- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

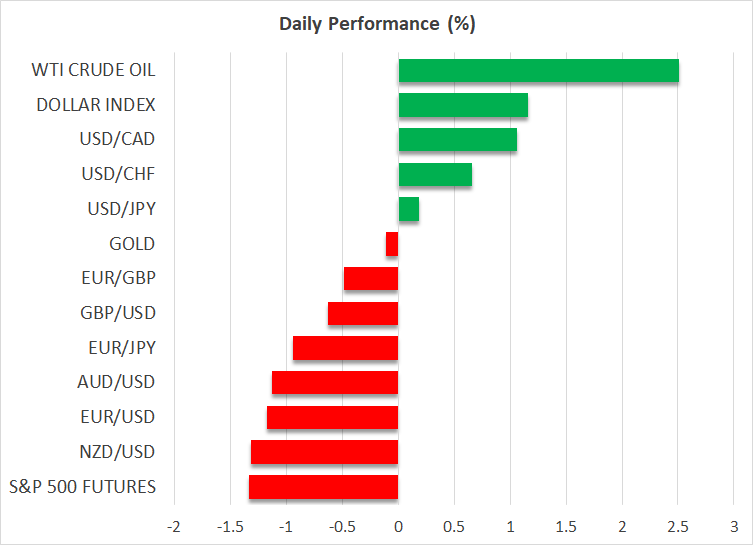

Risk Sentiment Suffers as Trump Makes the First Move

- Trump announces tariffs on Canada, Mexico and China.

- Stocks and cryptos are under severe pressure as the dollar surges.

- A busy data calendar today that also includes Fed speakers.

- Gold in the red, but oil rallies ahead of the OPEC+ meeting.

Trump makes the first move

US President Trump has signaled the start of “Trade War 2.0” with the imposition of a 25% tariff on both Mexican and Canadian imports, but only a 10% tariff on Canadian energy products, and an extra 10% tariff on goods imported from China. These trade restrictions will commence on February 4.

Trump’s decision sends a clear message that he is not bluffing and is determined to implement the “America First” agenda that earned him a second presidential term. He could have started with a 10% tariff on America’s two neighboring countries and gradually increased this level, but his “shock and awe” plan does not support a soft approach.

However, Trump has opened the door to the withdrawal of these tariffs on Canadian products, if Canada addresses the fentanyl crisis and illegal immigration. The US President is scheduled to speak today with both Canadian and Mexican leaders, with the chances of a U-turn appearing to be very slim at this stage. Such an outcome, though, would potentially reverse today’s negative market sentiment.

Risk Sentiment Suffers

Friday’s rumours about the postponement of these tariffs seem to have worked against the markets, as the announcement of these trade restrictions has resulted in severely negative market sentiment today. An acute risk-off reaction is taking place, with equity indices gapping lower and maintaining the negative momentum from last week. The cryptocurrency market is suffering the most at this point, with Ethereum leading the correction, and Bitcoin once again outperforming the pack.

Meanwhile, the dollar is showing its strength and recording solid gains across the board, with the exception of the yen which tends to benefit from safe-haven flows. Euro/dollar is hovering around the 1.0200 level, as some market participants remain convinced that this pair will hit parity soon.

Markets Try to Predict the Fed’s Likely Reaction

The gradual digestion of the tariff news could temper the markets’ nerves, but, unless Trump softens his tone, risk appetite will remain weak. Some might argue that the current stock market rout suits Trump’s plan for interest rates. He talked about the need for lower rates at the recent World Economic Forum in Davos, and he was also quite displeased following last week’s Fed meeting.

In the meantime, economists are busy recalculating the impacts of these trade tariffs. Most agree that there will likely be a considerable impact on both Canada’s and Mexico’s growth rates, but a negligible one on the US economy. However, a debate is brewing about the size of the impact on US inflation.

Therefore, the Fed might soon find itself stuck between a rock and a hard place. On the one hand, tariffs are expected to push inflation higher, complicating the economic outlook, and, on the other, a protracted correction could increase pressure on the Fed to support the markets. The famous “Fed put” could play into Trump’s hands, as the Fed might eventually be forced to loosen its monetary policy stance much earlier than currently priced in.

Data and Fed Speakers in Focus this Week

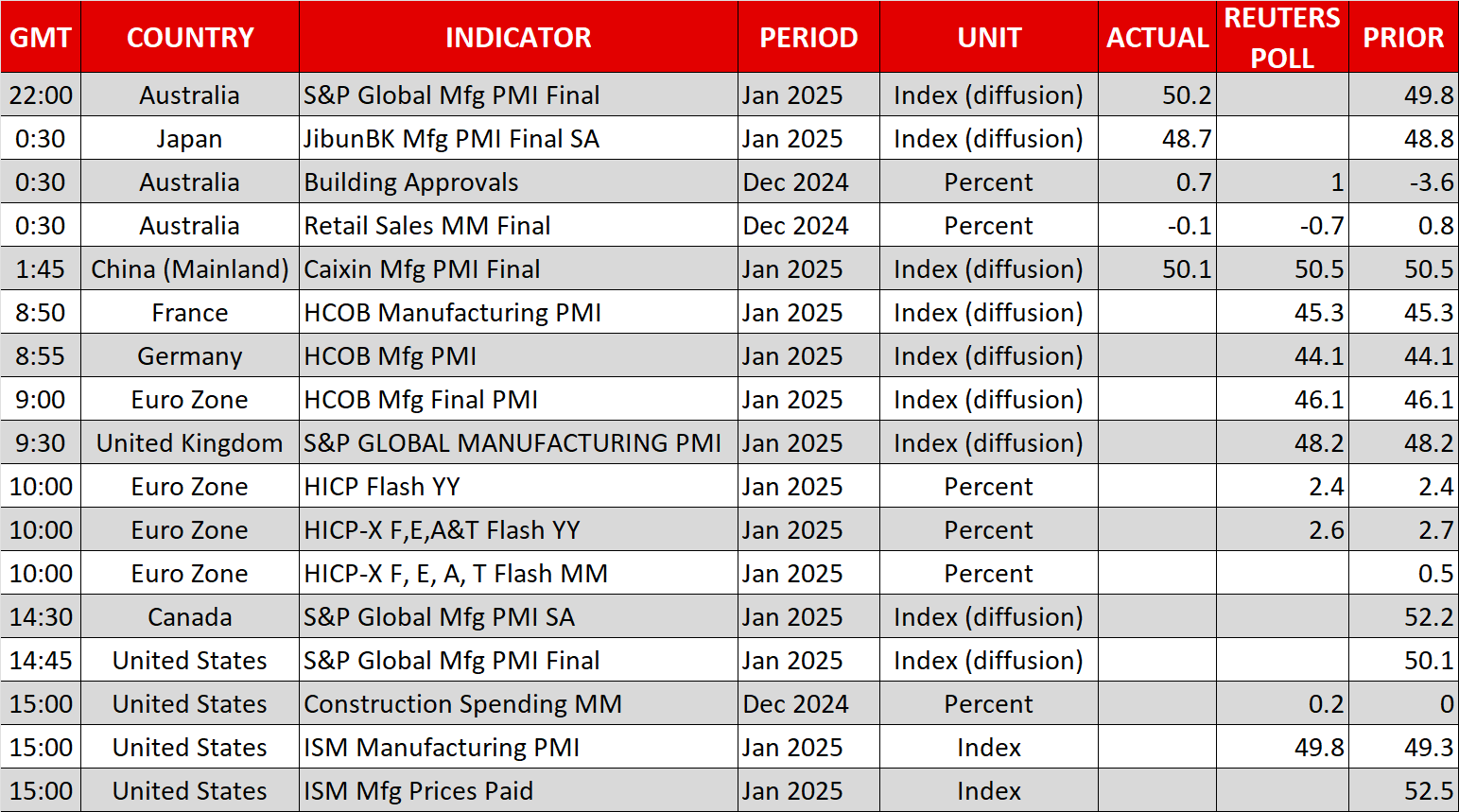

While markets digest the latest developments, the week is crammed with key data releases and Fed speakers. Today, the focus will be on US ISM manufacturing survey. Meanwhile, Fed members Bostic and Musalem, who tend to be slightly more hawkish than Chairman Powell, will be on the wires later today.

Finally, while gold is trying to recover from a quick $40 dip, oil prices are edging higher towards the $75 level, benefiting from Trump’s announcements. An OPEC+ meeting is scheduled for today and, provided this is not postponed amidst the worsening market conditions, it would be interesting to check if Saudi Arabia’s stance has changed after the recent call between Trump and Mohammed bin Salman.

Related Articles

1. S&P 500 Likely to Hold at 200-Day MA (1) Will S&P 500 indexes find support at their 200-day moving averages? We think so. Sentiment is quite bearish and the next batch...

According to the most recent Polymarket odds, 39% of betters believe recession is on the table during 2025, which is an uptick of 18% over the last week. However, many hold the...

Lately, volatility has been off the charts. We’re seeing triple-digit swings in stocks, and the market is getting a real taste of the wild ride that comes with a president who...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.