Ripple, the only major cryptocurrency that is centralized, briefly became the second largest after Bitcoin, after its price rose from below 20 cents a coin on December 8th, 2017, to over $3.31 by January 4th, 2018. As of this writing, it has been surpassed by Ethereum again, but it still maintains a total market capitalization near $100 billion, making Ripple’s co-founder and executive chairman, Chris Larsen, one of the richest men on the planet, at least on paper.

Good for him. However, what interests us as analysts and traders is where is XRPUSD going next. Are we going to see a new all-time high soon? Are bulls too tired already? The Elliott Wave analysis of Ripple’s 4-hour chart below should give us a hint.

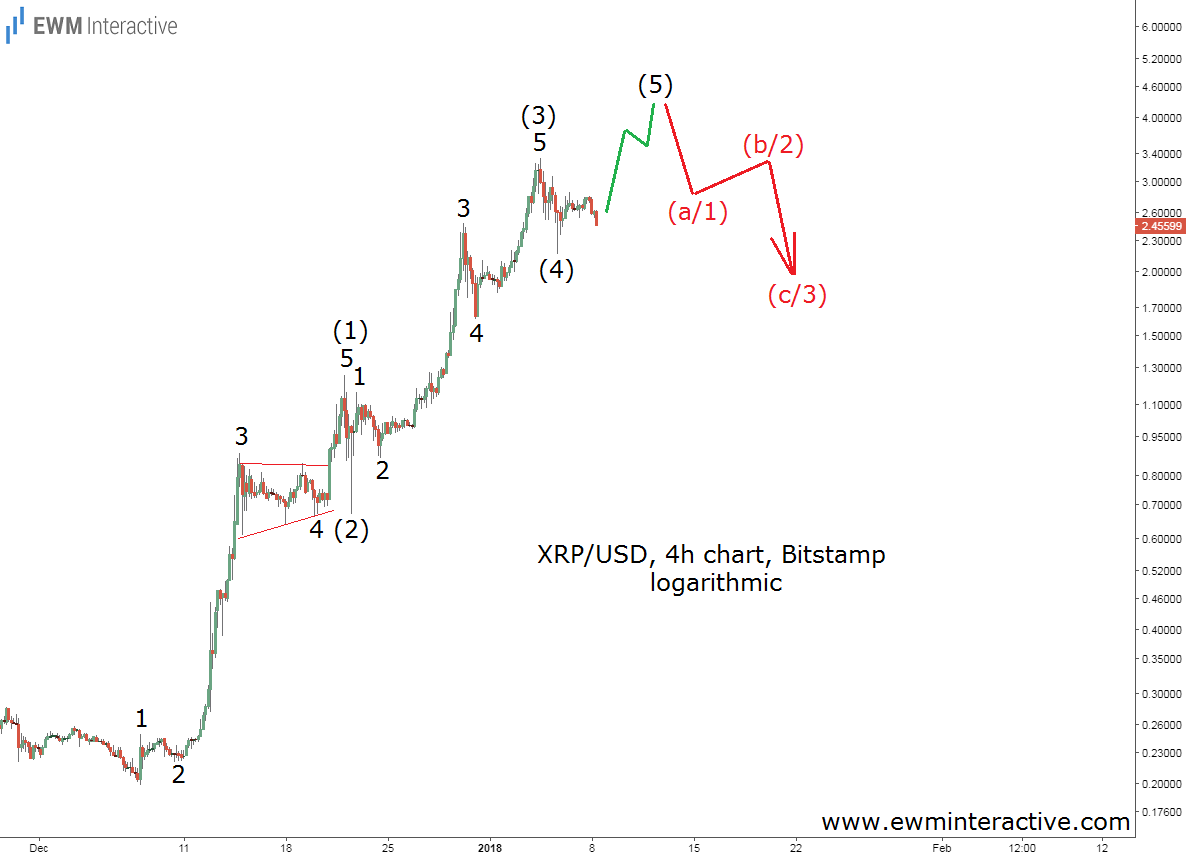

The logarithmic chart above shows Ripple’s recent ascent from $0.19776 to $3.31700. The San Francisco-based company’s blockchain payment network already serves more than 100 financial institutions, but the price of XRP is still subject to the two basic emotions, which govern the prices of all kinds of assets – fear and greed. Fortunately, these two form repetitive and therefore recognizable patterns.

The price pattern Ripple has been drawing for almost a month looks very similar to a five-wave impulse. Furthermore, the impulsive structure of waves (1) and (3) is also clearly visible. The only problem is that the fifth wave, labeled (5), is still missing, which gives us a reason to expect more strength from now on while it develops.

Wave (5) is supposed to exceed the top of wave (3). On different exchanges, wave (3) climbed to $3.31700, $3.34989 and even $3.84, so it seems reasonable to expect wave (5) to reach the $4 mark. With Ripple currently hovering around $2.49, this means the virtual currency could add another 60% to its market cap.

On the other hand, once the top of wave (3) is taken out, traders should be careful, because according to the Elliott Wave principle, every impulse is followed by a three-wave correction in the opposite direction.