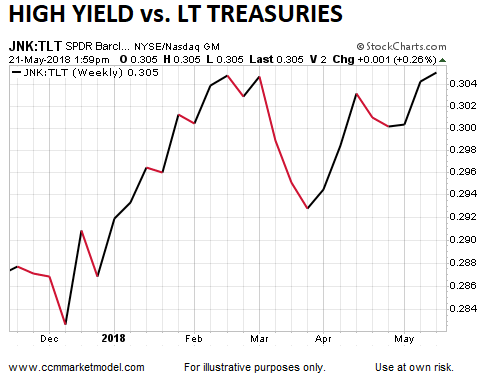

The high-yield ETF (NYSE:JNK) pays a 6.02% dividend. The long-term Treasury bond ETF (NASDAQ:TLT) pays a 3.04% dividend. The 6.02% dividend is tied to instruments that have a higher risk of default. Defaults typically increase during recessions. The ratio JNK:TLT ratio below says a lot about the market's current perception of the economy and default risk. dividend. The 6.02% dividend is tied to instruments that have a higher risk of default. Defaults typically increase during recessions. The ratio JNK:TLT ratio below says a lot about the market's current perception of the economy and default risk.

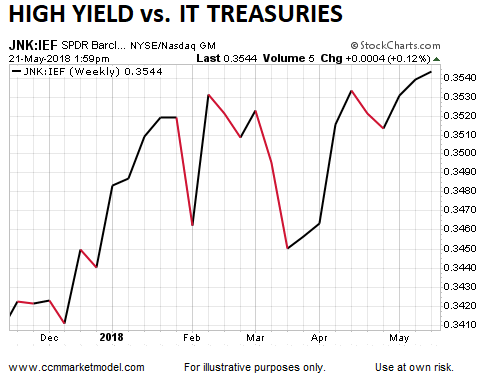

The same "we are not overly concerned about a recession and rising default rates" look can be found in the high-yield (JNK) / intermediate-term Treasury (NASDAQ:IEF) ratio.

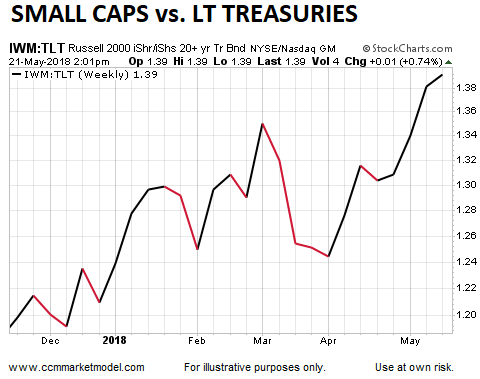

The growth-oriented small cap (NYSE:IWM) to more-defensive-oriented long-term Treasury bonds (TLT) ratio also tends to side with economic confidence rather than economic fear.

The Battle Of The Bulls And The Bears

When markets are in an indecisive trading range, it can be difficult to get a handle on who is winning the ongoing battle between the bulls and the bears. This week's video provides some longer-term insight by comparing the NASDAQ (NASDAQ:QQQ) in 2018 to the major peaks in 2000 and 2007. The video also examines small caps IJR, energy XLE, global stocks VT), MLPs (NYSE:AMJ), growth stocks (NYSE:VUG) and dividend stocks (NASDAQ:DVY).

Fear Of An Imminent Recession?

Since consumers tend to shy away from discretionary spending during recessions, but still buy toothpaste and soap, the XLY:XLP ratio tends to fall as economic fear increases. In the present day, the ratio tends to side with confidence over fear (see below).

Moral Of The Story

While there is nothing magical about the ratios above, they do contribute to the weight of the evidence. Presently, the weight of the evidence continues to slant in favor of economic confidence relative to economic fear. How long that will be the case falls into the TBD category, which is why under our approach, it is important to maintain a flexible, unbiased, and open mind.