The recent chunky rally in risk assets was all about the anticipation of central bank interventionism. Today’s ECB did little to provide fuel for the fire. Is the top in the pro-risk trades in the rear-view mirror?

ECB Yawn….

The ECB failed to cut rates as a fairly small minority were expecting. The single currency failed to react because a “more hawkish” ECB (i.e., no cut) suggests higher systemic risk due to an ECB unwillingness to pull out all of the stops to ensure maximum liquidity - rather than generating any interest in buying the euro on the interest rate implications. Draghi made the shocking observation that eurozone growth is looking weak in Q2. You think?

Other rhetoric on the economy was so boring as it is not worth repeating here, but the general idea was: inflation is stable and not a problem, downside risks to economic growth remain, fiscal rebalancing has progressed significantly and must continue to do so. New pro-growth measures should be enacted to help secure growth, etc….

The one concrete step the ECB took at today’s meeting was to extend its full allotment, fixed rate facility to mid-January of next year.

On key point: in the Q&A, Draghi questioned openly whether further LTRO’s would be effective, and the EUR/USD dropped a bit more on this while peripheral bond yields jumped a bit and German bunds did as well.

Chart: EUR/USD

The line in the sand now for the EUR/USD is 1.2500 after today’s ECB meeting and on the second consecutive day in which the pair has failed to sustain itself above this level.

Fed Unofficial Mouthpiece Suggests Fed Is QE-Ready

The Fed’s official non-official mouthpiece Hilsenrath at the Wall Street Journal penned an article late yesterday that had the market whipped up into a further “here comes the QE cavalry” frenzy. The article suggests that the weak US data and “strains in financial markets” have the Fed concerned enough to begin warming up possible plans for further easing. If we are to take the article as unofficial guidance after off the record discussions with Fed insiders, then we should believe – barring a massive meltdown between now and then – that the June 20 meeting is “too soon for conclusive decisions.” Still, this market is a pack of Pavlov’s dogs if anything, and we all know that the Fed rhetoric at the meeting in two weeks’ time will be in proportion with the current market circumstances.

The question is whether it is how quickly the diminishing returns of central bank interventionism are diminishing and how much the Fed’s potential bit has been muzzled by election season. Certainly, the dramatic retreat in gasoline prices has removed at least one obstruction to further Fed activism. It is interesting to think that the Fed’s Operation Twist program runs out at the end of this month – and that Hilsenrath’s article suggests the Fed won’t make a move just yet – with a significant gap until the FOMC could declare its attentions at the August 1 meeting – which is getting uncomfortably (or comfortably, as Bernanke, the supposed Republican, would certainly prefer that Obama remains in office) close to the election.

It is worth noting that the above article comes just before Bernanke’s testimony before the US Congress’ Joint Economic Committee tomorrow.

Looking Ahead

Look out for the latest Australia employment data out tonight – the recent part of the series is littered with mean reverting extremes, and we’ve just seen a good report for April following a very good report for March – time for a massive negative surprise? The market is a bit high on the aussie at the moment after the RBA “only” cut 25 bps at its meeting yesterday and on the strong GDP reading overnight (although quarterly GDP data is the most rear view of all rear view data – we’re seventeen trading days from the end of Q2 for goodness’ sake).

Tomorrow we have the Bank of England – and it is still likely a bit too early to look for anything new from the BoE, so we are likely to see radio silence tomorrow as usual from the BoE, which could feed further into the EUR/GBP sell-off that resumed today.

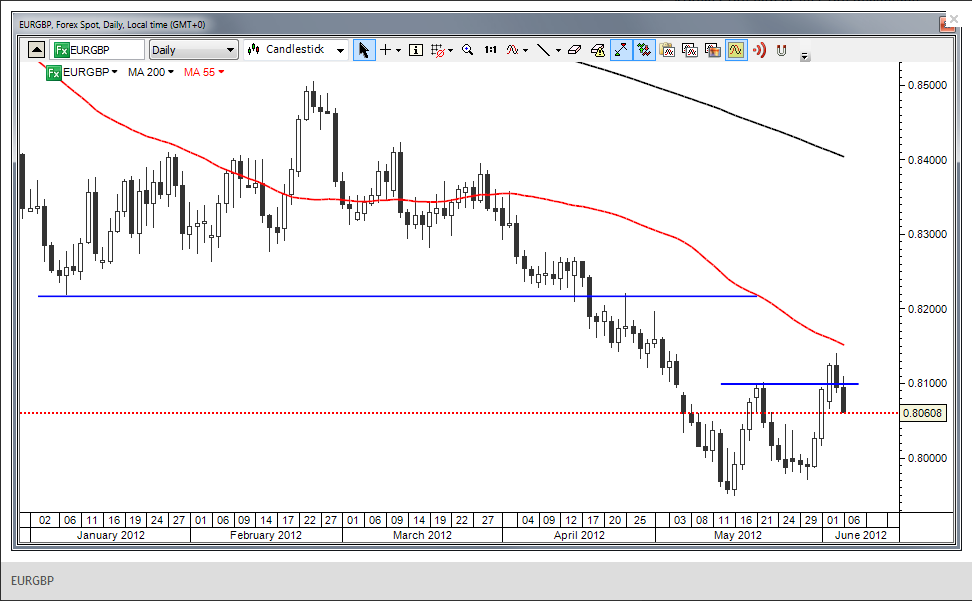

Chart: EUR/GBP

EUR/GBP saw a false upside break over the last couple of days as we headed into today’s ECB meeting, but today sees the market preferring the the pound. This underlines the strength of the long standing downtrend, but let’s see if the reversal holds through tomorrow’s BoE meeting and whether the EUR/GBP pair can get comfortable down through 0.8000.

Economic Data Highlights

- Australia Q1 GDP out at +1.3% QoQ and +4.3% YoY vs. +0.6%/+3.3% expected, respectively, and vs. +2.5% YoY in Q4

- Eurozone Q1 GDP out at 0.0% QoQ and -0.1% YoY vs. 0.0%/0.0% expected, respectively and vs. 0.0% YoY in Q4

- Germany Apr. Industrial Production out at -2.2% MoM and -0.7% YoY vs. -1.0%/+0.9% expected, respectively and vs. +1.4% YoY in Mar.

- Eurozone ECB leaves rate unchanged at 1.00% as widely expected