FORECAST

STOCKS: The world economy is healing; however, there remains clear headwinds to the continuation of this healing...such as the emerging market risk-reassessment. Quite clearly, risk is being mispriced at current levels given the economic backdrop and clear pressure upon corporate revenues/ margins/earnings — not to mention the contined QE taper glide path.

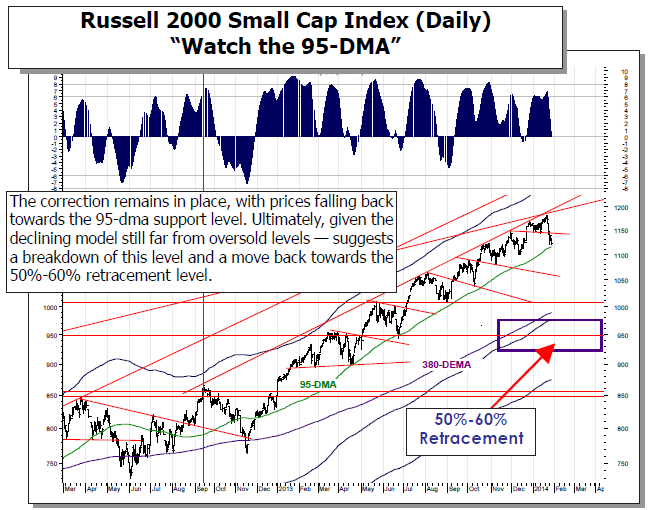

STRATEGY: The S&P 500 remains above the 160-wma long-term support level at 1444; but perhaps more importantly, the distance above the 160-wma stands at+23% — down from +28%. If it expands above +30%, then an upside explosion is under way; but under it — then a larger correction is expected to materialize.

WORLD MARKETS ARE ON BALANCE LOWER THIS MORNING with the Asian bourses taking the brunt of the losses as Japan’s NIKKEI 225 dropped -2.45%. European bourses too are lower, but modestly so in the Northern countries, with the Southern periphery actually showing very modest gains. The USD is sharply higher across the board, gold prices are lower – crude oil is higher. This is the landscape after the Fed decided to toe the line put in place in December – and taper an additional $10 billion split evenly between Treasuries and MBSs. No surprise here; this leaves incoming Fed Chairman Yellen with a glide-path to ending QE before year-end. We believe the markets shall challenge Ms. Yellen in the months after she begins her stewardship as the markets have with all Fed Chairmen since with Arthur Burns tenure in the 1970’s.