Fed funds futures are still leaning into expectations that the Federal Reserve will reduce its target rate next by a quarter point, but the related confidence of the forecast is slipping.

The current implied probability for another rate cut is roughly 59% this morning, according to CME Group (NASDAQ:CME) data.

Expectations for the prospects of more easing at the Dec. 18 FOMC meeting have been steadily eroding since Donald Trump’s election victory. As recently as Friday, the implied probability of a rate cut was 71%.

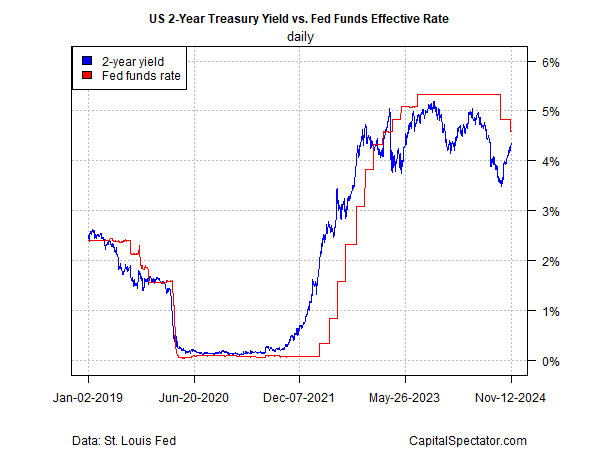

Another sign that the crowd is souring on the possibility of additional rate cuts: the policy-sensitive 2-year Treasury yield continues to rise.

This widely followed yield, which is considered a proxy for the near-term rate outlook, jumped to 4.34% on Tuesday (Nov. 12), the highest since late-July.

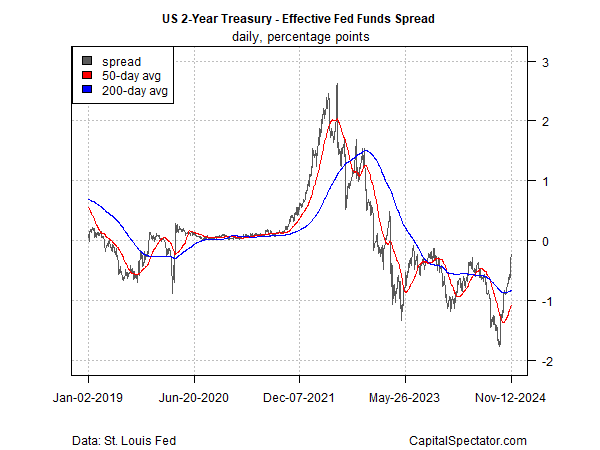

Notably, the spread between the higher median effective Fed funds target rate less the 2-year yield has narrowed to -24 basis points, the smallest spread in more than a year. The implication: the Treasury market’s outlook for more rate cuts is fading.

The election of Donald Trump is a key factor changing the calculus for rate cuts, driven by a view that the incoming president’s economic priorities may be inflationary.

The combination of across-the-board tariffs on imports and deporting millions of immigrant workers has sparked concerns that pricing pressure could revive in 2025.

“The tariff issue is a concern because it’s a sales tax,” says David Kotok, co-founder and chief investment officer at investment management firm Cumberland Advisors. “Tariffs are done by executive order. Congress gave the authority to the president long ago. They’re not going to take it back and no president would give it up without a fight.”

Economist and former Treasury secretary raises doubts about the wisdom of additional rate cuts at this juncture.

“My own judgement is that the Fed and markets are still underestimating the overheating risk,” he says. “I ask myself: Why is cutting rates a priority into that environment?”

If the Fed does pause on a rate cut, what would trigger the shift? Federal Reserve Bank of Minneapolis President Neel Kashkari responds:

“If we saw inflation surprises to the upside between now and then, that might give us pause,” he explains. But “it’d be hard to imagine the labor market really heats up between now and December. There’s just not that much time.”

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.