It is common knowledge that stock and bond prices move in opposite directions. Everyone knows this. So if they are moving in the same direction it would be chaos. Like cats and dogs living together. Well, common knowledge is quite often 100% wrong. In fact, stocks and bond prices move together more often than not. And cats and dogs can live together in harmony. Just look at that picture.

So even though stock prices are rising, making new all-time highs, it does not have to mean that bond prices are going to fall. And the chart of the 20+ year Treasury ETF, iShares 20+ Year Treasury Bond (NYSE:TLT), below shows that quite the opposite may be about to happen.

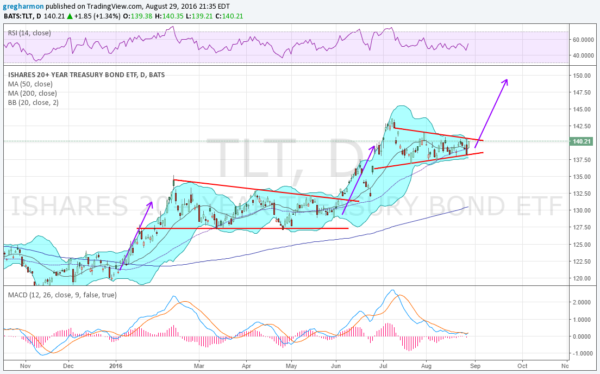

The ETF went through a long consolidation in a descending triangle from February through to early June. When it broke above that it moved up to the target and higher to a new all-time high.

Now it is consolidating again in a symmetrical triangle. A break above the triangle gives a target near 150 to the upside. Momentum is starting to turn bullish. The RSI continues to hold over the mid line and in the bullish zone. It is the MACD that is starting to improve. It is level and now rolling towards a bullish cross up.

With the Bollinger Bands® squeezing in, the time for a move is soon. And now all the indicators are suggesting it will be to the upside. Maybe it will be cats and dogs living together.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the blog, please see my Disclaimer page for my full disclaimer.