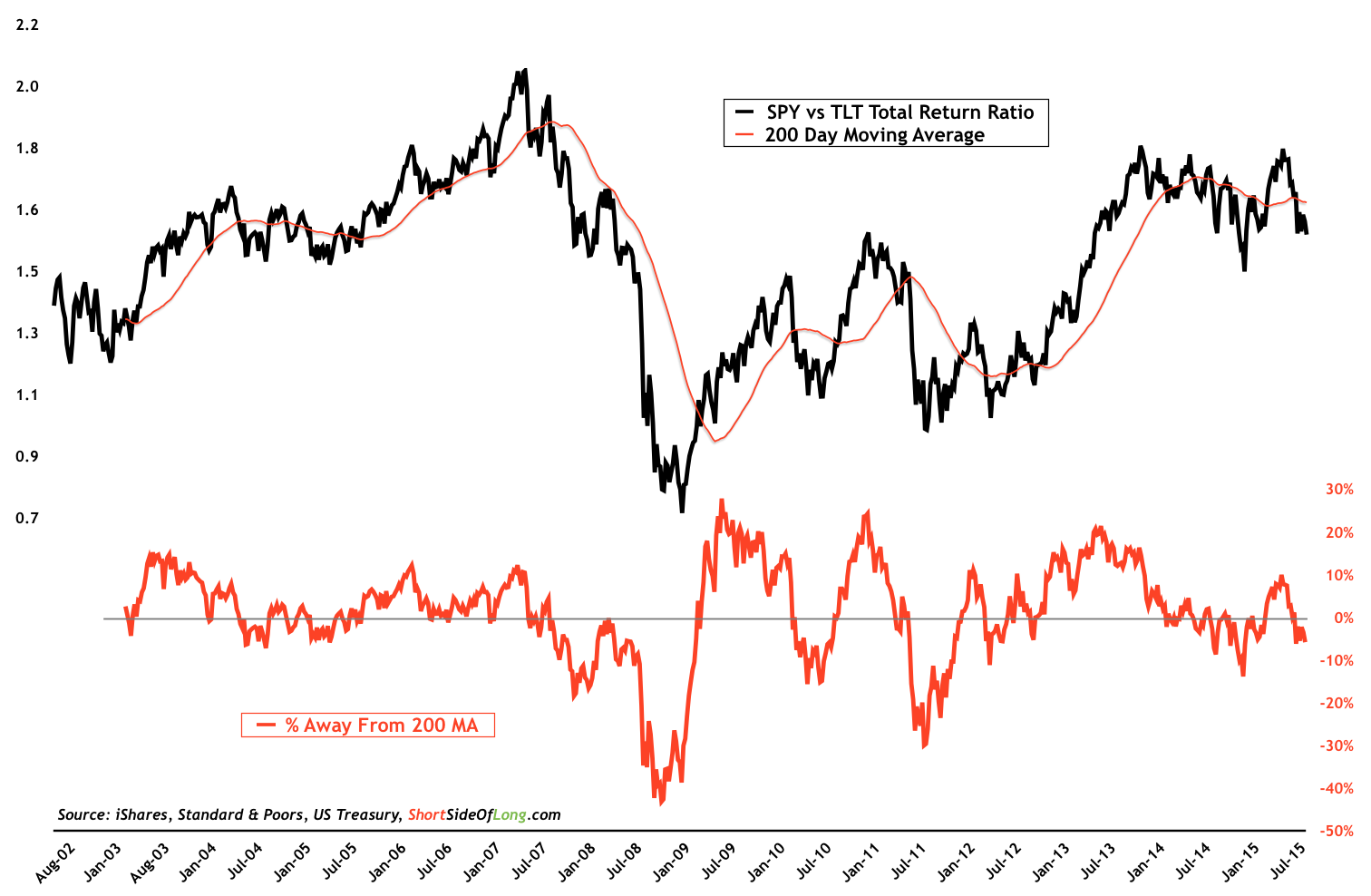

Stocks have underperformed bonds since July 2015.

Source: Short Side of Long

Global stock bear market continues as we have been discussing throughout August, when the called the bottom in US and EM stocks. We believe today, as we did back than, that the remaining selling pressure throughout September and October is going to be a technical retest of a major low formed in August. As savvy investors already know, both September and October are months known for weak returns and poor seasonal strength.

Readers of this blog have been well informed over the last several months on how US equities have been outperforming international stocks for majority of the bull market since October 2011 bottom. Interestingly, this has occurred both during the rally rising further, and right now also during the correction by falling less.

Away from the nominal price and relative strength between stock regions, today we look at two charts which show the way US stocks (NYSE:SPY) and EM stocks (NYSE:EEM) have been performing on a relative perspective against US government bonds (NYSE:TLT). Since the bull market began in March 2009, US stocks have managed to outperform bonds mainly due to their higher beta.

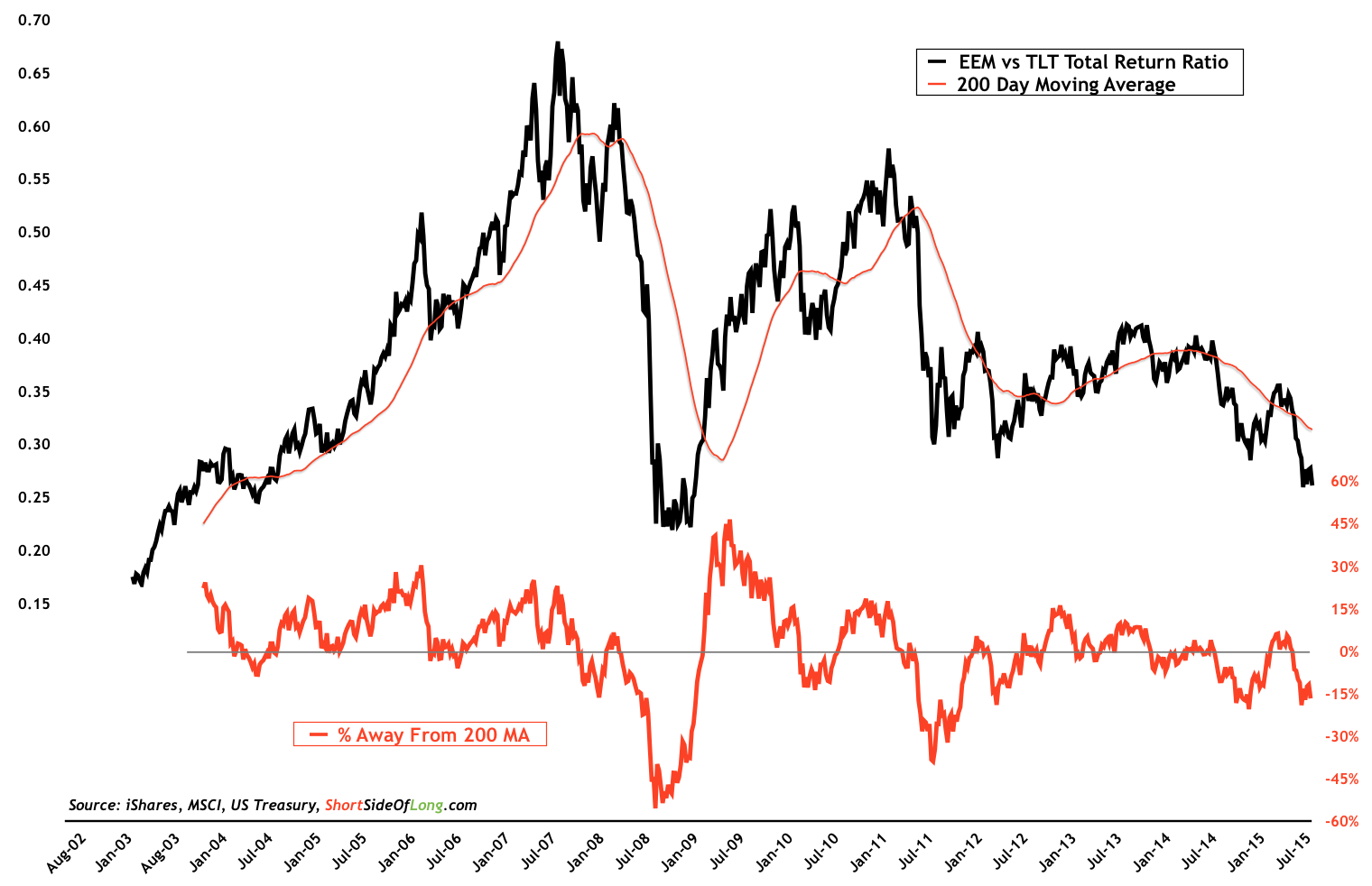

However, stocks have also experienced periods where bonds have outperformed rather strongly and this appears to be the case yet again. As for emerging-market stocks, their continuous under-performance against US bonds speaks wonders about the capital flight toward US dollar-denominated assets. The main question is, how long will this underperformance persist for?

EM stocks have been underperforming US bonds for a long time.

Source: Short Side of Long