Market movers today

Markets will watch out for further trade war escalation and 'tit-for-tat' headlines, after China on Friday announced tariff hikes on US imports and President answered in kind.In Europe focus is on the German Ifo index for August. Last week's PMI figures finally signalled some stabilization, but the ZEW survey gave a different signal. We think the battered German economy is not yet out of the woods (see here ) and hence look for a further deterioration in today's Ifo expectations and current situation assessment on the back of ongoing geopolitical uncertainties.In the US, preliminary capex orders in July are due, which will be interesting in the light of the ongoing manufacturing slowdown and trade war uncertainty. It seems that many companies are reluctant to invest in the current environment.

Selected market news

The US-China trade war went from bad to worse to an unprecedented level on Friday with a tit-for-tat escalation of imposing tariffs from either side of the front. On Friday afternoon, China announced countermeasures to Trump's 10% tariffs on USD300bn of Chinese goods. Beijing will add 5-10% tariffs on USD75bn of US imports on 1 September and 15 December (see China weekly letter here ). Trump responded violently. The president 'ordered' US companies to find an alternative to China, and said that he would respond to China's tariffs in the afternoon (US time). After US markets closed, Trump announced that he would raise tariffs by 5% on all US imports from China, which amount to around USD550bn. The US will raise tariffs on USD250bn of Chinese imports to 30% from 25% on 1 October. The 10% tariffs on USD300bn of Chinese imports will be raised to 15% on 1 September and 15 December. With the latest tit-for-tat escalation, it's nearly impossible to say how the end game of the trade war will play out. Near term, we should watch out for: a) China's response to Friday's tariffs, b) China's countermeasure to the blacklisting of Huawei and its affiliates, which Beijing says that it will announce soon, c) information about trade talks set to take place in September, and d) signs that China considers imposing restrictions on exports of rare earth metals. We expect that China will respond to the US's blacklisting of Huawei and Friday's tariffs. See also Harr's view: Lower equities, higher volatility on trade war escalation .

In Powell's much awaited Jackson Hole address he did not pre-commit to more easing as expected, which in other words means an unchanged Fed narrative. He repeated the easing bias through "will act as appropriate to sustain the expansion". We believe that in particular Powell addressed two very important items; 1) the worsening trade war (Powell referred to the period since the July FOMC meeting as 'eventful') 2) the global economy has shown more weakness since the July FOMC meeting.

The Asian session points to another risk off mood to dominate financial markets after the escalating trade war with equities down around 2. US 10Y touched 1.48%, which has not been seen since late 2016.

Fixed income markets

The trade war between the US and China continues to dominate global financial markets and the yield on 10Y Treasuries fell some 12bp from the peak on Friday on the expectation of more easing from the Federal Reserve, and both China and US adding tariffs on each other’s imported goods. However, we have seen limited impact on the 10Y BTPS-Bund spread which is now below 200bp despite the political uncertainty in Italy and the bleak prospects for the Italian economy in case of a full-blown trade war.

This week, there are 2Y and 10Y auctions in Germany and Italy sells a 2Y 0% bond on Tuesday and traditional BTPS on Thursday. We expect that the Italian Tesoro will launch a new 7Y bond on Thursday as they have done for the past four years. Furthermore, we expect that Finland will “open” the new issuance “season” in the European government bond market with a syndicated deal this week. The Finnish State Treasury has traditionally been the first one to come to the market in Q3 and this year is no different. We expect it to be a 5Y benchmark. See more in our Government bond weekly.

In Scandi markets both Norway and Sweden will tap-sale in government bonds. Sweden will do a 7-year benchmark and 10Y benchmark. Norway will announce today which bond they are going to issue.

FX markets

Fed hawks did their best talking up US rates and USD last week, but it all turned around Friday after Fed chair Powell’s Jackson Hole speech and the escalation of the trade war.

USD rates and USD/JPY are now trading close to mid-August lows and even EUR/USD bounced on the news even though the pair has been less receptive to trade and/or US monetary policy news lately. Development on Friday means that markets will be on its toes this week before key US data releases (ISM and NFP) next week. We stress that we still see potential for USD/JPY to undershoot our 3M (NYSE:MMM) forecast of 1.05.

In Scandi FX, especially the NOK suffered from the further ‘tit-for-tat’ trade war escalation on Friday as risk assets came under pressure returning EUR/NOK to the 10.00 level. This illustrates the important point that domestic releases are far less important in driving the NOK now relative to the global risk environment. We expect this to also be the case this week. That said, this week will finish off with a range of important Norwegian numbers (GDP, retails sales, NAV) which, however, are more likely to drive front-end NOK rates.

Our expectation is that the numbers will come out to the strong side of markets’ expectations and hence increase market expectations of a September rate hike from Norges Bank. All else equal, this should drive a stronger NOK, but we emphasize the global environment is far more important at this stage.

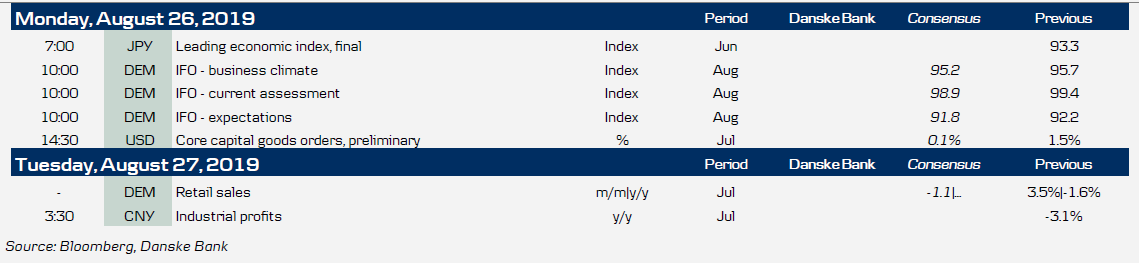

Key figures and events