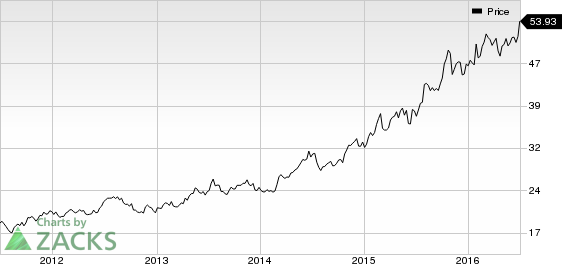

Shares of cigarette manufacturer Reynolds American Inc. (NYSE:RAI) rallied to a new 52-week high of $53.99 on Jun 30, recording a healthy year-to-date return of 16.86%. The company has been on the rise ever since it posted better-than-expected first-quarter fiscal 2016 results in Apr 2016. Further, the tobacco maker is benefiting from the renewed interest from investors seeking a safe haven in the tobacco sector amid the choppy global macroeconomic scenario.

Investors are also encouraged by the company’s positive outlook for 2016 coupled with its recent progress in the e-cigarette category.

What’s Behind the Rally?

The tobacco sector seems to be a relatively safe investment space in the wake of the financial market rout. Further, the company, with an all-American exposure, is insulated from the Brexit turmoil that is rattling the whole of Europe.

Another tobacco stock Altria Group Inc. (NYSE:MO) , with a vast exposure to America, gained post the Brexit episode. However, shares of Philip Morris International Inc. (NYSE:PM) , which has a significant presence in Europe, slumped following Brexit.

Generally, companies like Reynolds benefit from the addictive nature of their tobacco products. In addition, lower gas prices and an improving job scenario have increased consumer spending, which is doing the trick for these stocks.

Further, Reynolds reported decent first-quarter earnings on the back of higher pricing and strong performance of the core tobacco business and leading premium brands. The company also expects its business momentum to continue throughout the year.

Investors are encouraged by the company’s attempt to strengthen its presence in the growing e-cigarette category. Meanwhile, R.J. Reynolds Vapor Company, a subsidiary of Reynolds, has re-engineered and developed its own patented vapor technology and launched an e-cigarette brand Vuse. Being a “digital” cigarette, Vuse is installed with a proprietary computer chip that modulates its performance. The chip delivers consistent flavor which lends it an edge over other e-cigarettes. The brand is well received by customers and is generating substantial revenues for the company.

Zacks Rank & A Key Pick

Reynolds carries a Zacks Rank #2 (Buy). Another favorably ranked stock in the consumer staples sector is Tyson Foods Inc. (NYSE:TSN) with the same Zacks Rank as Reynolds.

TYSON FOODS A (TSN): Free Stock Analysis Report

ALTRIA GROUP (MO): Free Stock Analysis Report

PHILIP MORRIS (PM): Free Stock Analysis Report

REYNOLDS AMER (RAI): Free Stock Analysis Report

Original post

Zacks Investment Research