The fundadmental backdrop is likely to be volatile: the Italian election is not yet resolved in terms of a sitting government; U.S. sequestration is in place; and China is moving to “dampen” their housing mar- ket. These issues, coupled with the Cyrpiot depositor saga. will dominate the headlines in the short-term, but longer term -- the euro-zone recession, the likely decline in corporate margins/ profitability and the Fed’s potential tapering of QE will serve as strong headwinds.

STRATEGY: The S&P 500 remains above the 160-wma long-term sup- port level at 1287; and the standard 200-dma support level at 1424. Col- lectively, with the breakout above the Sept-2012 highs at 1475 has run into major long-term overhead resistance, and should find “rough sledding” in the weeks ahead as a top is formed. This, coupled with our models in increasingly negative lights puts the risk-reward to the downside.

CAPITAL MARKET COMMENTARY WORLD MARKETS ARE ALL LOWER THIS MORNING on the bailout terms related to Cyprus in the euro zone. Now, Cyprus is a small country that has recently elected a President, and is in dire need of a €10 billion bailout given the banking system implosion. Cyprus banks had enormous exposure to Greece, and now the Eurozone taskmasters will require that “depositors” in Cyprus banks must bear part of the bailout -- to the tune of 6.75% on balances up to €100,000; and 9.90% at this level and above -- and receive shares in the banks where the deposits are held in the amount of the bailout levy. The reason behind this is that 50% of Cypriot depositors are Russian or have ties to Russia, and the Germans are worried about money laundering and this is the only way to pass the bailout through the lower German parliament. Quite obviously, this has caused a bit of a “contagion” throughout Europe and the world as it is stoking fears that this is how the euro zone shall implement any additional bailouts.

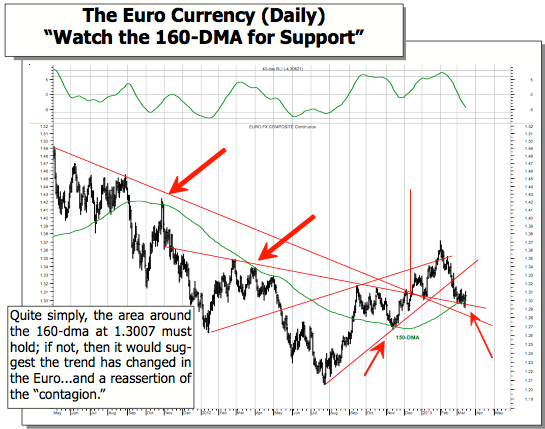

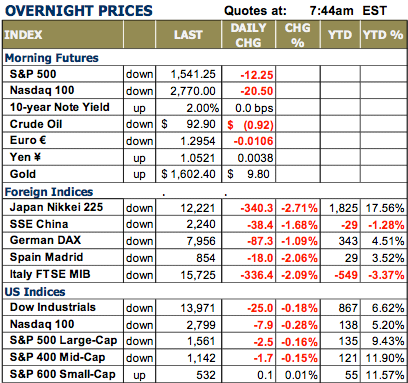

We aren’t so worried about Cyprus per se, as Cyprus is rather small. It is more about the “contagion” that many will speak of that will be tinder that stokes fears amongst world traders and investors alike that they are much too exposed to the risk markets given the fiscal challenges around the world; that the southern European bond yields of Spain and Italy are about as good as it gets, and thus warrant pulling back. This morning, we find the Euro currency falter rather sharply, and indeed it is below our “trend change” 160-day moving average at 1.30 for all intents and purposes. Too, we’re seeing Spanish and Italian bond stocks in particular. This occurred after the 2007 high, and while it may not be exactly like that period of time...it could very well rhyme as energy stocks tend to be late-cycle stocks. Today will be a good indication of a potential rotation after the opening dust settles.

Outside of this, we’ll simply watch today’s trade from afar, for it will be a “tug of war” between those believing in contagion, and those serial bubble-blowers that want to see the S&P hit higher highs as rising prices dictate everything, and reflect nothing. We’ll see who wins today’s battle before forming any conclusions.

Good luck and good trading,

Richard

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rhodes Weighs In On Today's Battle Front

Published 03/18/2013, 10:05 AM

Updated 07/09/2023, 06:31 AM

Rhodes Weighs In On Today's Battle Front

FORECAST STOCKS

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.