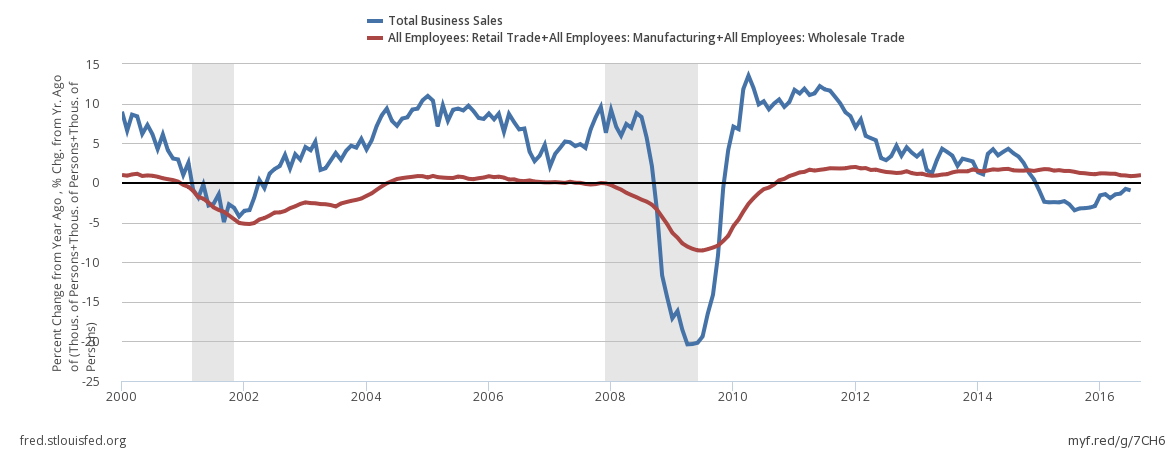

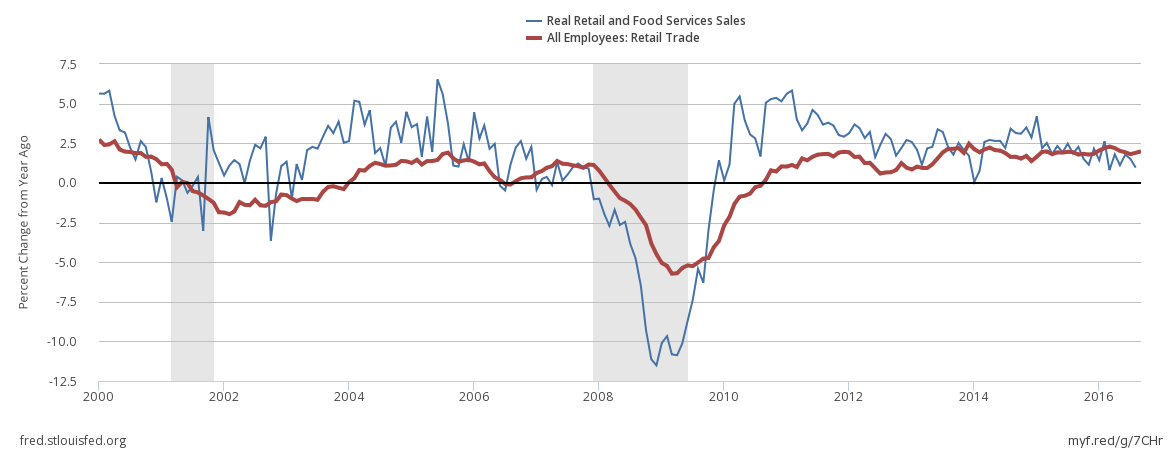

Using technical jargon, the employment numbers and business sales are seriously out of whack. Sales are in contraction and employment is in expansion - an event usually associated with recessions.

Follow up:

There are issues with defining the problem.

For one thing, employment data includes a certain amount of double counting (the same person holding two or more jobs and being counted as two or more people).

A second problem, I have serious reservations about the ability to detect flows in outsourcing manufacturing overseas. No doubt after NAFTA, jobs moved outside of the USA to Canada and Mexico. This had little effect on sales, but reduced man-hours per sale in the USA. If there were a moderate reversal of outsourcing, it would show a gain in employment without the gain in sales.

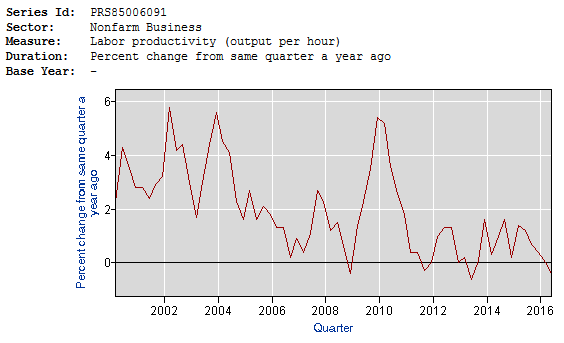

Which brings up a third problem: There are limitations using the productivity numbers produced by BLS. When a production or service disappears - it also disappears in the productivity analysis. When a new technology or service appears, it starts showing no productivity growth as it is a new product baseline. And say a component or service was outsourced years ago - and was brought back with no or few jobs - again there was no productivity improvement even though real productivity skyrocketed.

Source: BLS

Yet there is enough data to show there is a problem.

There is a disconnect between the year-over-year growth of employment in business and business sales. The rate of growth of sales is below the rate of growth of employment in this sector. Employment growth is well below sales growth. This happens in RECESSIONS.

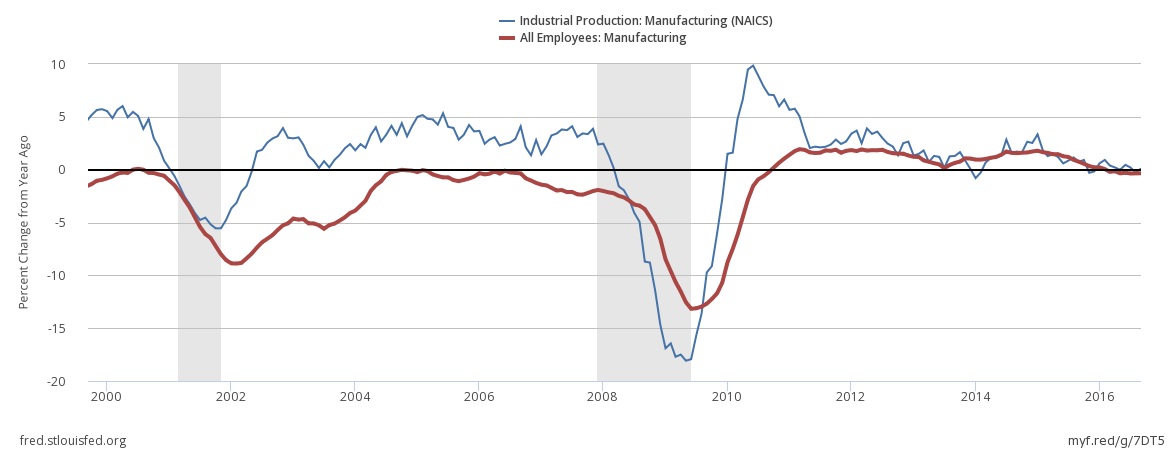

This inversion does not appear in the manufacturing portion of business sales.

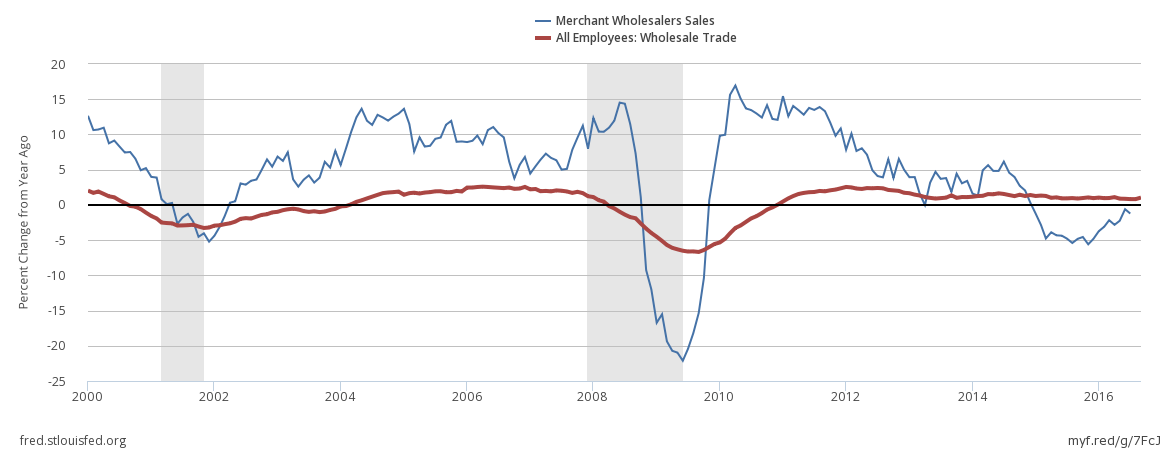

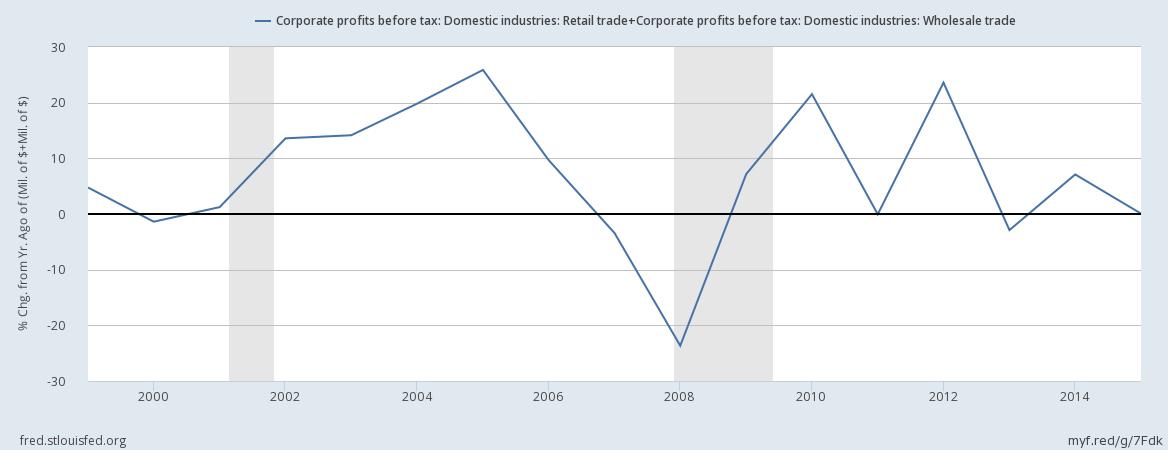

But does appear in the wholesale trade and retail portions of business.

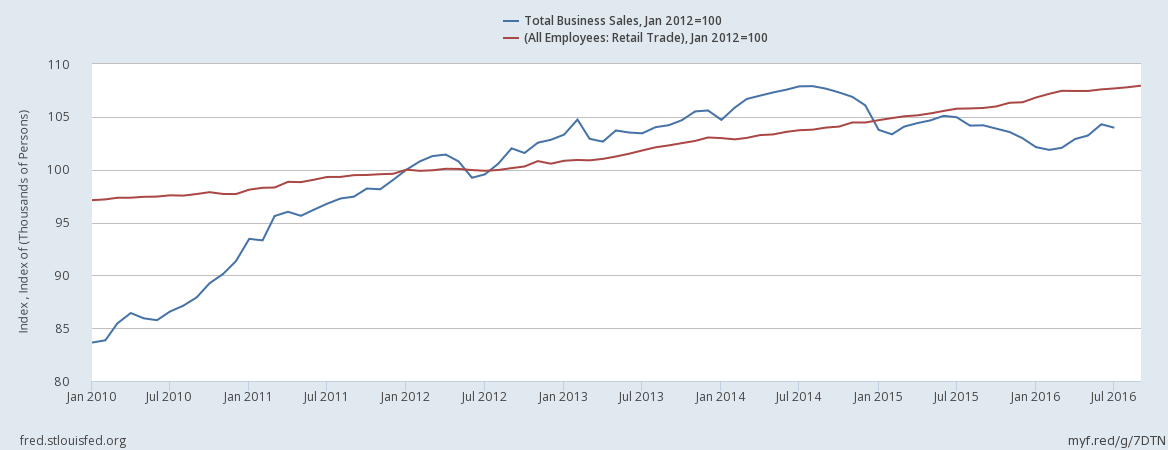

Instead of using year-over-year growth (as used in the graphs above), the graph below uses indexed data to January 2012 so that one can understand that the rate of business sales slowed in early 2012, and the inversion of the relationship between employment and business sales began in 2014.

Why?

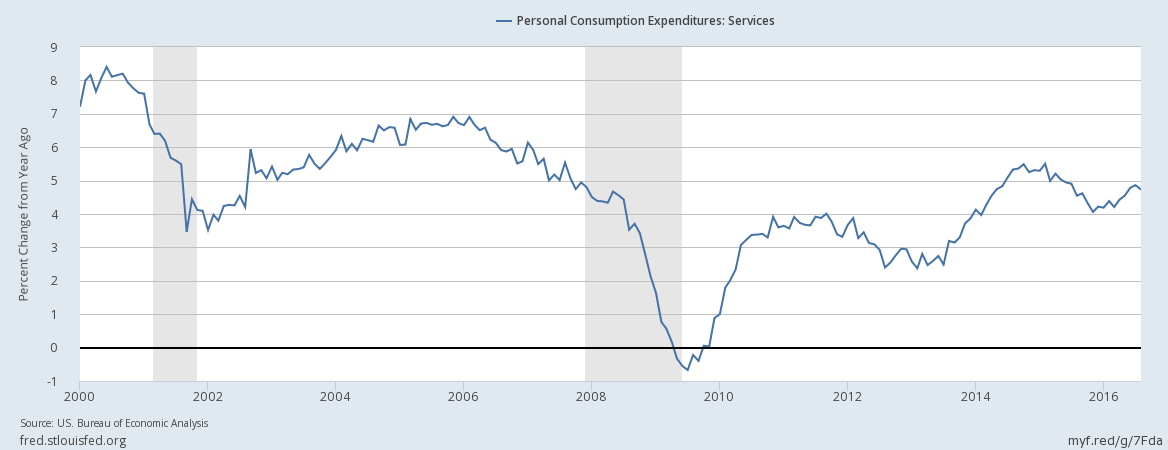

This inversion is happening in the services end of the economy. And the services end of the economy is what had been the strength of this weak economy.

And, although corporate profits are nothing to write home about in the wholesale and retail sectors of the economy, they are not in contraction.

There seems to be no smoking gun as to why the service end of the economy has inverted sales and employment.

Is it possible that either sales or employment data sets have corrupted data?

Bankruptcies this Week: Performance Sports Group Ltd (NYSE:PSG) (f/k/a Bauer Performance Sports), DirectBuy Holdings, Privately-held Shoreline Energy

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: