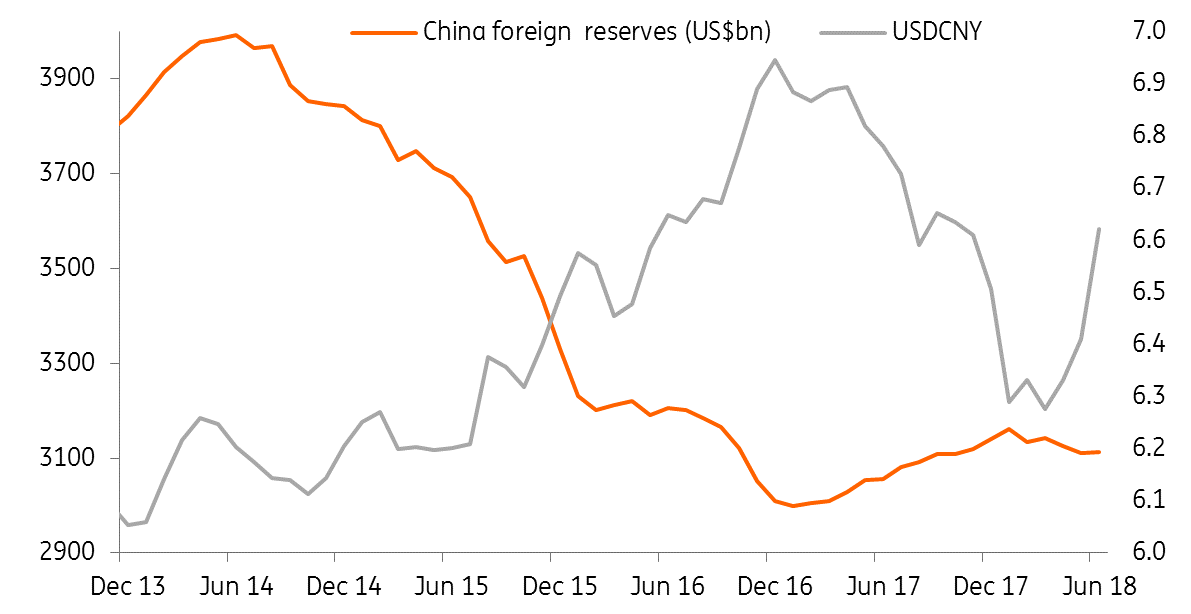

Foreign exchange reserves in China rose $1.51 billion in June from May, stopping the falling trend. A-share's inclusion in the MSCI from 1 June helped, and wider inflow channels give more room for yuan weakening.

No depletion of foreign exchange reserves

Inflows have more than offset outflows in June.

On 1 June 2018, A-shares inclusion in the MSCI brought $22 billion capital inflows into China. We also expect a trade surplus of near $25 billion in June.

But as the dollar index rose by 0.5%, the valuation effect on non-USD dollar assets in China's foreign exchange reserves was negative. This was the main reason for the drop in foreign reserves in April and May.

Yuan depreciation of more than 3% in the month should have resulted in some capital outflows.

Yuan can weaken further as persistent net outflows is no longer a concern

In the future, we expect inflow channels to continue to widen further. This is the main reason that we have revised our yuan forecast to 7.0.

Inflows include investments in financial assets onshore (more A-share inclusion in the MSCI on 3 September 2018), and the opening up of business markets for foreign investors interested in financial sectors and transport manufacturing (the opening up of different sectors has a different time frame from now to 2020).

If foreign exchange reserves fall only slowly or even rise due to inflows when the yuan weakens, then the worry of net capital outflows that would create fast foreign exchange reserves depletion could be a big concern. In other words, we do not expect the falling speed of foreign exchange reserves in 2018 to be as fast as in mid-2014-2016.

We believe that a weaker yuan in the middle of a trade war between China and US is reasonable because a currency would depreciate to adjust for slower export growth. It would be strange if the yuan appreciates against the dollar when the trade war continues.

Foreign reserves rose in June even though the yuan weakened

Trade war's impact on asset market

The trade war started officially at the beginning of July, and we expect another $16 billion of goods will be subject to a 25% tariff from the US and then from China as soon as before August.

All of this should have been priced in in asset markets.

But the extra $200 billion worth of goods subject to a 10% tariff from the US after China retaliates is still to be fully priced in. When the $200 billion tariff becomes more imminent then the market should be more volatile than the current environment.

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. For our full disclaimer please click here.