SEK has been the European sessions’ worst performer as Riksbank surprisingly introduced negative rates and announced QE. In Denmark, the pressures on EUR/DKK peg increase speculations that the DNB may also intervene anytime to cool-off tensions before the EU/Greece talks restart on Monday. Finally, the ZAR takes a breather with good political news out of Minsk gathering on Russia/Ukraine. South African gold production turned positive for the first time in two years, while the mining sector continues contracting.

Riksbank unexpectedly goes negative, announces QE

To our surprise, Riksbank decided to act sooner rather than later and unexpectedly cut the key rate by 10 basis points to -0.10% and announced the purchase of SEK 10 billion worth of government bonds with 1-to-5 year maturity. “There are signs that underlying inflation has bottomed out, but the situation abroad is now more uncertain and this increases the risk that inflation will not rise sufficiently fast”. The negative repo rate is to remain until the inflation rises close to bank’s 2% target and it will “not be appropriate” to proceed with normalization before 2H, 2016 according to the official statement. Riksbank pledges to take further action if needed, among the additional measures is cited a program of loans to companies via banks. EUR/SEK rallied to 9.6867 strengthening the short-term bullish trend building since weeks. USD/SEK immediately advanced to 8.5551 for the first time since April 2009. With Riksbank aggressively dovish in the central banks’ game, we expect the SEK to remain under heavy selling pressures. The way is now open to 9.00/9.30 era in USD/SEK, last seen six years ago.

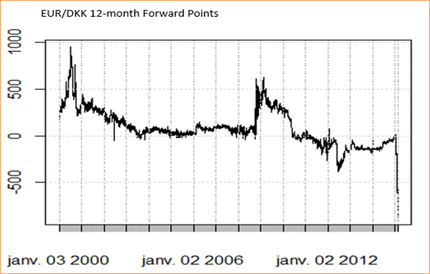

Pressures on EUR/DKK peg persist

News that Denmark rejected all bids in a T-bill auction to prevent investors from rushing into DKK assets, pulled 2-year sovereign yields to a record, below -1%, the 5-Year and 10-Year yields eased to -0.48% and 0.12% respectively. While Denmark sovereign bond issues are suspended until next notice, the T-bills remain the only alternative for the government funding. According to the central bank however, the government is pre-funded through 2015 and does not need to look for further debt anytime soon. Given the money market reaction to yesterday’s T-bill auction and the forward points pricing, it is almost clear that Danish National Bank will have no choice but to proceed with additional measures to protect the EUR/DKK peg (7.46038 krone per euro +/-2.25%). The 1-year forward points deepen to fresh record low of -879.50, exceeding 1% swing around the target, while in practice no higher than 0.5% deviation is allowed. Markets already talk about a possibility of a re-peg, should the current setting becomes unsustainable.

South African gold production expands first time in two years

South African Rand takes a breather amid yesterday’s aggressive unwind to 13-year lows verse USD. As the risk-off sentiment dissipates with Russia/Ukraine agreement to cease fire and the EU/Greece talks pushed back to next Monday, the December gold, mining production data sustained the ZAR-recovery. Data showed, the Gold production turned positive (+2.3% y/y in Dec) for the first time since end-2013, the platinum production contracted 14.9%y/y (vs. -14.3 y/y in Nov), while the mining production remained subdued despite slight recovery in December.

At this point, the mid/long term selling pressures on the high-yielding EM currencies will likely continue as global macro and political risks remain. Yet cool-off in short-run FX volatilities should trigger some more short covering in ZAR before Feb 18th inflation data. We believe a correction is healthy before renewed attempt to 12-psychological level. We see support building at 11.33/11.50 era (100-dma / optionality).

EUR/DKK 12m forwards at record lows

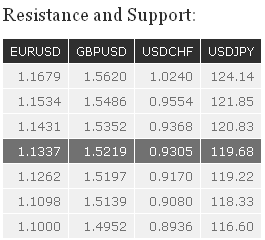

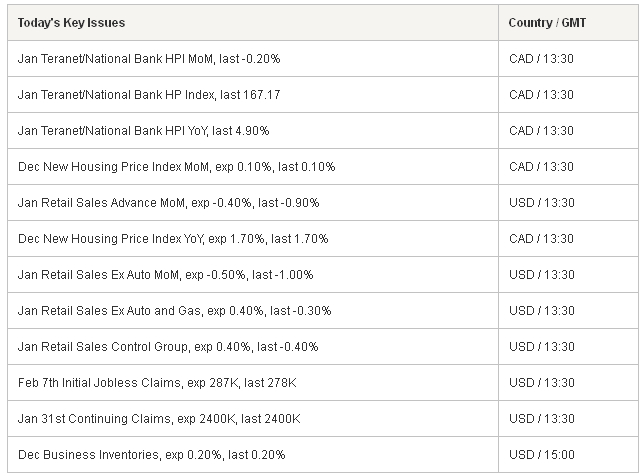

The Risk Today

EUR/USD EUR/USD has thus far successfully tested the support at 1.1262. However, the inability to break the hourly resistance at 1.1359 suggests persistent selling pressures. Another hourly resistance can be found at 1.1431 (intraday low, see also the declining trendline), while a key resistance at 1.1534. Another support lies at 1.1098. In the longer term, the symmetrical triangle favours further weakness towards parity. As a result, any strength is likely to be temporary in nature. A resistance lies at 1.1679 (21/01/2015 high), while a key resistance stands at 1.1871 (12/01/2015 high). Key supports can be found at 1.1000 (psychological support) and 1.0765 (03/09/2003 low).

GBP/USD GBP/USD has broken the key resistance at 1.5274 (06/01/2015 high). Even if the declining trendline remains thus far intact, further strength towards the resistance at 1.5486 is favoured. Hourly supports stand at 1.5197 (10/02/2015 low) and 1.5139 (04/02/2015 low). An hourly resistance can be found at 1.5352 (06/02/2015 high). In the longer term, the break of the key resistance at 1.5274 (06/01/2015 high) suggests renewed buying interest. Upside potential are likely given by the resistances at 1.5620 (31/12/2014 high) and 1.5826 (27/11/2014 high). The strong support at 1.4814 should cap the medium-term downside risks.

USD/JPY USD/JPY has broken the resistance implied by its declining trendline, confirming an improving technical structure. However, the resistance area between 120.83 and 121.85 will likely be hard to break. Today's breach of the hourly support at 119.22 (06/02/2015 high) confirms this scenario. Another support lies at 118.33 (09/02/2015 low). A long-term bullish bias is favoured as long as the key support 110.09 (01/10/2014 high) holds. Even if a medium-term consolidation is likely underway, there is no sign to suggest the end of the long-term bullish trend. A gradual rise towards the major resistance at 124.14 (22/06/2007 high) is likely. A key support can be found at 115.57 (16/12/2014 low).

USD/CHF USD/CHF is consolidating below the resistance at 0.9368 (15/10/2014 low, see also the 200-day moving average). Hourly supports stand at 0.9170 (30/01/2015 low) and 0.8936 (27/01/2015 low). Another resistance lies at 0.9554 (16/12/2014 low). Following the removal of the EUR/CHF floor, a major top has been formed at 1.0240. The break of the resistance implied by the 61.8% retracement of the sell-off suggests a strong buying interest. Another key resistance stands at 0.9554 (16/12/2014 low), whereas a strong support can be found at 0.8353 (intraday low).