Global stock markets took a small step up at the opening of markets on Monday. However, overall we can speak of a very mixed sentiment. The complex market picture we have seen in previous weeks is still in place after the start of the US economic aid package.

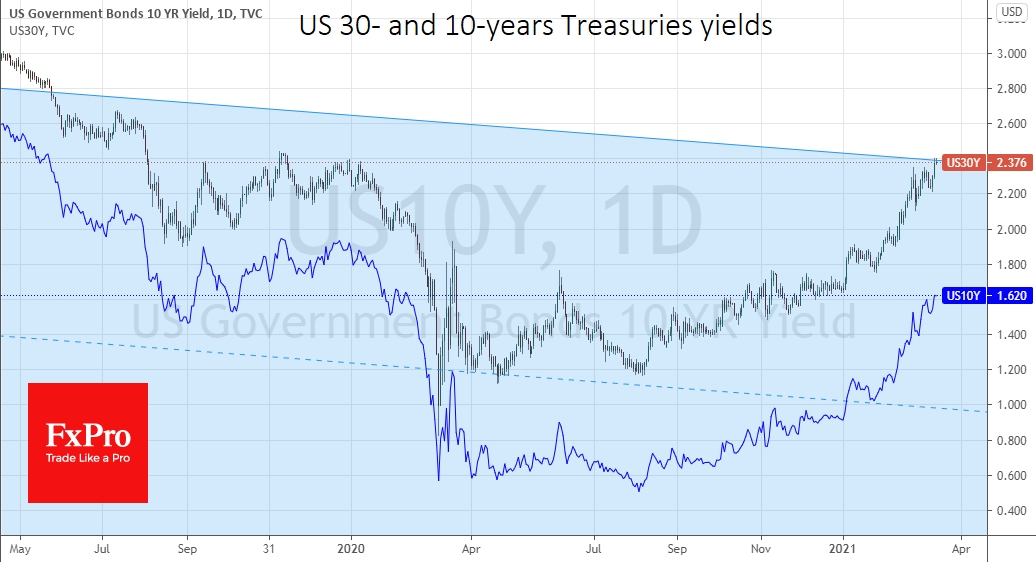

Longer-term US government bond yields continued their climb, taking the 10-year above 1.625%, a 13 month high. The 30-year bond yield rose to 2.38%, where it was steadily above before August 2019.

Rising US bond yields are putting the trends of previous weeks back on the agenda. Investors also ask for higher bond yields in other regions and sectors, which is reflected in many market dynamics.

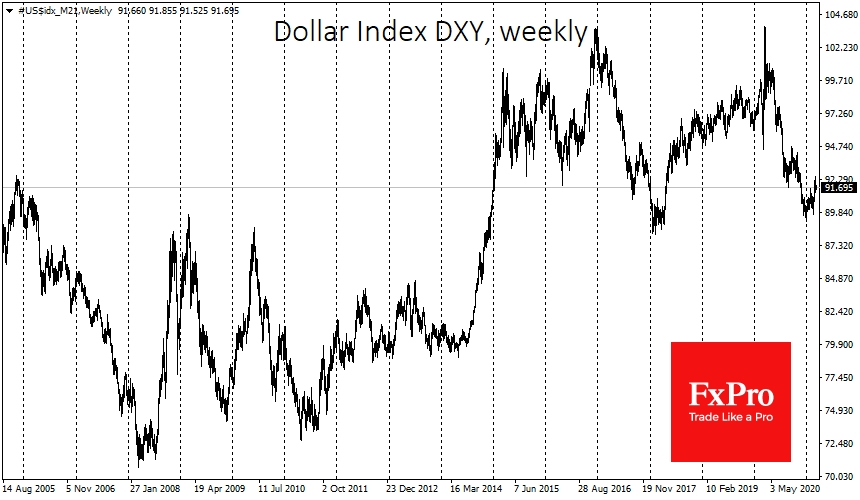

Although the rise in yields is a consequence of the sell-off in the debt markets, this does not hinder the dollar. On the contrary, it is gaining on bond pressure. One can see how the dollar index has turned upwards since the end of February, reflecting the debt markets' trends.

Rising yields tighten financial conditions and undermine the basis for economic recovery. That is why central banks in several countries have stepped up their efforts to curb rising yields. More and more, the market's eyes are now on the Fed: Will it agree this week to announce more measures to curb rising yields?

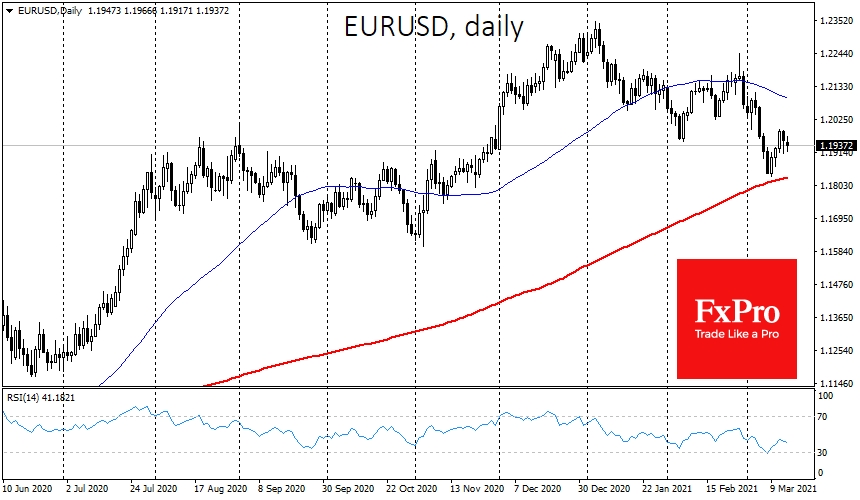

This type of rising dollar hits emerging market currencies the hardest, although the dollar index added more than 20% in the year following its turn to growth in 2014.

Simultaneously, a sharply growing dollar with a weak economy undermines the recovery, although it promises to curb inflation.

The example of the rising dollar in 2014-2016 is difficult to take as a predictor of what awaits us now. The chances are much higher than the dollar's strengthening on rising yields will not go beyond the first half of the year. It may be even earlier if the Fed agrees to increase its purchases of long-term bonds as part of QE as early as this coming Wednesday.

Further strengthening of the dollar causes us to watch the significant near-term levels with particular caution. A rise in the Dollar Index above the previous local highs (92.5) would confirm the bullish sentiment of participants towards the USD.

For EUR/USD, a major level to watch is 1.1940, last week's lows and where 200 SMA now located. In GBP/USD, the nearest important support is seen at 1.3800.

Locally, we see weak movements in oil and gold. Oil's ability to renew its highs above $70 for Brent is highly questionable with the dollar rising. It will not be easy for gold to develop a reversal to the upside. A new bearish sideways attack with a renewal of last week's lows at $1680 is also possible.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rising Dollar Despite Plenty Of Money. What's Next?

Published 03/15/2021, 06:10 AM

Updated 03/21/2024, 07:45 AM

Rising Dollar Despite Plenty Of Money. What's Next?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.