Machinery company Rexnord Corporation (NYSE:RXN) yesterday announced that it has agreed to acquire Centa Power Transmission. Financial consideration of the buyout has not been disclosed.

Centa Power is primarily engaged in manufacturing flexible couplings and shaft lines. Its products are mainly used by customers in the industrial, marine, power generation and rail end markets. Based in Haan, Germany, the firm operates through its subsidiaries in 10 countries with nearly 450 employees.

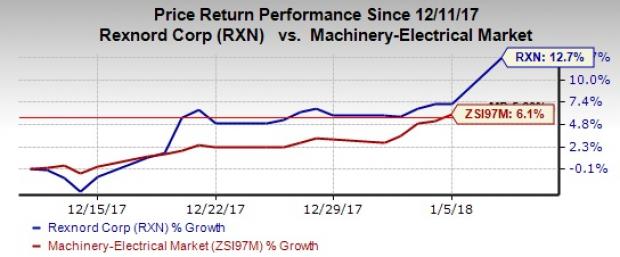

In a month’s time, Rexnord shares have yielded 12.7% return, outperforming 6.1% gain recorded by the industry it belongs.

Details of the Deal

Rexnord will integrate the acquired assets with its Process and Motion Control segment. The company anticipates that the addition of this asset will strengthen its business portfolio and create new business opportunities for it in the couplings market. Centa Power assets, in combination with Rexnord’s digital productivity platform — DiRXN — and related products, will be an added benefit.

The company anticipates the buyout to enhance its revenue generation capability by approximately $100 million.

Contingent on the fulfilment of customary closing conditions, Rexnord anticipates to close the buyout by February 2018 end.

Inorganic Initiatives Drive Growth

Over time, Rexnord has worked toward improving its business portfolio and enhancing profitability by acquiring meaningful businesses or disposing non-core assets.

In this regard, the acquisition of Cambridge International Holdings and divestiture of non-strategic RHF product line in fiscal 2017 (ended March 2017) as well as the buyout of World Dryer Corporation in third-quarter fiscal 2018 is worth mentioning. The World Dryer assets will be integrated with the company’s Water Management business segment and strongly complement the segment’s Zurn business. The combined business will offer superior products to commercial building owners.

Notably, acquisitions and divestitures had a positive impact of 3% on revenues in fiscal 2017 while the positive impact of 1% in the first quarter of fiscal 2018 has been negated by 1% negative impact in the fiscal second quarter.

Zacks Rank & Stocks to Consider

With a market capitalization of nearly $2.9 billion, Rexnord currently carries a Zacks Rank #3 (Hold). Despite expansionary efforts, we believe that the company’s exposure to industry rivalry, forex woes and uncertain economic conditions can jeopardize its prospects in the near term.

Earnings estimates on the stock have been decreased in the last 60 days. Currently, the Zacks Consensus Estimate is pegged at $1.25 for fiscal 2018 and $1.52 for fiscal 2019, reflecting a decline of 1 cent from their respective tallies 60 days ago.

Rexnord Corporation Price and Consensus

Rexnord Corporation (RXN): Free Stock Analysis Report

Atlas Copco AB (ATLKY): Free Stock Analysis Report

EnPro Industries (NPO): Free Stock Analysis Report

Colfax Corporation (CFX): Free Stock Analysis Report

Original post

Zacks Investment Research