A lot of the data and trends we’re seeing lately are making me more convinced that the signals are getting it right here and the markets are looking vulnerable. The most important relationship in the markets right now might be that of Treasury yields and small-caps.

The 10-year yield has dropped 30 basis points in less than a week. This looks like more than just a move relative to interest rate expectations. There’s a flight to quality aspect to this as well.

If economic growth were looking steady here, you could make the argument that the Fed is simply adjusting policy rates to go from positioning for high inflation to positioning for moderate inflation. When we get data showing weakness in housing, consumer spending, manufacturing and maybe even the labor market, the drop in Treasury yields looks more defensive.

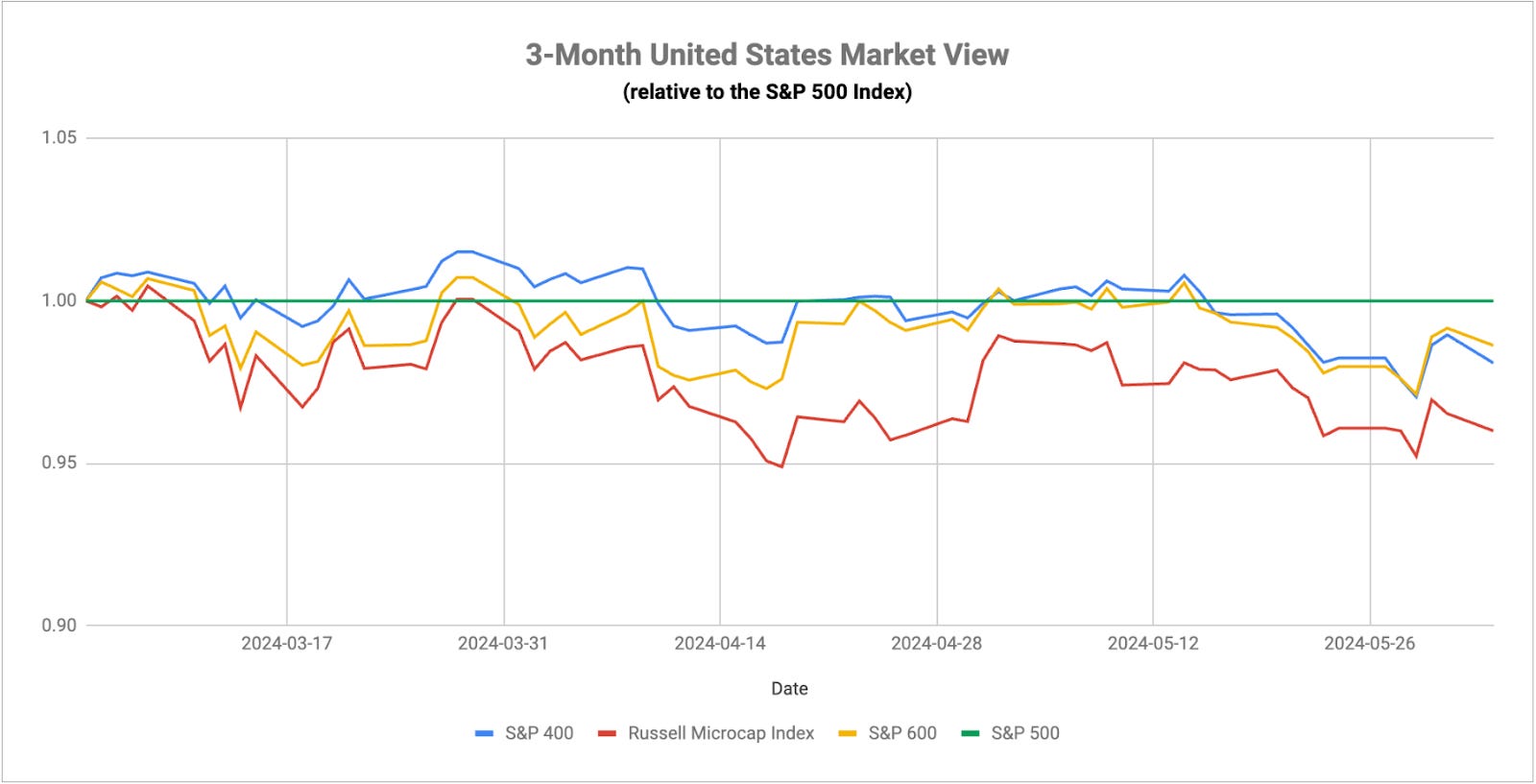

That means investors are likely expecting more cuts to support the economy, not necessarily just normalize policy conditions. Small-caps are a good gauge to measure this against. When small stocks, which are supposed to be more sensitive to change in interest rates due to their need for debt to finance operations, are continuing to underperform even though rates get more favorable, there’s a strong negative sentiment underpinning this market.

Speaking of the labor market, we may or may not see a big change in non-farm payrolls later this week, but the trend we’re seeing in the JOLTS number isn’t good. In just three months, job openings have dropped from 8.81 million in February to 8.36 million in March to 8.06 million in April, bringing it to its lowest level since February 2021. For comparison, job openings pre-COVID were about 7 million, so we may not have gone full round trip just yet, but it might not be long either. This number and the unemployment rate have historically had a very strong inverse correlation i.e. when one falls, the other rises.

The unemployment rate has already risen modestly from 3.4% a year ago to 3.9% today, but if job openings continue to rapidly fall as they have been, the labor market may be in the early stages of breaking. Even though the economic numbers have trended lower lately, the labor market is the one thing that has sustained investor sentiment. If that goes, there may not be much preventing a big VIX spike.

While that indicates rising risk for the jobs market, a note recently released by the FDIC shows just how vulnerable the U.S. banking system might be. The tl:dr version says that the number of problem banks rose from 52 last quarter to 63 in Q1 and that banks as a whole are sitting on more than half a trillion dollars of unrealized losses. Most of that comes from positions built over the past few years when banks began purchasing longer duration bonds in order to improve the yield they were earning. Now having gone through the most aggressive rate hiking cycle in history, those long-dated bonds are massively in the negative.

This is the same phenomenon that resulted in the failures of Silicon Valley Bank and Signature Bank (OTC:SBNY) last year and Republic First Bank (NASDAQ:FRBA) this year. We know that the loan market is stagnating as high yields price many potential lenders out of the market, but can this turn into an outright collapse?

Perhaps this is part of the reason why the Fed decided to reduce the pace of balance sheet reduction starting this month and may be preparing to eliminate it altogether. As long as it’s small regional banks that are failing, the Fed probably won’t be terribly motivated to intervene. If the big banks start to look threatened, you can bet the Fed will be ready to drop another liquidity bomb on the system. All of this bond buying is another potential reason why Treasuries could be positioning to extend their rally.