Machinery company Rexnord Corporation (NYSE:RXN) yesterday announced that it has completed acquiring Haan, Germany-based Centa Power Transmission. Financial consideration of the buyout has not been disclosed. The deal was originally announced on Jan 8.

Centa Power specializes in manufacturing flexible couplings and shaft lines. Its products are mainly used by customers in the industrial, marine, power generation and rail-end markets. It carries its operations through subsidiaries in 10 countries and with the help of nearly 450 employees.

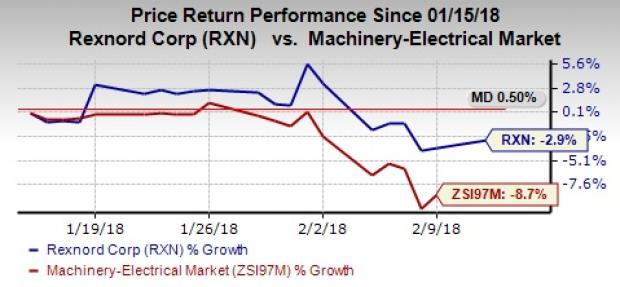

In a month’s time, Rexnord shares have declined 2.9%, less than the fall of 8.7% recorded by the industry it belongs.

Details of the Buyout

As noted earlier, the acquired Centa Power assets will be integrated with Rexnord’s Process and Motion Control segment. The company anticipates that this acquisition will strengthen its business portfolio and create new business opportunities in the couplings market. Centa Power assets, in combination with Rexnord’s digital productivity platform — DiRXN — and related products, will be an added benefit.

The company anticipates the buyout to enhance its revenue generation capability by approximately $100 million.

Rexnord’s Inorganic Initiatives: A Boon

Over time, Rexnord has worked toward improving its business portfolio and enhancing profitability by acquiring meaningful businesses or disposing of non-core assets. In this regard, the acquisition of Cambridge International Holdings and divestiture of non-strategic RHF product line in fiscal 2017 (ended March 2017), as well as the buyout of World Dryer Corp. in third-quarter fiscal 2018 (ended Dec 31, 2017), is worth mentioning.

World Dryer’s hand dryers strongly complement Water Management segment’s Zurn business, which provides water-efficient plumbing products. Notably, acquisitions and divestitures had a positive impact of 1% on revenues in the third-quarter fiscal 2018.

For fiscal 2018 (ending Mar 31, 2018), Rexnord anticipates benefiting from the innovation of new products, strengthening of demand in end markets, benefiting from its supply-chain optimization and footprint-repositioning programs and synergistic benefits from acquired assets. Net income is predicted to be within $155-$159 million range.

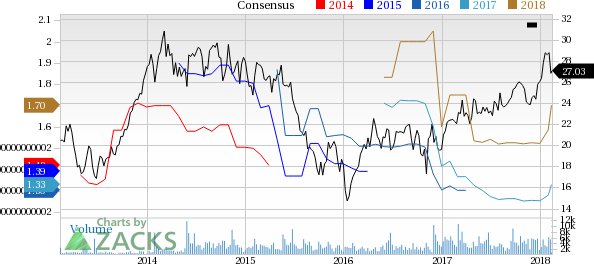

In the last 30 days, earnings estimates on the stock have been revised upward. Currently, the Zacks Consensus Estimate is pegged at $1.33 for fiscal 2018 and $1.70 for fiscal 2019, reflecting the growth of 6.4% and 10.4% from the respective tallies, 30 days ago.

Rexnord Corporation Price and Consensus

SPX FLOW, Inc. (FLOW): Free Stock Analysis Report

Emerson Electric Company (EMR): Free Stock Analysis Report

Rexnord Corporation (RXN): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Original post

Zacks Investment Research