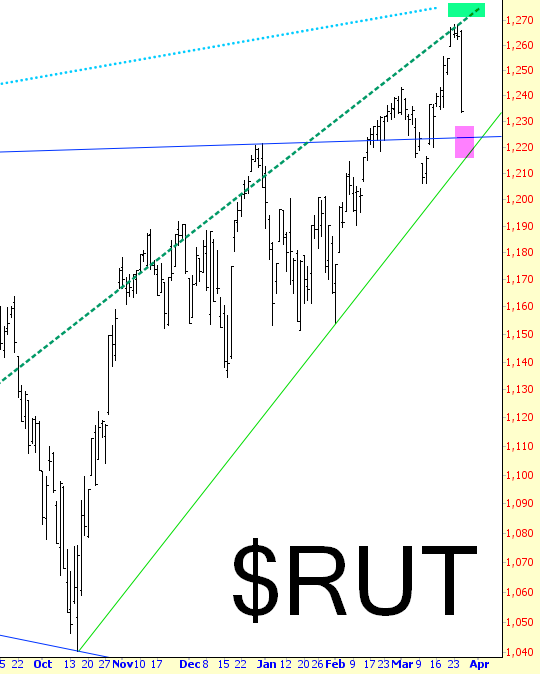

As for the Russell 2000, it had been irritatingly strong for days, but today it finally succumbed. The opportunity (break the supporting trendline!) is much closer to the risk (pushing above the cyan and green resistance lines).