On Sep 24, we issued an updated research report on US Bancorp (NYSE:USB) USB. The company continues to gain from its organic and inorganic growth strategies, rising loans and deposit balances, while mounting expenses on investments in technology, lack of diversification of loan portfolio as well as pending legal matters remain near-term headwinds.

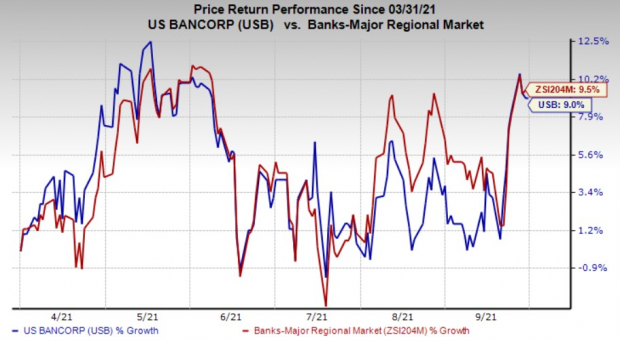

Shares of US Bancorp have rallied 9% in the last six months, while the industry has appreciated 9.5%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The stock currently carries a Zacks Rank #3 (Hold).

The company witnessed continued organic growth over the last few years backed by its constant efforts to fortify the existing relationships and improving customers experience through the introduction of new products. A decent lending scenario, aided by economic growth, might support the company’s net interest income (NII) in the days to come.

Notably, the company’s average deposits and loans reflected a five-year CAGR of 3.5% and 6.2%, respectively, in 2020. Total deposits witnessed a rising trend in the first half of 2021, while total loans declined. We believe that both loan and deposit balances are poised to increase in a recovering economy.

Driven by a strong liquidity position, US Bancorp has been able to expand via a couple of mergers and acquisitions in the past couple of years, which have opened up new markets to it and fortified the existing markets. These acquisitions, combined with the ongoing investments in innovative product improvements and services, have bolstered the company’s balance sheet and fee-based businesses besides boosting the market share.

However, rising costs are hurting the company’s bottom-line growth. As it intends to make investments in digital, data and technology refinements, product differentiation and other initiatives, we believe, such costs might weigh on its expense base to some extent in the upcoming quarters. US Bancorp has witnessed non-interest expenses CAGR of 3.8% over the last five years (2016-2020), with the trend continuing in the first half of this year.

Further, a bulk of US Bancorp’s loan portfolio – nearly 48% as of Jun 30, 2021 – comprises total commercial loans. Such a lack of diversification can be precarious for the company amid a challenging economy.

U.S. Bancorp continues to battle investigations and lawsuits from investors and regulators. Though the company has resolved certain litigations related to the sale of risky mortgage-backed securities, many of the cases are yet to be settled. All these might lead to elevated legal expenses and provisions in the near term.

Stocks to Consider

Better-ranked stocks in the financial space include American International Group (NYSE:AIG), Inc. AIG, sporting a Zacks Rank #1 (Strong Buy), and JPMorgan Chase (NYSE:JPM) & Co. JPM and The Bancorp (NASDAQ:TBBK), Inc. TBBK, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

American International Group earnings estimate for the current year remained unchanged in the past seven days. Moreover, its shares have gained 20.8% in the last six months.

The Bancorp’s earnings estimate has remained unchanged for the current year in the past month. Also, its share price has jumped 23.4% over the last six months.

JPMorgan’s current-year earnings estimate has been revised marginally upward over the last 30 days. Further, its shares have gained 9% in the last six months.

Zacks’ Top Picks to Cash in on Artificial Intelligence

This world-changing technology is projected to generate $100s of billions by 2025. From self-driving cars to consumer data analysis, people are relying on machines more than we ever have before. Now is the time to capitalize on the 4th Industrial Revolution. Zacks’ urgent special report reveals 6 AI picks investors need to know about today.

See 6 Artificial Intelligence Stocks With Extreme Upside Potential>>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM): Get Free Report

American International Group, Inc. (AIG): Get Free Report

U.S. Bancorp (USB): Get Free Report

The Bancorp, Inc. (TBBK): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research