- Drop in ISM manufacturing PMI rounds up malaise in global factory activity

- Dollar and stocks steady as Fed rate path little changed, all eyes on NFP report

- Aussie falls then bounces after RBA holds rates; oil prices whipsaw on OPEC+ cut

Weak manufacturing PMIs dampen mood

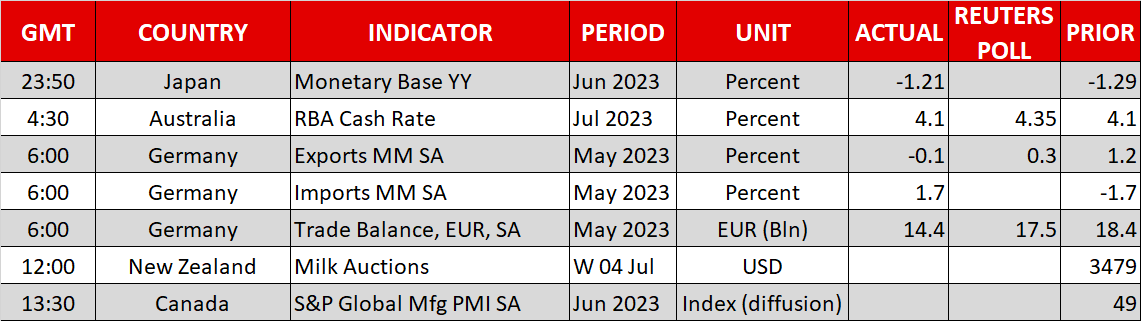

Markets were generally trading sideways on Tuesday as investors pondered central banks’ next moves amid conflicting signals from the latest data and a bank holiday in the United States. Trading in July initially got off to an optimistic start after last week’s upwardly revised US GDP data and softer-than-expected PCE inflation figures fuelled the risk rally in stocks. But it seems that the calls for a recession may not have been premature after all following yesterday's dire manufacturing PMIs globally.

Whilst the downward revision to the Eurozone’s already bad PMI reading was a worry, the biggest shock came from the ISM manufacturing PMI in the US where the closely watched gauge fell to its lowest since the pandemic slump of 2020. Within the survey, the sharp drop in the prices paid and employment subindices raised doubts about the Fed’s intention to hike interest rates by at least a couple more times this year.

However, Fed fund futures barely budged and investors still see the Fed raising rates by slightly more than 30 basis points by year end. It’s possible that over the next few weeks, markets and the Fed will meet each other halfway on where the terminal rate will be set, but for now, with the June jobs report coming up in a few days’ time and US traders off celebrating Independence Day, many investors are sitting on the sidelines.

It's all calm in equity markets

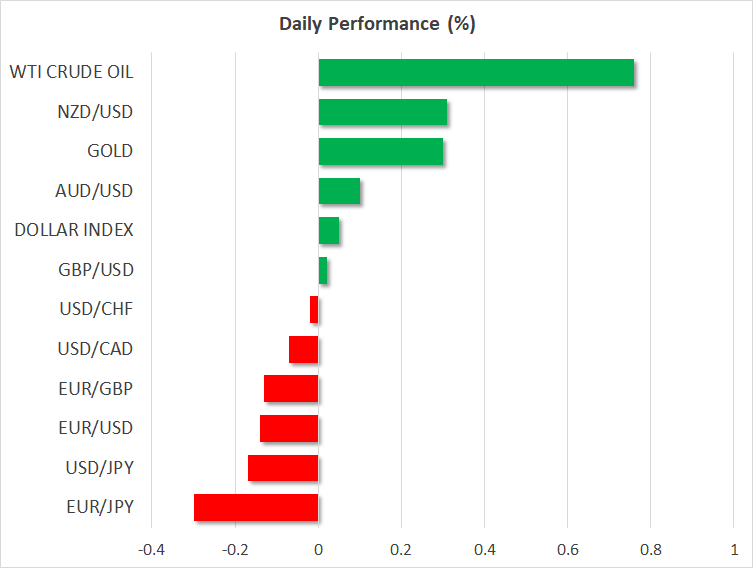

On Wall Street, while the shorter trading session may have affected Monday’s moves slightly, it was another case of bad news is good news as the main indices edged higher, extending the prior week’s impressive gains. Shares in Europe and Asia also appear to have mostly shrugged off the manufacturing gloom.

Even the US yield curve inversion deepening the most since the 1980s when skyrocketing interest rates pushed the American economy into a steep recession doesn’t appear to have frightened the markets.

That could change however, if Friday’s nonfarm payrolls number beats the consensus estimates again as it would boost expectations of the Fed unpausing in July.

Dollar takes ISM hit, aussie recovers from RBA pause

Interestingly, it was the US dollar that reacted the most to the poor ISM data, reversing lower after earlier gains and trading mostly flat today.

The greenback’s softness is likely helping the Australian dollar to recoup its losses after it tumbled from the Reserve Bank of Australia’s decision to keep interest rates unchanged. The RBA took some traders and most analysts by surprise when it went back on pause earlier today as there had been some expectation that the central bank would hike rates for the third meeting in a row.

Policymakers maintained a hawkish bias in the statement, although on the whole, it seems that the RBA is nearing the end of its tightening cycle.

The aussie was last trading around $0.6680 after brushing an intra-day low of $0.6639.

The yen maintained its steadiness of the last few days against its major peers, raising some question marks about whether Japanese authorities are already intervening in the currency markets. Finance ministry officials have been ramping up their verbal intervention in recent days as the Bank of Japan refuses to lift the cap on the Japanese 10-year yield, which dipped today due to strong demand at an auction for new notes.

Little boost for oil after surprise OPEC+ cut, gold firms

Commodity markets were also having a lacklustre session despite a surprise announcement from OPEC+ on Monday of fresh supply cuts in crude oil production. Saudi Arabia decided to extend the 1 million barrels a day of cuts it announced last month at least until August. But Russia is joining in this time with a 500,000 bps reduction of its own for August.

Yet, oil prices fell back after a brief spike and although they are edging up today, it appears that the sluggish demand outlook continues to outweigh concerns about tighter supply.

Meanwhile, growing jitters about a recession and a somewhat weaker dollar are likely aiding gold’s recovery from last week’s 3½-month lows. The precious metal is inching higher today to approach $1,930/oz.