Doha, 29 October 2017- QNB Group has published the Singapore Economic Insight 2017. The report examines recent developments and the outlook for the Singaporean economy

Singapore is a highly open economy and its exports should benefit from firming global trade over the next three years

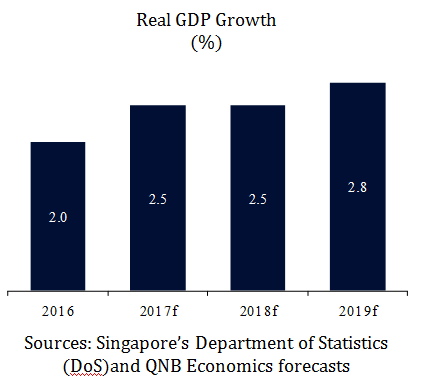

As a result, real GDP growth is expected to accelerate to an average of 2.6% over 2017-2019

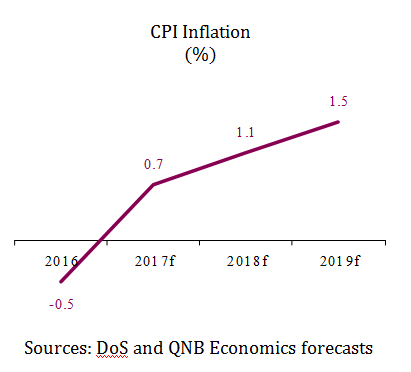

Inflation is expected to exit deflationary territory in 2017, rising to 0.7%, and should continue to strengthen to 1.1% in 2018 and 1.5% in 2019

The improvement in inflation is expected to be driven by higher commodity prices and a gradual recovery in the housing market.

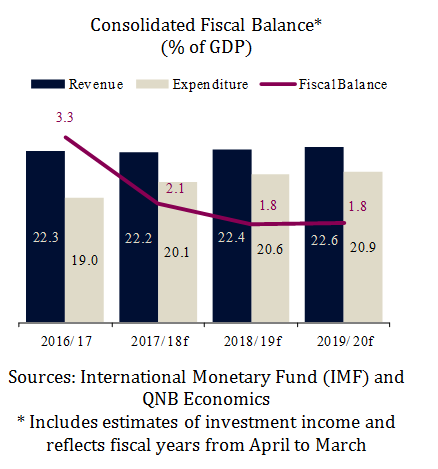

The government is expected to continue its fiscal easing stance, reducing the consolidated fiscal balance to an average of 1.9% of GDP over 2017-19

Higher spending is aimed at stimulating domestic demand to counteract headwinds such as continued population ageing.

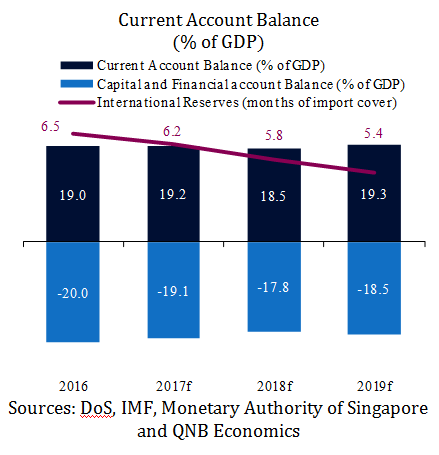

The current account is expected to remain relatively stable at an average of 19.0% over the forecast horizon, supported by robust trade as a result of rising external demand

While the capital and financial account should remain broadly stable as Singapore’s current account surpluses continue to be invested abroad.

Disclaimer : and Copyright Notice: QNB Group accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Where an opinion is expressed, unless otherwise provided, it is that of the analyst or author only. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. The report is distributed on a complimentary basis. It may not be reproduced in whole or in part without permission from QNB Group.