Risk rises over fears of trade tensions

- •Developments over the weekend increased fears over higher trade tensions.

- •According to media, US authorities could be preparing rules that would forbid companies with a 25%+ Chinese ownership to take over US companies which are in “industrial significant technologies”.

- •US president Trump’s threats of imposing a 20% tariff on EU cars and EU answering that it will retaliate also heightened uncertainty.

- •The US Dollar weakened against JPY and should there be further escalation we could see it weakening even further.

Erdogan’s win supports TRY

- •Erdogan seems to be winning the elections in Turkey according to polls however other parties did not accept the results yet.

- •The win is expected to give Erdogan sweeping new powers as the president of Turkey in the internal political front.

- •On the monetary front it could be the case that he may try to intervene to CBT’s decisions.

- •TRY strengthened, as political uncertainty was removed with the result and could strengthen further on positive headlines.

Today’s other economic highlights

- •Germany: Ifo Business Climate for June, Survey: 101.7 Prior: 102.2, 08:00 (GMT), could weaken EUR

- •US: New Home Sales for May, Survey: 667k Prior: 662k, 14:00 (GMT), could strengthen USD

As for the rest of the week

- •On Tuesday, we get the US Consumer Confidence indicator for June.

- •On Wednesday, the US Durable Goods growth rates for May are due out.

- •On Thursday, RBNZ’s Interest rate decision is to be released as well as Germany’s HICP preliminary rate for June and the final US GDP growth rate for Q1.

- •On Friday, we get Japan’s unemployment rate for May, France’s preliminary CPI (EU Norm.) for June, Germany’s Unemployment data, UK’s final GDP growth rate for Q1, Eurozone’s preliminary CPI rate for June, US Consumption for May, Canada’s GDP growth rate for April and the final release of the US U. Michigan Consumer Sentiment for June.

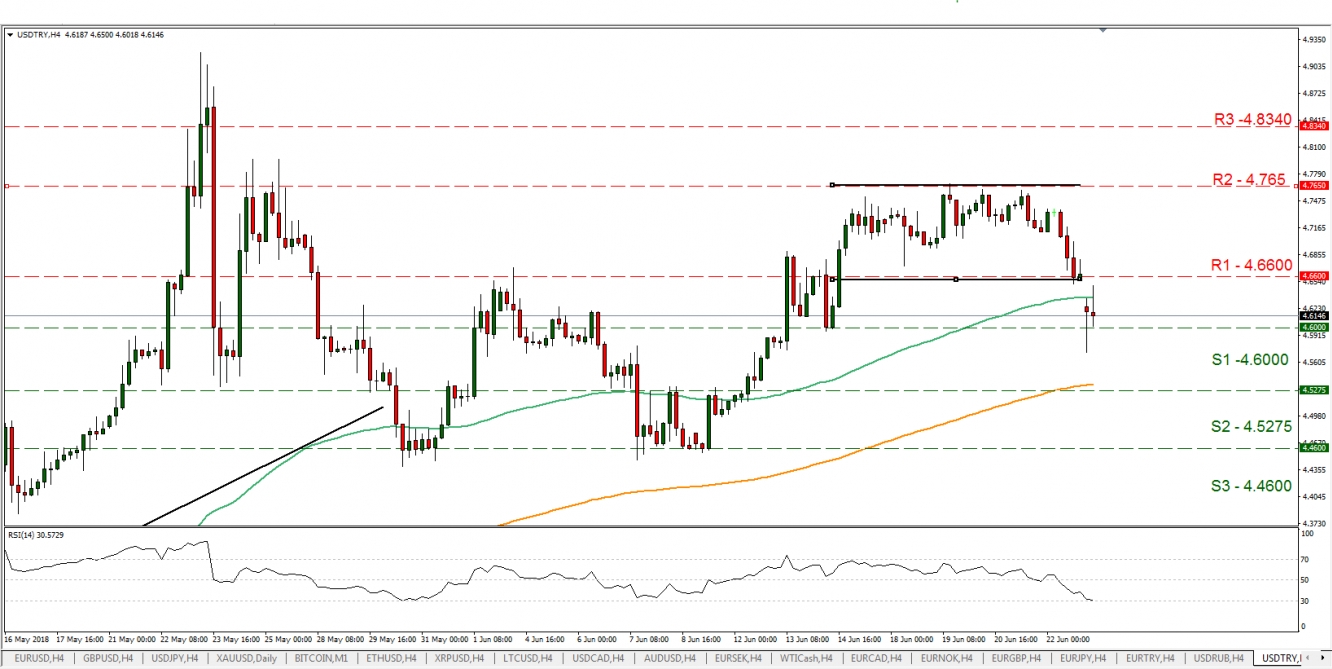

USD/TRY

·Support: 4.6000(S1), 4.5275(S2), 4.4600(S3)

·Resistance:4.6600(R1), 4.765(R2), 4.8340(R3)

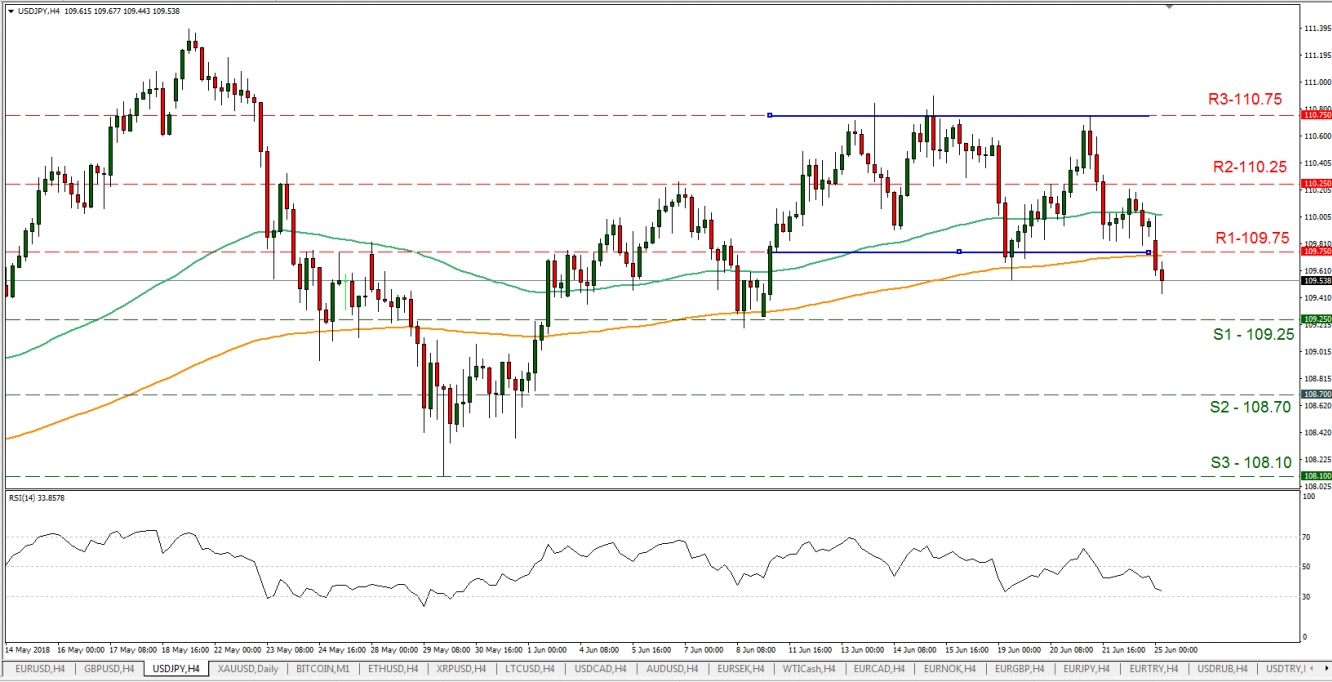

USD/JPY

·Support: 109.25(S1), 108.70(S2), 108.10(S3)

·Resistance: 109.75(R1), 110.25(R2), 110.75(R3)