Gold prices have been climbing, as investors seek out safe havens amid the recent surge in stock market volatility. After gaining 1.4% last week, December-dated gold futures are up again today, last seen 0.7% higher at $1,230.30. Against this backdrop, options volume is accelerated on the SPDR Gold Shares (NYSE:GLD), the VanEck Vectors Gold Miners ETF (NYSE:GDX), and Barrick Gold Corporation (NYSE:ABX), as traders look for ways to gain exposure to the malleable metal.

GLD Bears Bet on a November Retreat

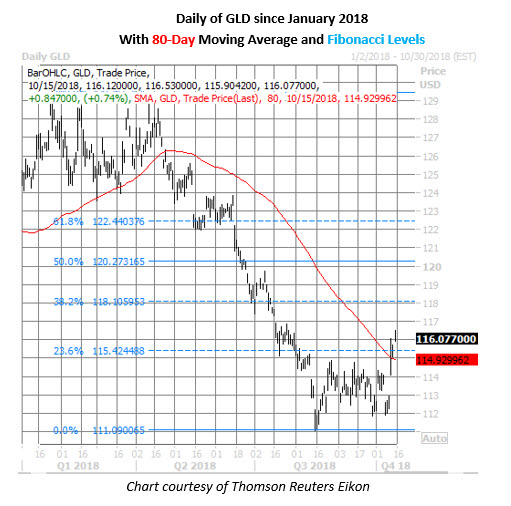

The SPDR Gold Shares are up 0.7% to trade at $116.08. Last week, the fund broke out above recent congestion in the $114.50-$115 region, and is now trading north of $115, a region that roughly coincides with GLD's 80-day moving average and a 23.6% Fibonacci retracement of its plunge from April highs near $129.50 to August lows around $111.

In the options pits, around 77,000 calls and 46,000 puts are on the tape today, about 1.6 times what's typically seen at this point in the day. The November 114 put is most active, and it looks like new positions are being purchased for a volume-weighted average price of $0.67. If this is the case, breakeven for the put buyers at the close on Friday, Nov. 16 -- when the options expire -- is $113.33 (strike less premium paid).

GDX Options Bull Raises the Bar

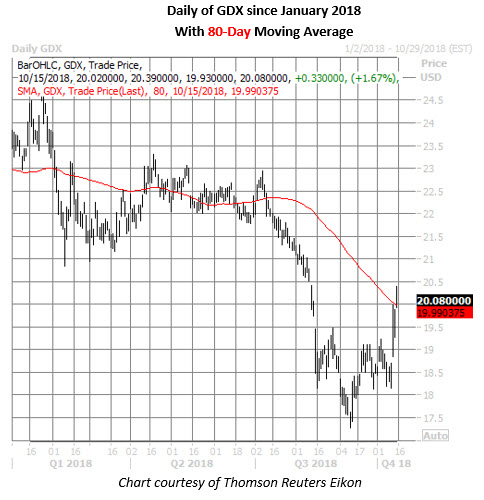

The shares of the VanEck Vectors Gold Miners ETF have also moved above their 80-day moving average -- last seen up 1.7% at $20.08, bringing their month-to-date gain to 8.4%. The fund is now testing the round $20 mark, home to its mid-August bear gap.

One options trader today doesn't seem to worried about this potential layer of resistance. Amid accelerated call volume -- the 115,000 contracts traded is twice the expected intraday amount -- a bullish bettor appears to be selling to close October 20 calls and rolling them up and out to the weekly 10/26 21-strike, expecting GDX to break out above $21 by the close next Friday, Oct. 26.

Barrick Gold Calls Pop

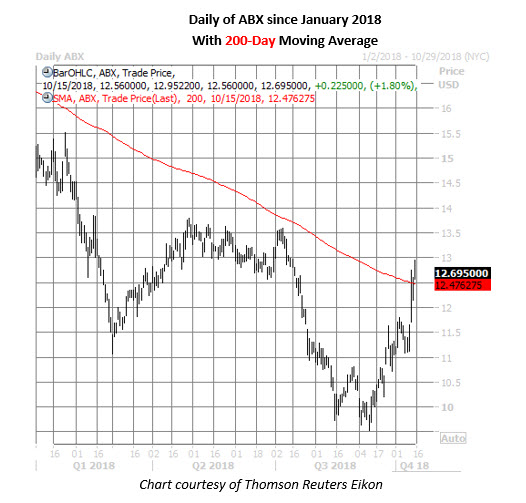

Gold mining stock Barrick Gold is enjoying sector tailwinds, up 1.8% at $12.70. The shares are up 33.3% from their mid-September low of $9.53, and are pacing toward their second close north of their 200-day moving average since last September -- the first of which occurred last Thursday, Oct. 11. ABX is still 12.3% lower year-to-date.

With about 90 minutes left in today's trading, ABX has seen 33,000 calls and roughly 15,000 puts change hands, about two times the average pace and total options volume running in the 95th annual percentile. The October 13 call is most active, though it's not clear how these front-month options are being traded.