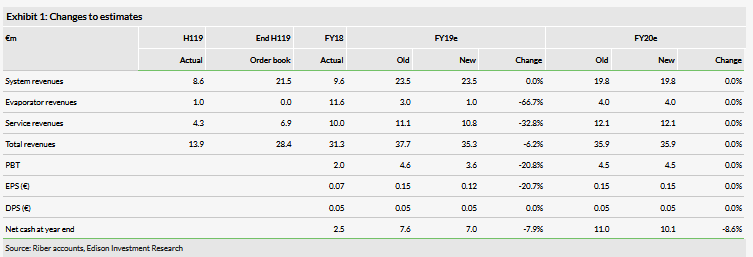

Riber (PA:RIBE)’s H119 revenue numbers show a 17% year-on-year decline to €13.9m, with higher molecular beam epitaxy (MBE) systems and service revenues partly offsetting lower evaporator sales. The order book indicates that evaporator sales will remain subdued in H219, so we reduce our FY19 group revenue and EPS estimates by 6% and 21%, respectively, leaving our FY20 estimates unchanged.

Strong MBE system performance in H119

As anticipated, given the order book at the start of FY19, revenues from MBE systems grew strongly, more than doubling to €8.6m during H119, as the group delivered four production machines, two of which were initially scheduled for delivery during H218, compared with only one production machine and three smaller R&D machines in H118. Revenues from services and spares rose by 65% to €4.3m, following an initiative to make the customer base more aware of the complete offering. As expected, sales of evaporators were much lower than the previous year (€1.0m vs €10.4m) reflecting lower demand from a major customer.

More to follow in H219

Management is confident that the strong performance in MBE systems will continue, with an order backlog at end June 2019 of 13 systems, six of which are the larger production machines, totalling €21.5m. It expects to deliver a further eight or nine systems during H219, so we leave our FY19 system revenue estimate unchanged. While the order book for services is lower than a year previously (€6.9m vs €8.3m), the sales cycle here is relatively short, giving time to secure additional orders sufficiently ahead of the year end for delivery during H219. We reduce our segmental revenue estimates slightly (see Exhibit 1). There are currently no orders for evaporators. While management remains confident that the major customer will recommence placing orders during H219, it is not likely to be able to fulfil these by the year end, so we substantially cut our FY19 segmental revenue estimates.

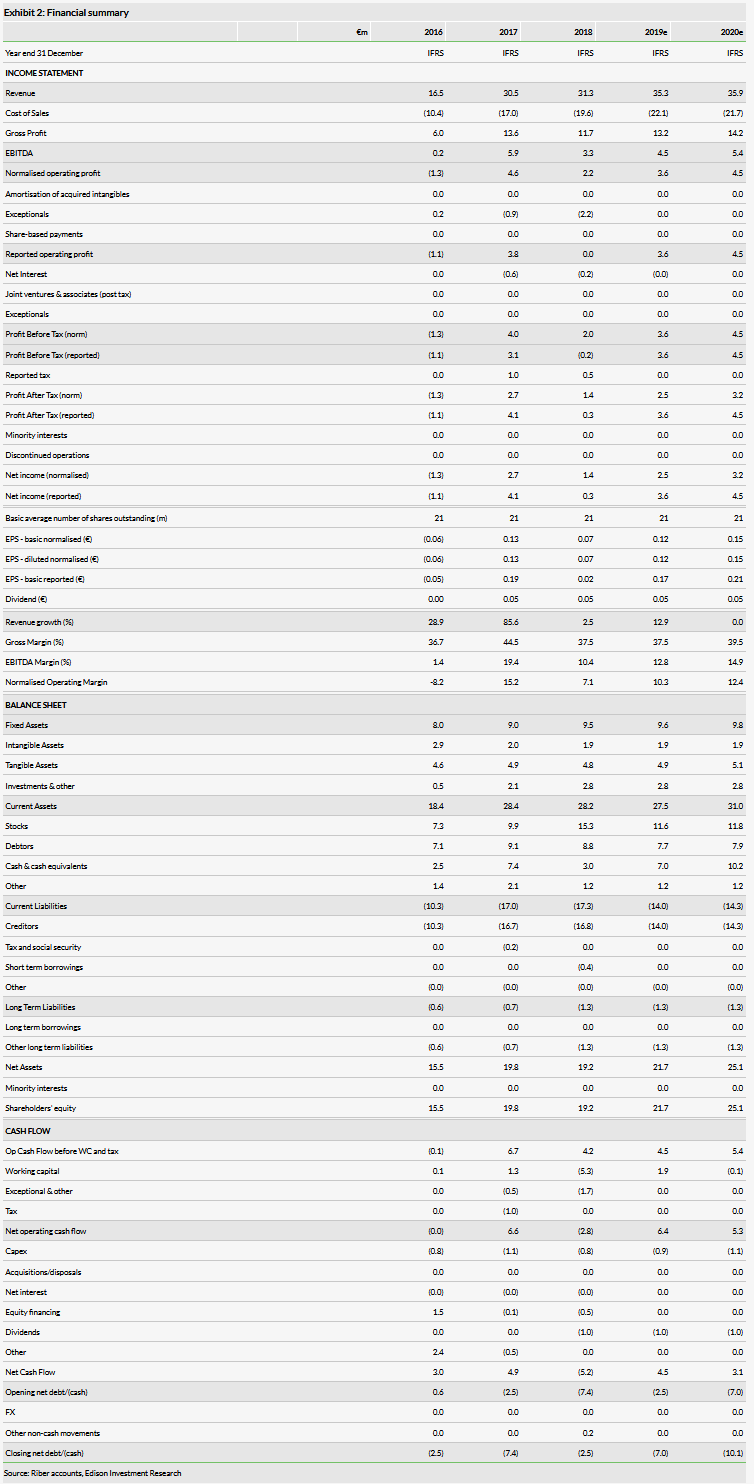

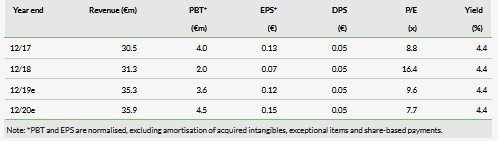

Valuation: Trading at a discount to peers

The share price has halved over the last year, and Riber is now trading at a discount to both Aixtron and Veeco with respect to all prospective multiples. While some discount for a small capitalisation and relatively low free float is justified, the size of the discount (year one EV/sales multiple of 0.6x for Riber vs 2.4x for our sample mean) is, in our opinion, unwarranted. This gives scope for share price appreciation as Riber converts the strong order book into a sustainable profit recovery.

Business description

Riber designs and produces molecular beam epitaxy (MBE) systems and evaporator sources and cells for the semiconductor industry. This equipment is essential for the manufacturing of compound semiconductor materials that are used in numerous high-growth applications.

Estimate revisions