Investors Positive On U.S. Developments

We’ve seen a clear shift in risk appetite over the last 24 hours, with the U.S. being the source of most of this as the government looks to avoid a shutdown and the truce deadline with China may be extended.

The shutdown soap opera may be over for now – assuming Trump doesn’t throw one final spanner in the works – after Democrats and Republicans agreed on a deal to keep government funded, at the expense of most of the funds the President demanded his border wall. This is unlikely to deter Trump though who will be seeking alternative arrangements to secure this but will be keen to avoid another shutdown after the finger of blame last month was pointed in his direction.

One of the primary risk factors for the markets is unquestionably the U.S./China trade war and so a lot depends on those talks – now taking place in Beijing – progress. The rhetoric has been changing week by week but comments from Trump on Tuesday gave investors plenty of cause for optimism, with the President suggesting he very much wants a deal and could let the deadline slide. This means the tariff on $200 billion worth of Chinese imports may not yet increase from 10% to 25% and further tariffs won’t be proposed, which is clearly coming as a relief to investors.

Brexit Can Is Kicked Down The Road

The can has been kicked down the road as far as Brexit is concerned, with Theresa May confirming on Tuesday that an agreement has not yet been reached with Brussels and that MPs will have a chance to vote on any new deal by 27 February, a little over a month before Brexit day. If a new deal isn’t forthcoming, then MPs will instead have the opportunity to vote on amendments to a motion put forward by the Prime Minister, which means another chance to postpone Brexit or block no deal. For now, the saga continues and the prospects of an eleventh-hour deal become ever higher. Still, sterling traders remain relatively chilled about the whole situation with apparent increased no deal risks no fazing them, for now.

Gold Gains As USD Ends Eight Day Winning Streak

The risk rally has brought an end to the eight-day winning streak in the dollar, with improved prospects on Sino-U.S. talks primarily behind that. This has provided some relief for gold just as the downward pressure was building. We hadn’t yet seen the crucial $1,300 support come under any significant pressure but it may have only been a matter of time if the dollar had continued to make gains at the same rate.

Gold bulls have shown strong resilience in the face of an impressive rally in the greenback but how long could they have kept it up? Obviously, global central banks becoming notably more dovish does help.

Oil Buoyed By Numerous Factors On Tuesday

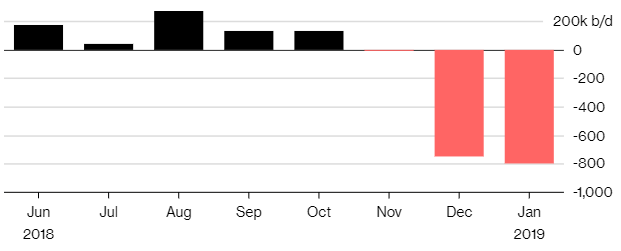

A combination of factors seemed to contribute to a lift in oil prices on Tuesday, a rally that has continued into this morning. The improved risk appetite is, of course, one of these, as it the better prospects for trade talks but the most important factor is probably the efforts of oil producers to reduce output and counter the oversupply in the markets. Saudi Arabia clearly stands out here as it vowed to reduce output by 500,000 barrels more than it previously committed to by March. This is a welcome development at a time when Russia’s compliance is being called into question. The API report showing inventories had fallen by almost a million barrels a day – against expectations of a 2.7 million barrel build – didn’t do the rally any harm either.