The EUR/USD, which had come within a one-week high during the overnight session yesterday, once again fell below the 1.3300 level during European trading. Analysts attributed the bearish correction to ongoing uncertainties regarding the eurozone economic recovery. Today, the US ADP Non-Farm Employment Change figure is likely to be the highlight of the trading day.

The figure is considered a valid predictor of Friday's all-important Nonfarm Payrolls figure, and typically leads to heavy market volatility. A better-than-expected result could help the USD against its main currency rivals.

Economic News

USD - Dollar Stages Slight Recovery Vs. EUR, AUDThe US dollar was able to correct earlier losses against several of its main currency rivals during the European session yesterday, as risk aversion among investors led to gains for safe-haven assets. The EUR/USD, which peaked at 1.3366 during overnight trading, fell as low as 1.3299. Against the Australian dollar, the greenback was able to gain over 100 pips during trading yesterday. The AUD/USD dropped from a high of 1.0463 to 1.0352.

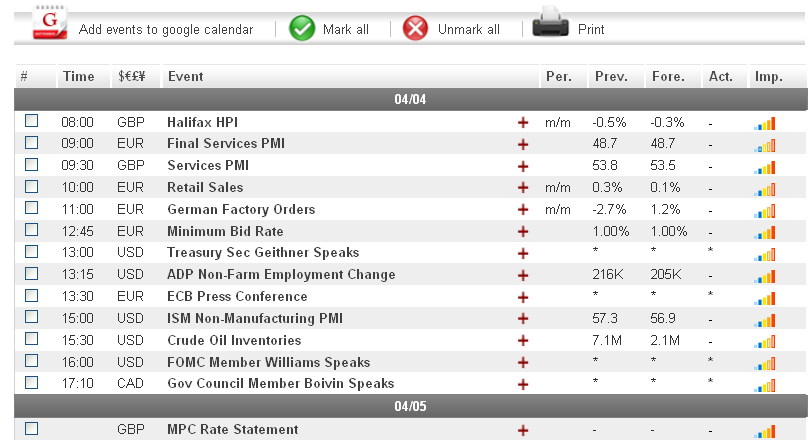

Turning to today's news, all eyes are likely to be on the ADP Non-Farm Employment Change figure, scheduled to be released at 12:15 GMT. At the moment, analysts are forecasting the figure to come in at 209K. While that number would represent a slight drop over last month's, it would still signal that the US economic recovery is continuing and may benefit the dollar, especially vs. the Japanese yen.

Traders may also want to pay attention to a press conference from the European Central Bank, scheduled to take place at 12:30 GMT. Any negative announcements could help the dollar vs. its riskier currency rivals.

EUR - Eurozone Recession Fears Weigh On EUR

After staging a brief recovery during Asian trading yesterday, the euro once again turned bearish against many of its main currency rivals during the afternoon session. Concerns that the eurozone is slipping back into recession have been reinforced by near record high unemployment rates in several countries in the region.

As a result, the common currency tumbled vs. several of its main currency rivals including the US dollar, which briefly dropped below 1.3300, and Canadian dollar. The EUR/CAD, which earlier in the week fell some 140 pips, took additional losses yesterday, reaching as low as 1.3184.

Turning to today, traders will want to pay attention to the European Minimum Bid Rate at 11:45 GMT, followed by the ECB Press Conference at 12:30. While no changes in eurozone interest rates are forecasted to be announced, the press conference serves as an opportunity for the European Central Bank to communicate to investors the current state of the region's economies. Any negative announcements may weigh down on the euro, especially against its safe-haven currency rivals, the US dollar and Japanese yen.

JPY - Yen Reverses Gains Vs. USD

The USD/JPY, which had fallen as low as 81.54 during overnight trading yesterday, was once again moving up by the afternoon session. The pair advanced some 80 pips to peak at 81.35. The yen also staged a reversal against the euro. The EUR/JPY, which earlier in the week fell close to 250 pips, saw steady gains throughout the day yesterday. The pair went as high as 109.71, a 100 pip gain.

Today, yen traders will want to monitor news out of both the United States and eurozone. The US ADP Non-Farm Employment Change figure is forecasted to show further improvements in the American employment sector. If the figure comes in at or above the forecasted 209K, the yen may see further losses against the greenback.

How the yen performs vs. the euro is largely dependent on the ECB Press Conference, scheduled to take place at 12:30 GMT. Any negative announcements at the press conference could lead to risk aversion, which may benefit the yen.

Crude Oil - Crude Oil Turns Mildly Bearish

Following significant gains made earlier in the week, the price of crude oil slipped during yesterday's trading session, as eurozone recession fears weighed down on riskier assets. The price of oil, which had peaked at $105.10 a barrel, fell as low as $104.14 during the morning session before stabilizing around the $104.60 level.

Analysts are confident that the price of oil may remain near its current levels in the coming days. That being said, with significant US news set to be released on Friday, the markets are likely to see some volatility. The US Nonfarm Payrolls figure is expected to show positive gains in the American employment sector. Should the news lead to risk taking, the price of oil may go up as a result.

Technical News

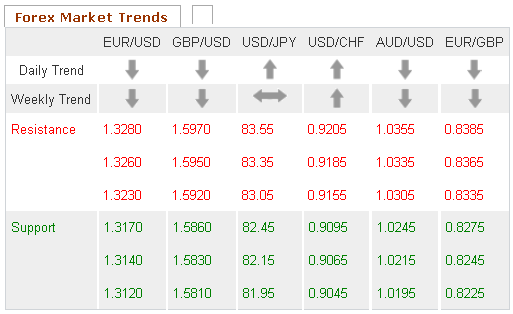

EUR/USDThe weekly chart is showing mixed signals with its RSI fluctuating at the neutral territory.

However, there is a fresh bearish cross forming on the daily chart's Slow Stochastic, indicating a bearish correction might take place in the nearest future. In that case, traders are advised to swing in after the breach takes place.

GBP/USD

The pair has recorded much bullish behavior in the past several days. However, the technical data indicates that this trend may reverse anytime soon. For example, the daily chart's Stochastic Slow signals that a bearish reversal is imminent. Going short with tight stops might be a wise choice.

USD/JPY

The price of this pair appears to be floating in the over-bought territory on the weekly chart's RSI, indicating a downward correction may be imminent. The downward direction on Stochastic also supports this notion. When the downwards breach occurs, going short with tight stops appears to be preferable strategy.

USD/CHF

The pair has recorded much bearish behavior in the past several days. However, the technical data indicates that this trend may reverse anytime soon. For example, the daily chart's Stochastic Slow signals that a bullish reversal is imminent. An upward trend today is also supported by the RSI. Going long with tight stops may turn out to pay off today.

The Wild Card

EUR/CHFThe Williams Percent Range on the 8-hour chart has dropped into oversold territory, in a sign that this pair could see upward movement in the near future. The Slow Stochastic on the daily chart appears to be forming a bullish cross. Forex traders will want to monitor this indicator. Should the cross take place, a bullish correction may occur.