Yesterday, the Chairman of the Federal Reserve, Jerome Powell spoke.

Some highlights

- U.S. BUDGET IS ON AN UNSUSTAINABLE PATH; REVENUE AND SPENDING NEED TO BE BETTER ALIGNED

- CENTRAL BANK CAN NOT TAKE DEBT AND DEFICITS INTO ACCOUNT IN SETTING RATES; NEEDS TO FOCUS ON INFLATION

- THE FED IS FAR FROM A SITUATION OF FISCAL DOMINANCE, USES ITS TOOLS TO ACHIEVE MANDATE ON INFLATION AND JOBS

- BITCOIN IS USED AS A SPECULATIVE ASSET; IT IS A COMPETITOR WITH GOLD NOT THE U.S. DOLLAR

- GEOPOLITICAL RISK IS ELEVATED AROUND THE WORLD

- LOW AND MODERATE INCOME FAMILIES IN THE U.S. ARE UNDER PRESSURE EVEN THOUGH AGGREGATE NUMBERS ARE STRONG

In essence, Powell is saying that he is concerned about the debt but does not make policy on that. He is less concerned about inflation and perhaps more concerned about lowering rates for low- and moderate-income families.

Regardless, the long bonds iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) rallied, which helped the indices, precious metals, bitcoin and chip sectors.

Meanwhile, small caps, transportation and retail were either marginally up or red.

What is the takeaway from the bond action?

What is so interesting about TLTs is not only their connection to yields, but also their use to assess risk on or risk off.

Lower yields are great until they either

- Create inflation

- Signal a flight to safety, hence a risk-off

As I do not se too many people worrying about a crash or risk off, and only a smattering of people worried about inflation or stagflation, here are some chart points to watch.

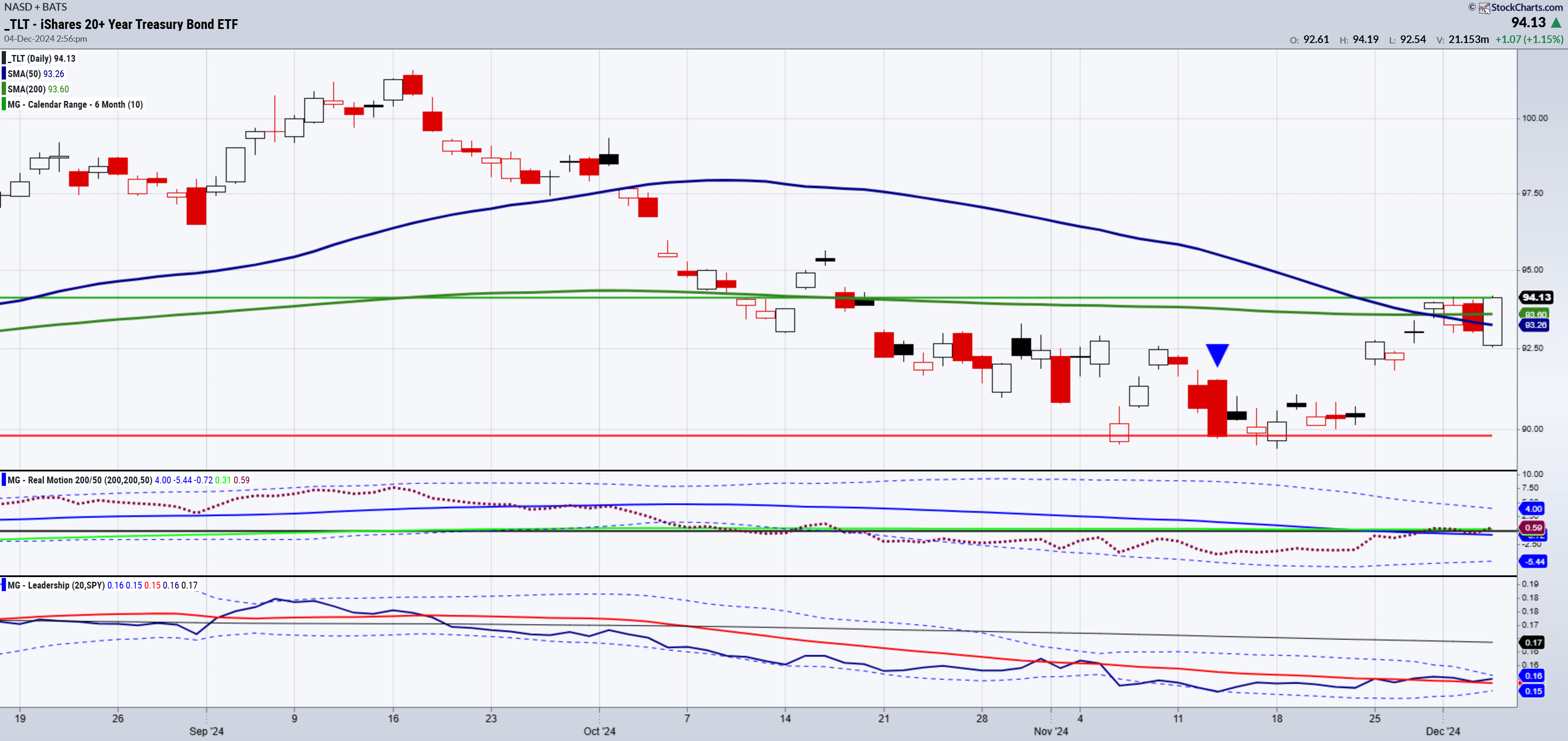

Note on the chart that TLTs cleared the 50 and 200 daily moving averages.

This is interesting as the 2 MAs also had a death cross.

The Leadership chart should not be ignored. As of the last 2 days, the long bonds are OUTPERFORMING the benchmark. This could be the start of risk off.

Real Motion or the momentum indicator, shows no real divergence bullish or bearish.

And the price, while clearing the MAs stopped short of the July 6-month calendar range.

We are watching the 94.50 level carefully.

We are also watching for any weakness in the indices, especially small caps.

Risk off has not sustained in a long time.

That would be so mean of Santa if TLTs are flashing a warning.

And don’t forget about precious metals.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 600 pivotal-new highs

- Russell 2000 (IWM) 238-240 support to hold

- Dow (DIA) 445 pivotal

- Nasdaq (QQQ) 507 support-new highs

- Regional banks (KRE) 65 support 70 resistance

- Semiconductors (SMH) 250 pivotal

- Transportation (IYT) 72.50 support

- Biotechnology (IBB) 140 support

- Retail (XRT) 80 support 87 resistance

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79.50 pivotal