German trade surplus and industrial production were better than expected in March. Will the DAX index continue gaining?

German economic data were mixed lately: retail sales unexpectedly fell in March, declining 0.6% month-on-month, while consumer inflation remained at 1.6%. German statistics agency reports on Tuesday were positive though with trade balance surplus and industrial production in March increasing more than expected: trade balance surplus grew to 25.2 billion euros from 18.5 billion in February, and industrial production rose 3.2% month over month in March after 2.2% growth in previous month. Rising trade surplus and expanding industrial production are bullish for DE30.

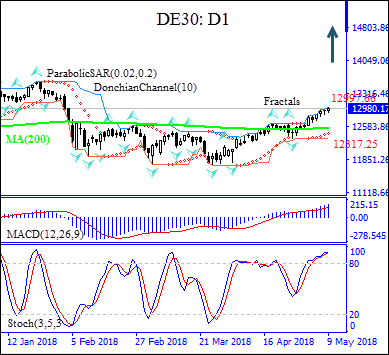

On the daily chart DE30: D1 is retracing after hitting 15-month low in the end of March. It is above the 200-day moving average MA(200).

- The Parabolic indicator has formed a buy signal.

- The Donchian channel gives a neutral signal: it is flat.

- The MACD indicator is above the signal line with the gap widening. This is a bullish signal.

- The stochastic oscillator is in the overbought zone, this is a bearish signal.

We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 12997.66. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the lower Donchian boundary at 12317.25. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop-loss level (12317.25) without reaching the order (12997.66) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

Position Buy

Sell Stop Above 12997.66

Stop loss Below 12317.25