LEDE

This is a slightly advanced option trade that starts three calendar days after Alibaba (NYSE:BABA) Group Holding Limited (NYSE:BABA) earnings and lasts for the 5 calendar days to follow, that has been a winner for the last 2-years.

According to NASDAQ, Alibaba has earnings due out 8-17-2017 before the market opens. To replicate this back-test, the trade would open on 8-21-2017 near the market close and the position would be closed on 8-24-2017 near the market close, unless a stop loss or limit gain is triggered before hand.

Alibaba Group Holding Limited (NYSE:BABA) Earnings

Most of the trades we have examined have owned options, which is code for being “long volatility.” Remember, option trading is volatility trading, whether we mean it to be or not. This time we will look to balance the trade positions with a trade that is short volatility.

For Alibaba Group Holding Limited, irrespective of whether the earnings move was up or down, if we waited three-days after the stock move, and then sold a one-week at out of the money iron condor (using weekly options), the results were quite strong. This trade opens three calendar days after earnings were announced to try to let the stock find equilibrium after the earnings announcement.

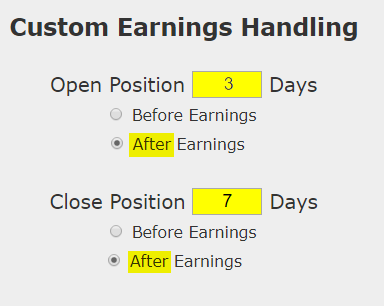

We can test this approach without bias with a custom option back-test. Here is our earnings set-up:

Rules

* Open the short iron condor 3 calendar days after earnings

* Close the iron condor 7 calendar days after earnings

* Use the options closest to 7 days from expiration (but at least 7-days).

And a note before we see the results: This is a straight down the middle volatility bet — this trade wins if the stock is not volatile the week following earnings and it will stand to lose if the stock is volatile.

LOGIC AND RISK

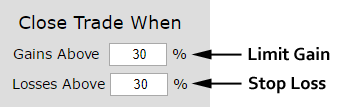

The logic here is simply that after Alibaba does whatever it does after earnings, the stock will then fall into a quiet period for several days and this trade looks to benefit from that. We do however add an additional risk control with a 30% stop and a 30% limit:

In English, if the iron condor is ever up or down 30% before the closing date, this trade was closed ahead of time.

RESULTS

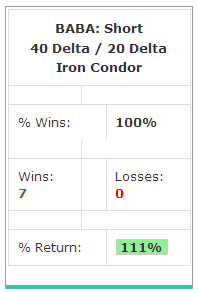

If we sold this 40/20 delta iron condor in Alibaba Group Holding Limited (NYSE:BABA) over the last three-years but only held it after earnings we get these results:

We see a 111% return, testing this over the last 7 earnings dates in Alibaba Group Holding Limited. That’s a total of just 44 days (4 days for each earnings date, over 7 earnings dates).

Setting Expectations

While this strategy had an overall return of 111%, the trade details keep us in bounds with expectations:

The average percent return per trade was 14.7% over 4-days.

THE LAST YEAR

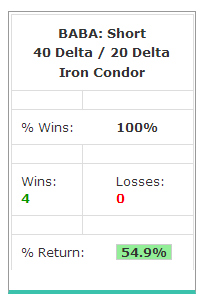

Obviously the trade has also won each of the last four earnings cycles (since it was a winner for the last seven), but we can look at the average returns as well:

The average percent return per trade was 15.2% over 4-days.

WHAT HAPPENED

This is it — this is how people profit from the option market — finding trading opportunities that avoid earnings risk and work equally well during a bull or bear market.

To see how to do this for any stock we welcome you to watch this quick demonstration video:

Thanks for reading.

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.