- Riksbank is expected to announce it’s interest rate decision today and is expected to remain on hold at -0.5%. SEKOIS imply that the market has priced in Riksbank to remain on hold with a probability of 85%. Financial data and fundamentals support the case for the bank to remain on hold as well. Specifically, the inflation rate is currently at +1.7% yoy, below Riksbank’s target of +2.0% yoy and unemployment is at 6.0% evident of the existing slack in the labour market. On the fundamental side, Sweden maybe facing a housing bubble with Riksbank trying to achieve a “soft landing” of the prices. Hence, focus may shift to the accompanying statement and the press conference. The tone is expected to be neutral, maybe even a bit dovish. SEK could be weakened by the developments and some volatility could be expected upon the announcement of the rate decision.

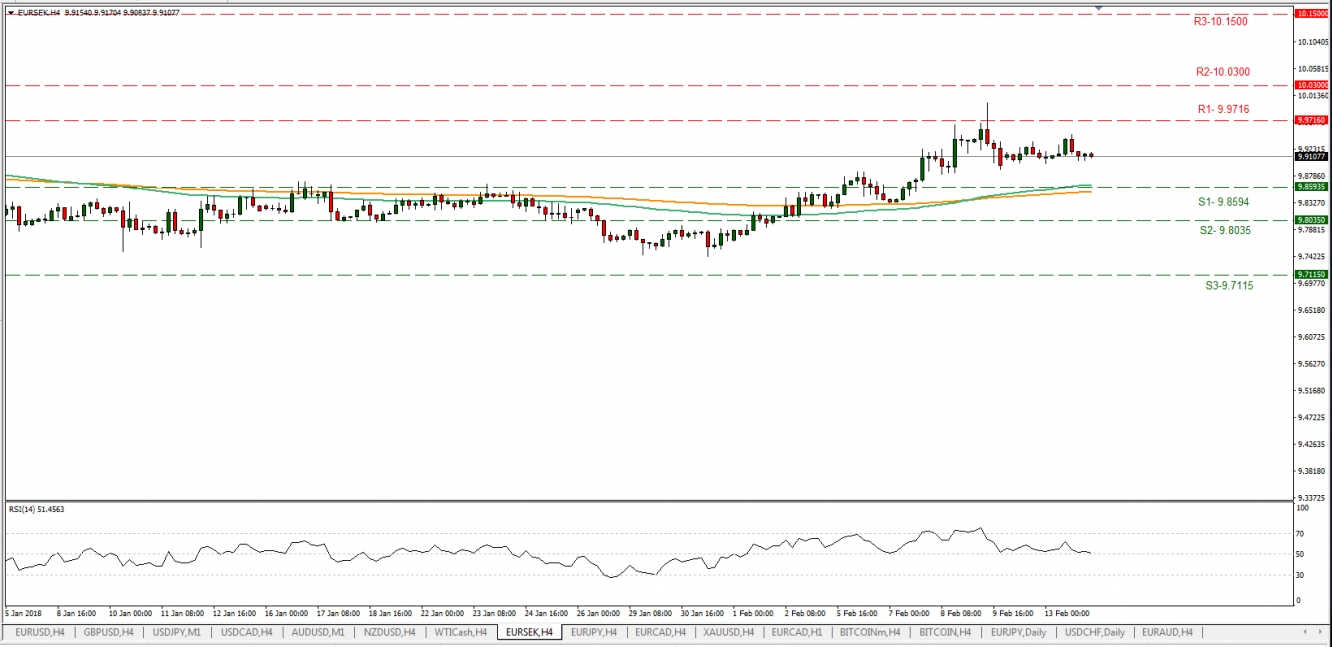

- EUR/SEK has been trading in a sideways manner the past few days, well between the 9.8594(S1) support line and the 9.9716 (R1) resistance line. We see the case for the pair to trade sideways with a bullish sentiment in the short term, due to the fundamentals mentioned before. Should the bears get in the driver’s seat, we could see the pair breaking the 9.8594 (S1) support line and aim for the 9.8035 (S2) support zone. On the other hand should the bulls take the reins, we could see the pair breaking the 9.9716 (R1) resistance line and aim for the 10.0300 (R2) resistance hurdle.

A speech to Unite a Kingdom

- The first speech about Brexit is to be delivered today by Boris Johnson. Media reports suggest that the speech may call for unity and present Brexit not as “grounds for fear but hope”. Other headlines suggest that the UK’s border and immigration system is unprepared for Brexit, providing further uncertainty. The EU side on the other hand seems to be focusing more on inner politics, as France’s Macron concentrates on EU reforms and Germany is still struggling to form a government. We expect the speech to overshadow any other Brexit development today and its content to create a positive sentiment which could support the GBP.

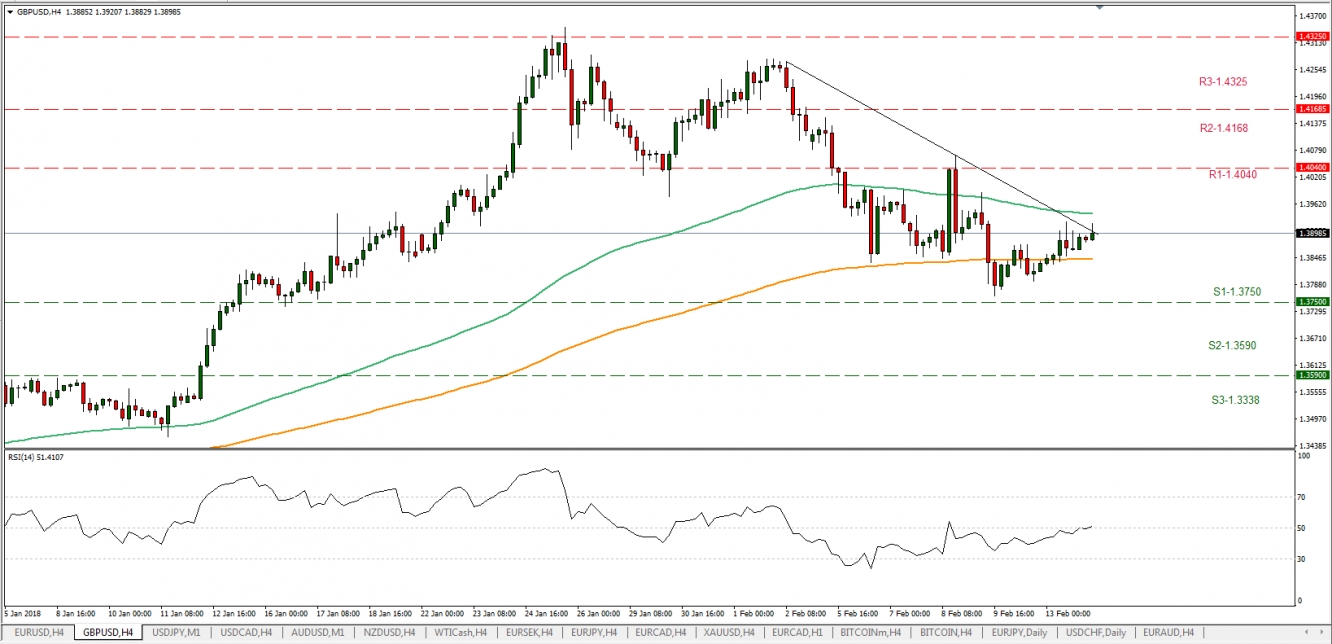

- Cable, as analysed yesterday moved in a sideways manner with bullish tendencies and broke the downward trend-line incepted on the 2nd of February, however failing to reach the 1.4040(R1) resistance line. We see the case for the pair to continue to trade in a sideways manner with bullish tendencies and it could be influenced by the fundamentals mentioned before as well as the US inflation data which are to be released today. Should the pair find new selling orders, we could see it breaking 1.3750 (S1) support line and aim for the 1.3590 (S2) support zone. On the other hand should the pair come under buying interest we could see it breaking the 1.4040 (R1) resistance level.

As for today’s other economic highlights:

- In the European morning, we get the German preliminary GDP growth rate for Q4 and the German final HICP rate for January. Also during the European morning, Riksbank’s interest rate decision will be announced and later on the much anticipated US inflation data are due out. Last but not least, US Crude Oil Inventories are to be released. As for speakers, ECB Board member Yves Mersch speaks.

GBP/USD

Support: 1.3750(S1), 1.3590(S2), 1.3338(S3)

Resistance: 1.4040(R1), 1.4168(R2), 1.4325(R3)

EUR/SEK

Support: 9.8594(S1), 9.8035(S2), 9.7115(S3)

Resistance: 9.9716(R1), 10.0300(R2), 10.1500(R3)