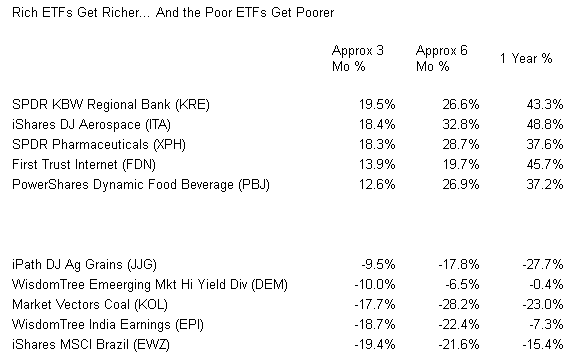

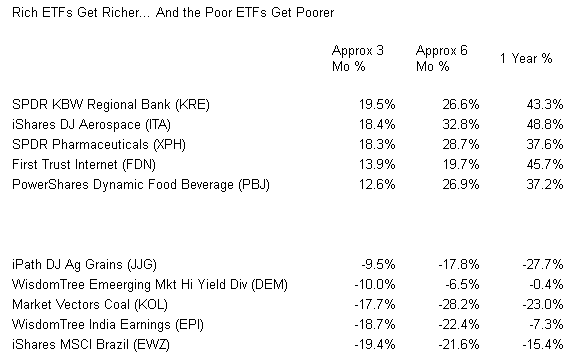

The best performing exchange-traded stock funds over the last three months are essentially the same ones that outperformed over the last six months and over one year. The worst performers were consistently weak over all three time periods as well. Simply stated, the rich ETFs are getting richer, while the poor ETFs are becoming impoverished.

Consider several examples. Before the Federal Reserve began to discuss tapering its bond buying program in May, one of the most successful sectors was regional banking. Regional bankers were beneficiaries of an uptick in lending and a real estate recovery. Yet even with the threat to mortgages and borrowing-based consumption, regional banks figure to succeed in a rising rate environment where profit margins can improve. That’s the thesis behind super-sized gains for the sector over 3-, 6- , 12-months — a thesis that seems to suggest that these ETFs are currently immune to profit taking.

Similarly, economic weakness in Asia and Europe only served to harm Latin America ETFs early in the year; the funds have often been “export-dependent.” Yet even after the Fed announced that it might pull the plug on stimulus this past May, Latin American stocks did not benefit from the possibility of currency depreciation in South and Central America — depreciation that could enhance exports; instead, the Fed’s imminent exit is being viewed as yet another challenge for countries like Brazil, Chile and Peru, as rates around the world may climb simultaneously, further depressing global demand for Latin American products and services.

On the surface, it may be easy to dissect the performance numbers in the table above. Waning economic activity in China and in Europe has killed demand for natural resources; both the corporations and the countries/regions that are tethered to resources exporting continue to struggle. Meanwhile, Fed policy has benefited growth-oriented sectors with defensive attributes (e.g., Pharma, Aerospace, etc.) as well as bankers that can borrow at negligible overnight lending rates and either lend out in large quantities when rates are low or enhance profitability in a higher-rate environment.

Beneath the surface, however, is the very nature of complacency itself. Rare is the circumstance when the same investments continue to lead. Equally rare, the biggest losers do not tend to stay underperformers for multiple years. It follows that a series of questions arise, ”How long should an investor let the winners run?” “When should one take profits and raise cash?” “When should an investor rotate into depressed and undervalued equities?”

Perhaps ironically, I do not see a compelling reason to change my top holdings whatsoever. Not yet, anyway. Funds like SPDR Pharmaceuticals (XPH) and Aerospace (ITA) have growth potential and are less tied to rate moves. They’re not cheap like the emerging market funds above, but they’re Fed-fueled uptrends remains intact. And therein lies the answer to many of the questions posed. Let your winners run until you’ve encountered a stop-limit loss order or your fund has breached a 200-day trendline. Do not rotate into losers until your prospect has risen above a significant moving average.

Am I sidestepping valuation here? Yes. Am I favoring technical trends. Absolutely.

When world equities are being “goosed” (give credit to Rick Santelli for the comment) by Federal Reserve quantitative easing intervention, when stocks falter in the absence of that intervention and when they succeed upon the announcement of each new infusion, you simply ride the waves. In all likelihood, once tapering occurs and once the amount is interpreted by markets as significant, stocks will plummet. At that time, I will be more interested in a hunt for bargain-basement “value.”

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Consider several examples. Before the Federal Reserve began to discuss tapering its bond buying program in May, one of the most successful sectors was regional banking. Regional bankers were beneficiaries of an uptick in lending and a real estate recovery. Yet even with the threat to mortgages and borrowing-based consumption, regional banks figure to succeed in a rising rate environment where profit margins can improve. That’s the thesis behind super-sized gains for the sector over 3-, 6- , 12-months — a thesis that seems to suggest that these ETFs are currently immune to profit taking.

Similarly, economic weakness in Asia and Europe only served to harm Latin America ETFs early in the year; the funds have often been “export-dependent.” Yet even after the Fed announced that it might pull the plug on stimulus this past May, Latin American stocks did not benefit from the possibility of currency depreciation in South and Central America — depreciation that could enhance exports; instead, the Fed’s imminent exit is being viewed as yet another challenge for countries like Brazil, Chile and Peru, as rates around the world may climb simultaneously, further depressing global demand for Latin American products and services.

On the surface, it may be easy to dissect the performance numbers in the table above. Waning economic activity in China and in Europe has killed demand for natural resources; both the corporations and the countries/regions that are tethered to resources exporting continue to struggle. Meanwhile, Fed policy has benefited growth-oriented sectors with defensive attributes (e.g., Pharma, Aerospace, etc.) as well as bankers that can borrow at negligible overnight lending rates and either lend out in large quantities when rates are low or enhance profitability in a higher-rate environment.

Beneath the surface, however, is the very nature of complacency itself. Rare is the circumstance when the same investments continue to lead. Equally rare, the biggest losers do not tend to stay underperformers for multiple years. It follows that a series of questions arise, ”How long should an investor let the winners run?” “When should one take profits and raise cash?” “When should an investor rotate into depressed and undervalued equities?”

Perhaps ironically, I do not see a compelling reason to change my top holdings whatsoever. Not yet, anyway. Funds like SPDR Pharmaceuticals (XPH) and Aerospace (ITA) have growth potential and are less tied to rate moves. They’re not cheap like the emerging market funds above, but they’re Fed-fueled uptrends remains intact. And therein lies the answer to many of the questions posed. Let your winners run until you’ve encountered a stop-limit loss order or your fund has breached a 200-day trendline. Do not rotate into losers until your prospect has risen above a significant moving average.

Am I sidestepping valuation here? Yes. Am I favoring technical trends. Absolutely.

When world equities are being “goosed” (give credit to Rick Santelli for the comment) by Federal Reserve quantitative easing intervention, when stocks falter in the absence of that intervention and when they succeed upon the announcement of each new infusion, you simply ride the waves. In all likelihood, once tapering occurs and once the amount is interpreted by markets as significant, stocks will plummet. At that time, I will be more interested in a hunt for bargain-basement “value.”

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.