Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Stocks in the US had their largest single-day gain in a month as the German ZEW (sentiment) came in at 23.4 with a largely expected 19 print, along with the 12 and 18m Spanish bond sales and 10yr yields below 6% tempering worries the EU was unable to contain the current crisis - the ballooning Spanish Debt.

The S&P gained 1.55% on the day while the Dow closed up 194.13pts or 1.5% regaining a hold on 13k with AAPL ending its 5 day losing streak.

Risk was back on the table with oil, gold and the risk currencies such as the AUD and NZD all gaining strong on the day.

I would like to note in 6 of the last 9 days, the market has been pushing 2 sigma gains and losses and I expect this volatility to continue for the month of April and likely May as well. I also am not falling for the green light in the latest bull run mania today as Italy has just put its balanced budge targets back a year saying it will experience debt/GDP growth for the coming future. Add to this the Bank of Spain admitting it will need to provision another €29.1 billion with 45 banks still not able to find the cash for the capital plan in place.

Again, if housing slumps enough in Spain, the banks are in trouble and this will put the ECB on the hook unless Japan wants to put more of the money they do not have into the ring.

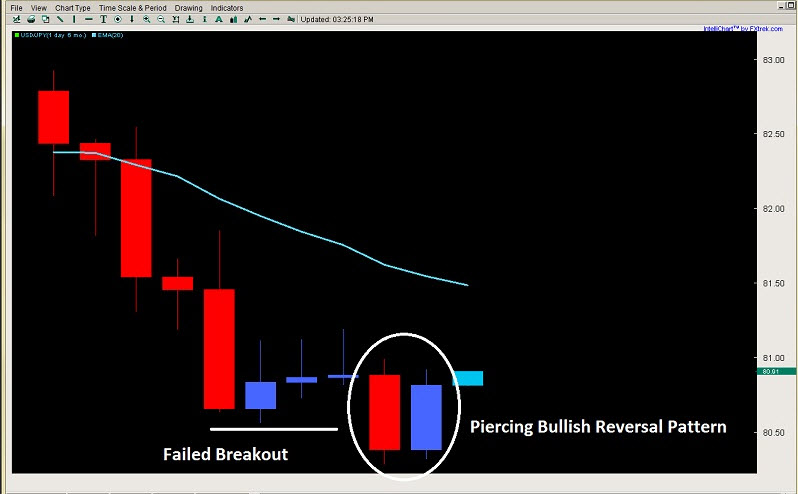

USD/JPY

After forming a final bear flag that led to a failed breakout for the USD/JPY, the market responded by forming a strong piercing pattern bullish reversal. This is interesting considering the breakout closed on the lows suggesting the bears did not take too many profits into the close. So where did all the bears go? Likely the final exhaustion of the move because the bulls did an about face and have pushed back strongly.

I suggest watching for intra-day price action triggers on the 4hr and 1hr around the 80.50 level with tight stops below targeting the 81.50 daily 20ema and dynamic resistance above.

The S&P gained 1.55% on the day while the Dow closed up 194.13pts or 1.5% regaining a hold on 13k with AAPL ending its 5 day losing streak.

Risk was back on the table with oil, gold and the risk currencies such as the AUD and NZD all gaining strong on the day.

I would like to note in 6 of the last 9 days, the market has been pushing 2 sigma gains and losses and I expect this volatility to continue for the month of April and likely May as well. I also am not falling for the green light in the latest bull run mania today as Italy has just put its balanced budge targets back a year saying it will experience debt/GDP growth for the coming future. Add to this the Bank of Spain admitting it will need to provision another €29.1 billion with 45 banks still not able to find the cash for the capital plan in place.

Again, if housing slumps enough in Spain, the banks are in trouble and this will put the ECB on the hook unless Japan wants to put more of the money they do not have into the ring.

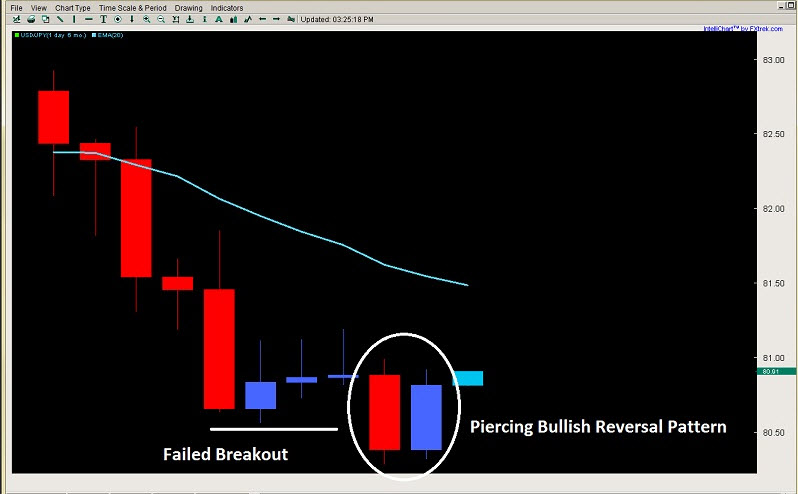

USD/JPY

After forming a final bear flag that led to a failed breakout for the USD/JPY, the market responded by forming a strong piercing pattern bullish reversal. This is interesting considering the breakout closed on the lows suggesting the bears did not take too many profits into the close. So where did all the bears go? Likely the final exhaustion of the move because the bulls did an about face and have pushed back strongly.

I suggest watching for intra-day price action triggers on the 4hr and 1hr around the 80.50 level with tight stops below targeting the 81.50 daily 20ema and dynamic resistance above.