Market Brief

The overnight session was marked by US decision to authorize targeted airstrikes to protect Americans in Iraq and prevent a potential act of genocide against Yazidi people. The risk aversion is the key driver in the FX and financial markets. USD, CHF and JPY are in demand, while EM currencies extend losses. XAU/USD advances to $1,320 and has more upside potential given the mounting tensions.

In Japan, the BoJ kept its monetary policy unchanged on unanimous decision, the Japan monetary base will continue growing at the pace of 60-70 trillion Yen annually. Released overnight, the Japanese current account printed larger-than-expected deficit in June (-399.1bn yen vs +522.8 yen a month ago), the trade deficit narrowed slightly. The BoJ revised down its forecasts on Japanese exports and industrial output. Combined to safe-haven inflows, Yen came broadly in demand. JPY gained most versus USD among G10 in Asia. USD/JPY tumbled down to 101.60 in Tokyo, pulling the Nikkei stocks -2.98% lower at week close. USD/JPY is likely to remain under selling pressure; technically a weekly close below 101.80 (MACD pivot) should confirm the short-term bearish reversal. EUR/JPY hits a fresh 2014 low (135.73, at the time of writing). The selling pressures in EUR post-Draghi and the increasing JPY safe-haven appetite should keep the bias on the bear side.

Yesterday, the BoE and the ECB maintained the status quo in their August policy meetings. The ECB President Draghi’s monthly press conference met the dovish market expectations. President Draghi insisted on the importance of growth friendly fiscal reforms and proficient structural reforms to increase efficiency in credit expansion. More importantly, Draghi made it clear, the ECB policy will remain on divergent path versus the Fed and the BoE. Thus the fundamentals for weaker EUR are much better today than 2-3 months ago. EUR/USD extended weakness to 1.3337 post-Draghi, yet managed to hold ground above 1.3296/1.3333 (Nov 2013 low / Aug 6th low), leaving the door open for some profit taking towards 1.3400. Option bets are negatively biased above 1.3400. EUR/GBP consolidates gains at the bullish consolidation zone (above June-July downtrend channel), trend and momentum indicators remain positive despite EUR-bearish pressures. Offers are eyed at 0.79780-0.80000 (50-dma / optionality). More option related offers will expire at 0.80400 before the closing bell.

GBP/USD broke support at 1.6814 (Aug 1/4th double bottom) and tests 1.6800 bids. June construction output and trade data will be closely monitored today, while the broad based USD demand is likely to push the Cable further down. From next week, traders will focus on UK inflation report (due on Aug 13th).

In Canada, USD/CAD remains well supported above 1.0900, trend and momentum indicators are comfortably bullish. Canada releases jobs report before the closing bell, the market expectations are optimistic. Resistance should limit the CAD sell-off pre-1.1000 if data meets the supportive forecasts. The short-term bids are eyed at 1.0850/80 (region including 200 and 100 dma).

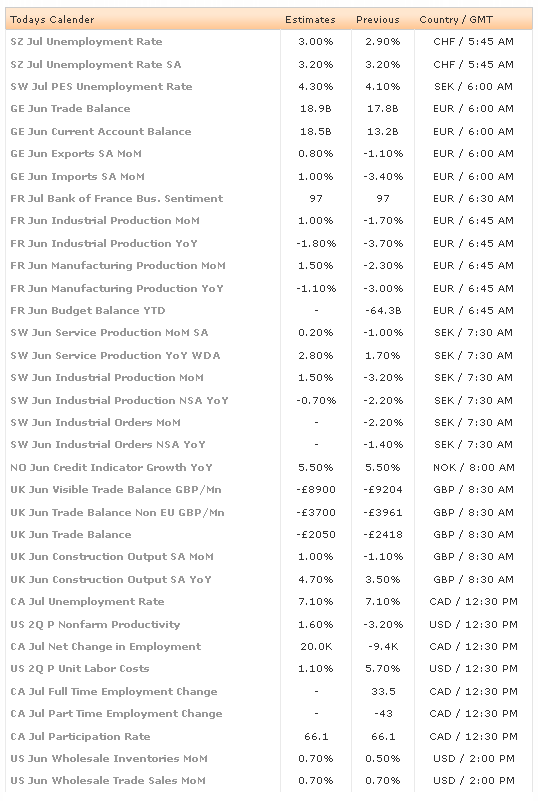

Today’s economic calendar consists of Swiss July Unemployment Rate, German June Current Account and Trade Balance, Exports and Imports m/m, French June Industrial and Manufacturing Production m/m & y/y, Swedish June Service and Industrial Production and Orders m/m & y/y, UK June Trade Balance and Construction Output m/m & y/y, Canadian Unemployment, Participation Rate, Full and Part Time Employment Change, US 2Q (Prelim) Nonfarm Productivity , Unit Labor Costs and US June Wholesale Inventories & Trade Sales m/m.