These are still early days for evaluating the risk outlook linked to the banking turmoil triggered earlier this month by the collapse of Silicon Valley Bank, but there are nascent signs that the worst has passed. Reverberations for the economy remain a threat, but for the moment the odds of contagion risk that spreads across the financial system seem to be receding. Blowback for the economy in the months ahead is less clear, but the immediate goal is avoiding a spike in financial-system risk writ large and on that front there’s a case for cautious optimism.

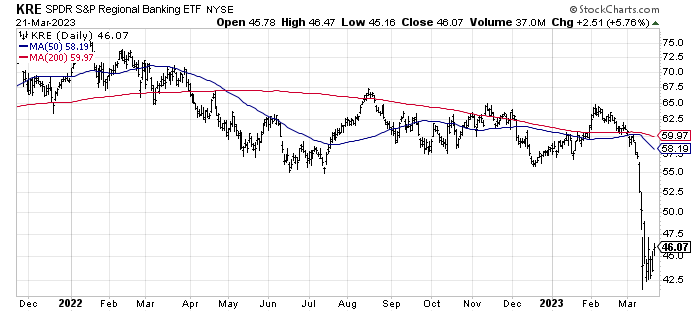

Let’s start with a proxy for gauging sentiment via an ETF of regional bank shares. During the early days of the SVB collapse, SPDR® S&P Regional Banking ETF (NYSE:KRE) fell sharply. But in recent days the fund has stabilized and so far this week has traded moderately above its crisis low.

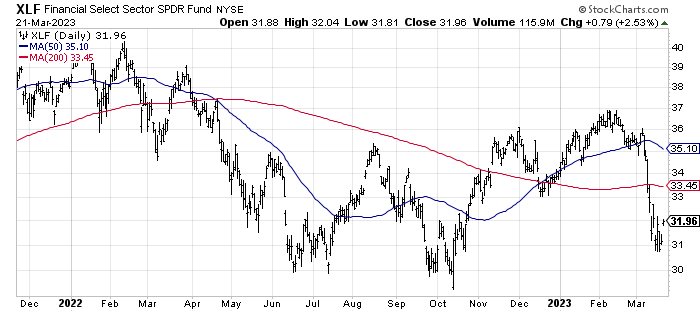

A similar story applies to the broader financial sector via Financial Select Sector SPDR® Fund (NYSE:XLF).

This could be the calm before the resumption of the storm, of course, and so a few days of stable pricing shouldn’t be viewed as an “all clear” sign. Nonetheless, it’s encouraging to see that market sentiment for the banking sector has calmed.

Fears of a wider, global crisis swirled as Switzerland-based Credit Suisse (NYSE:CS) looked set to implode last week, but the forced merger with UBS (NYSE:UBS)has soothed markets to a degree.

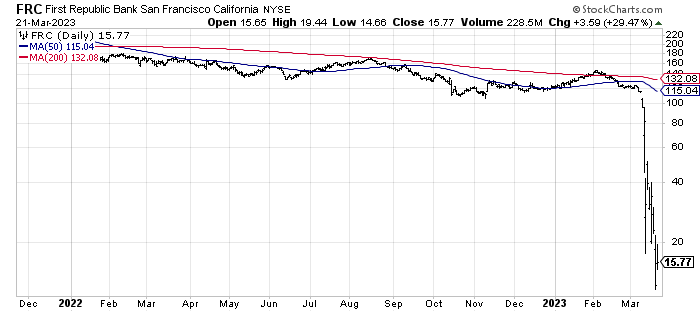

In the U.S., First Republic Bank (NYSE:FRC) is considered vulnerable, but the battered shares rebounded on Tuesday (Mar. 21) after Treasury Secretary Janet Yellen released a statement that said the federal government is prepared to take additional action to backstop the deposits at more banks if contagion risk increased.

Risk is still high and reassessing the level of financial-system danger remains a day-to-day affair, but market sentiment at the moment is mildly encouraging.

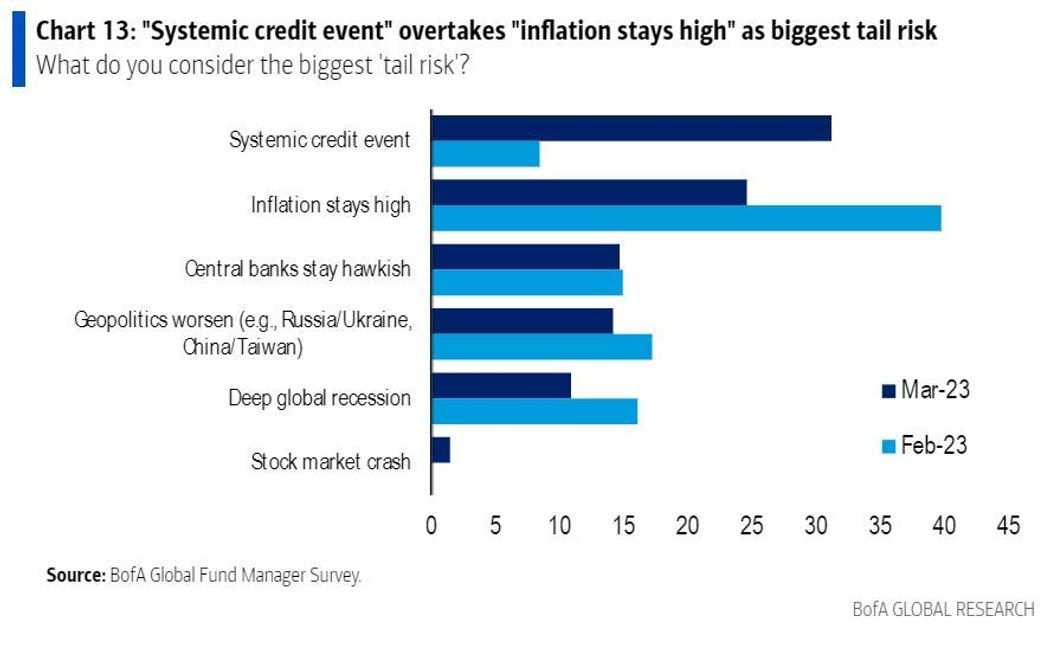

The uncertainty is whether deeper trouble is lurking down the road. Global fund managers remain anxious, according to a new survey published by Bank of America. The March poll finds that a “systemic credit event” is now seen as the biggest threat for financial markets, MarketWatch.com reports.

Perhaps the bigger risk is how bank turmoil affects the economy in the months ahead. The outlook is mixed. On the positive side, the increased stress on banks is likely to be disinflationary, which is helpful at a time when inflation remains high. But there’s a dark side in that the rise in risk aversion that flows from recent events will likely slow lending activity, which in turn creates a stronger headwind for the economy at a time when some economists say recession risk is rising.

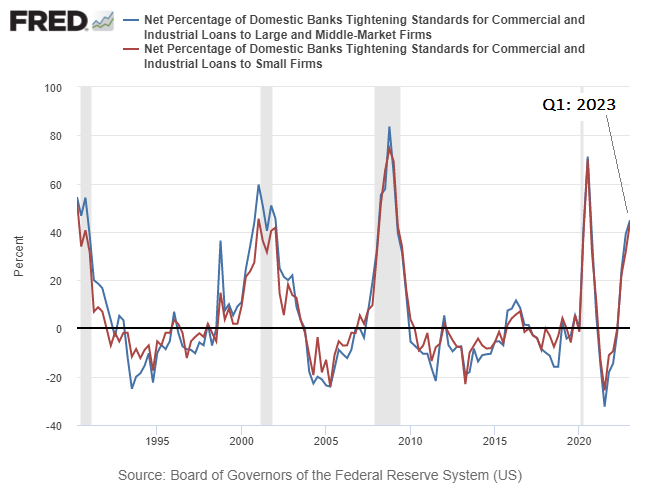

Indeed, even before this month’s bank turmoil it was obvious that banks were tightening lending standards through the first quarter. The tightening is likely to accelerate in the wake of recent events as banks err on the side of caution.

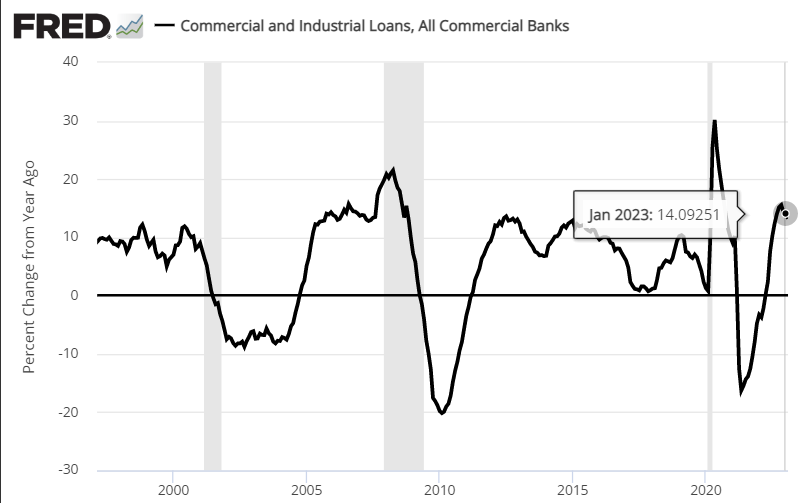

The year-over-year growth rate in commercial and industrial loans has already started rolling over through January, and the cyclical slide will probably accelerate as the bank turmoil continues to ripple through the financial system.

Exactly how recent events factor into the business-cycle outlook remains unclear, but it’s likely to take a bite out of growth. A number of economists advise that the banking turbulence of late will act as a defacto increase in interest rates for the economy.

The immediate question is whether the Federal Reserve adds to the monetary tightening with formal rates hikes from here on out to tame inflation? The Fed funds futures market this morning is pricing in a 90% probability that the central bank will announce another 1/4 point this afternoon.

If so, the wisdom of continuing to tighten policy during a period of elevated financial-system risk is open for debate. In fact, there’s a case for pausing rate hikes, or perhaps cutting, until it’s obvious that the banking turmoil is no longer a clear and present danger. To the extent the Fed disagrees, the onus is on Jerome Powell to explain why at today’s press conference following the policy announcement.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI