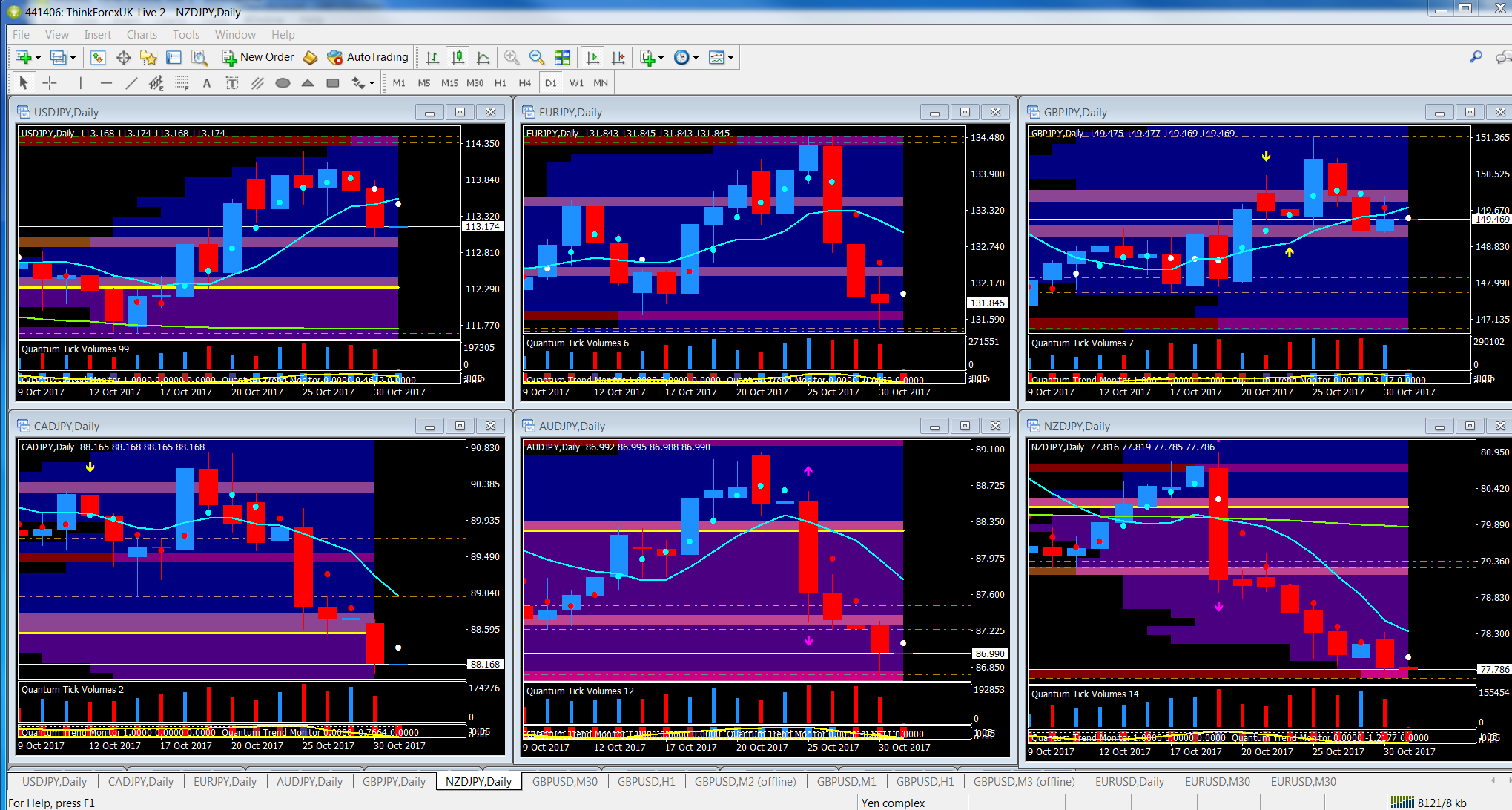

Monday’s risk-off sentiment was clearly seen in the the yen complex with the commodity pairs and USD/JPY falling the most and only GBP/JPY and EUR/JPY making an effort to rally ahead of the the BoJ, traditionally the last of the central banks to report. And it's significant that this is the first BoJ Outlook Report and Monetary Policy Statement since Shinzo Abe’s electoral victory earlier this month, so it will be interesting to see if that is reflected in the statement or the report. In other words, we're all wondering if there will will be any mention of Abe’s ‘third arrow’ of promised structural reform or if BoJ will continue to focus on the other two – monetary easing and yet more fiscal stimulus.

Broad Yen Support

From a technical perspective, the yen's four-hour charts suggest price support across the complex, with yen buying slowing as the currency looks very overbought on our currency-strength indicator. Some levels for the individual pairs include 113.02 to the downside for USD/JPY, from which the pair has managed to rally to test the first resistance at 113.23. But overall, the move lacks conviction.

For EUR/JPY, support came in at 131.44 and validated on the 15-minute chart by a bullish engulfing candle. The key upside level for EUR/JPY is 131.92 where we have a significant area of congestion. But a move through there would take the pair to test 132.27.

GBP/JPY is the only yen pair that managed to post a significant upside move but the high of the session was capped by strong resistance in the 150 region, where the pair has corrected at various times in the past. Monday’s failure to breach this price region has seen the pair move back to 149.16 from which it has been trying to rally and, in turn, created a candle with a significant upper wick, indicating continued weakness. Moreover, the candle is also supported by high volume, also suggesting further weakness to come and a possible move back to the congestion zone in the 147.80–148 price region.

For the yen commodity pairs, the price action on the daily chart has been remarkable similar, to Monday’s sharp falls that are now looking to reverse, with the strongest move in AUD/JPY where the candle of the day found good price support at 86.77 – if the pair manages to clear stiff resistance at 87, it would provide a good platform for the pair to move back to test 87.77.

However given Monday’s lackluster performance from the US indices and falling bond yields, any yen selling may be short lived. The only counter balance to this sentiment is the fact that the VIX is trading in the 10 region, which does not suggest that markets are ready for a major correction.

So until BoJ hits, minor turbulence.