The US dollar fell against most of its main currency rivals on Friday, a day after the Fed announced a new round of quantitative easing to stimulate growth in the US economy. The news led to risk taking among investors, who shifted their funds from safe-haven currencies like the greenback, to higher yielding ones like the euro and AUD. This week, traders will want to pay attention to a batch of euro-zone and US news. Tuesday's German ZEW Economic Sentiment, Wednesday's US Building Permits figure and finally German manufacturing data and a Spanish bond auction on Thursday, all have the potential to create significant market volatility.

Economic News

USD - Dollar may Extend Bearish Trend This Week

The US dollar took additional losses on Friday against its main currency rivals, as investors continued to shift their funds to higher-yielding currencies following the Fed's decision to initiate a new round of monetary easing to boost the US economic recovery. The USD/CHF fell more than 100 pips over the course of the day, eventually reaching as low as 0.9237 before staging a slight upward recovery to finish out the week at 0.9269. The GBP/USD shot up more than 70 pips over the course of the day to trade as high as 1.6255 before a downward correction brought the pair to 1.6215 where it closed out the week.

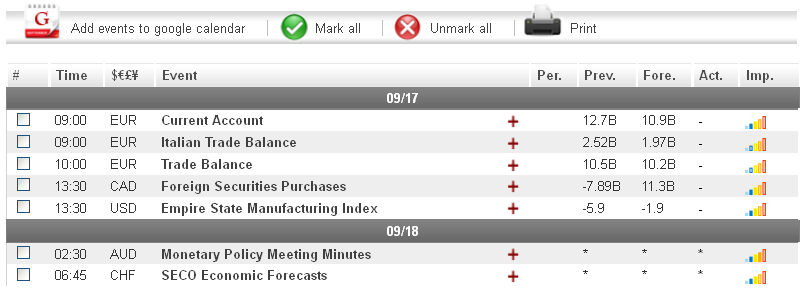

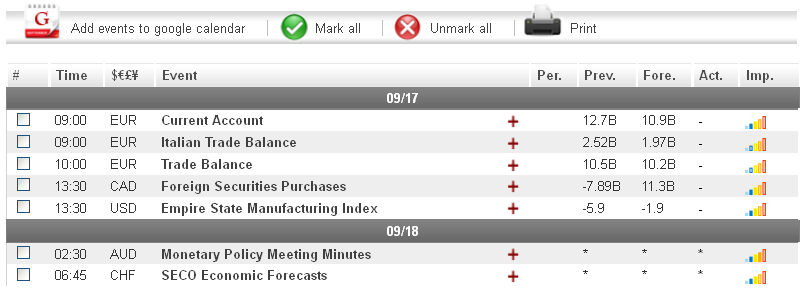

Turning to this week, traders will want to pay attention to several potentially significant US indicators. On Wednesday, the Building Permits and Existing Home Sales figures may be able to help the greenback recoup some of its recent losses if they come in above their forecasted levels. On Thursday, the weekly Unemployment Claims, followed by the Philly Fed Manufacturing Index may also generate volatility in the marketplace.

EUR - German Data Set to Impact EUR This Week

The recent approval of the ECB's plans to boost the euro-zone economic recovery combined with the Fed's decision to initiate a new round of quantitative easing in the US, led to broad euro gains on Friday. The EUR/USD advanced well over 100 pips over the course of the day, eventually reaching as high as 1.3166, its highest level in more than four months. Against the Australian dollar, the euro also was able to gain more than 100 pips before closing out the week at 1.2438.

Euro traders will want to pay attention to several indicators out of the euro-zone this week. Germany, the EU's largest economy, will release an economic sentiment figure on Tuesday, followed by manufacturing data on Thursday. In addition, a speech from ECB President Draghi on Thursday could impact the marketplace. Any better than expected data out of the EU could help the common currency extend last week's upward trend.

Gold - Gold Continues to Benefit from Fed Action

Gold was able to hold onto its recent gains on Friday, as risk taking in the marketplace continued to result in investors shifting their funds to higher-yielding assets over the course of the day. The precious metal approached $1778 an ounce during early morning trading, its highest level in six and a half months.

This week, gold traders will want to keep their eye on economic data out of the euro-zone. With Germany, the EU's biggest economy, set to release several key economic indicators, gold could see additional gains if the news signals any improvements in the euro-zone economic recovery. That being said, the precious metal could reverse its current trend if the news comes in below expectations.

Crude Oil - Crude Hits 4-Month High

Crude oil briefly traded above $100 a barrel on Friday morning, its highest level in four months, as recent news out of the US and euro-zone encouraged investors to shift their funds to riskier assets. The commodity was not able sustain its upward trend for the rest of the day though, and proceeded to drop back down to just below the $99 level before markets closed for the weekend.

This week, oil traders will want to pay attention to several economic indicators out of the US, including Wednesday's Building Permits and Existing Home Sales figures, as well as Thursday's Philly Fed Manufacturing Index. Any better than expected news could lead to speculations that demand in the US will go up, which may lead to further gains for crude.

Technical News

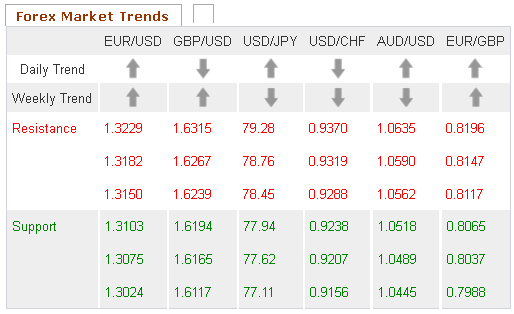

EUR/USD

The Williams Percent Range on the weekly chart has crossed into overbought territory, signaling that a downward correction could occur in the coming days. Furthermore, the Slow Stochastic on the same chart appears close to forming a bearish cross. Going short may be the best choice for this pair.

GBP/USD

A bearish cross on the weekly chart's Slow Stochastic indicates that this pair could see downward movement in the near future. In addition, the Relative Strength Index on the daily chart has crossed into the overbought zone. Going short may be the best choice for this pair.

USD/JPY

While a bullish cross has formed on the daily chart's MACD/OsMA, most other long term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

USD/CHF

The weekly chart's Williams Percent Range is in oversold territory, indicating that this pair could see upward movement in the coming days. Furthermore, the daily chart's Slow Stochastic has formed a bullish cross. Traders may want to open long positions for this pair.

The Wild Card

USD/MXN

The Slow Stochastic on the daily chart has formed a bullish cross indicating that upward movement could occur in the near future. Additionally, the Relative Strength Index on the same chart has just crossed into oversold territory. This may be a good time for forex traders to open long positions ahead of a possible upward correction.

Economic News

USD - Dollar may Extend Bearish Trend This Week

The US dollar took additional losses on Friday against its main currency rivals, as investors continued to shift their funds to higher-yielding currencies following the Fed's decision to initiate a new round of monetary easing to boost the US economic recovery. The USD/CHF fell more than 100 pips over the course of the day, eventually reaching as low as 0.9237 before staging a slight upward recovery to finish out the week at 0.9269. The GBP/USD shot up more than 70 pips over the course of the day to trade as high as 1.6255 before a downward correction brought the pair to 1.6215 where it closed out the week.

Turning to this week, traders will want to pay attention to several potentially significant US indicators. On Wednesday, the Building Permits and Existing Home Sales figures may be able to help the greenback recoup some of its recent losses if they come in above their forecasted levels. On Thursday, the weekly Unemployment Claims, followed by the Philly Fed Manufacturing Index may also generate volatility in the marketplace.

EUR - German Data Set to Impact EUR This Week

The recent approval of the ECB's plans to boost the euro-zone economic recovery combined with the Fed's decision to initiate a new round of quantitative easing in the US, led to broad euro gains on Friday. The EUR/USD advanced well over 100 pips over the course of the day, eventually reaching as high as 1.3166, its highest level in more than four months. Against the Australian dollar, the euro also was able to gain more than 100 pips before closing out the week at 1.2438.

Euro traders will want to pay attention to several indicators out of the euro-zone this week. Germany, the EU's largest economy, will release an economic sentiment figure on Tuesday, followed by manufacturing data on Thursday. In addition, a speech from ECB President Draghi on Thursday could impact the marketplace. Any better than expected data out of the EU could help the common currency extend last week's upward trend.

Gold - Gold Continues to Benefit from Fed Action

Gold was able to hold onto its recent gains on Friday, as risk taking in the marketplace continued to result in investors shifting their funds to higher-yielding assets over the course of the day. The precious metal approached $1778 an ounce during early morning trading, its highest level in six and a half months.

This week, gold traders will want to keep their eye on economic data out of the euro-zone. With Germany, the EU's biggest economy, set to release several key economic indicators, gold could see additional gains if the news signals any improvements in the euro-zone economic recovery. That being said, the precious metal could reverse its current trend if the news comes in below expectations.

Crude Oil - Crude Hits 4-Month High

Crude oil briefly traded above $100 a barrel on Friday morning, its highest level in four months, as recent news out of the US and euro-zone encouraged investors to shift their funds to riskier assets. The commodity was not able sustain its upward trend for the rest of the day though, and proceeded to drop back down to just below the $99 level before markets closed for the weekend.

This week, oil traders will want to pay attention to several economic indicators out of the US, including Wednesday's Building Permits and Existing Home Sales figures, as well as Thursday's Philly Fed Manufacturing Index. Any better than expected news could lead to speculations that demand in the US will go up, which may lead to further gains for crude.

Technical News

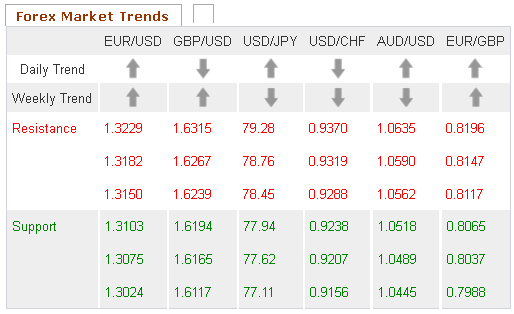

EUR/USD

The Williams Percent Range on the weekly chart has crossed into overbought territory, signaling that a downward correction could occur in the coming days. Furthermore, the Slow Stochastic on the same chart appears close to forming a bearish cross. Going short may be the best choice for this pair.

GBP/USD

A bearish cross on the weekly chart's Slow Stochastic indicates that this pair could see downward movement in the near future. In addition, the Relative Strength Index on the daily chart has crossed into the overbought zone. Going short may be the best choice for this pair.

USD/JPY

While a bullish cross has formed on the daily chart's MACD/OsMA, most other long term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

USD/CHF

The weekly chart's Williams Percent Range is in oversold territory, indicating that this pair could see upward movement in the coming days. Furthermore, the daily chart's Slow Stochastic has formed a bullish cross. Traders may want to open long positions for this pair.

The Wild Card

USD/MXN

The Slow Stochastic on the daily chart has formed a bullish cross indicating that upward movement could occur in the near future. Additionally, the Relative Strength Index on the same chart has just crossed into oversold territory. This may be a good time for forex traders to open long positions ahead of a possible upward correction.