This is part two of an article that was published last month in the POLICY Magazine of the Centre for Independent Studies. We updated our reporting on last year’s Reinhart-Rogoff controversy in the first part. In the second part, we explain that the real transgression in last year’s debate was the attempt by Reinhart’s and Rogoff’s foes to stifle a critical line of research. We then review a study in which we examined 63 high government debt episodes in Reinhart’s and Rogoff’s database and reached a surprising conclusion.

The Consequences of High Government Debt: Reinhart and Rogoff Versus Pundits (Part 2)

In part 1 of this article, we “scored” the debate that was triggered last April by a harsh critique of a well-known paper on government debt. The paper was written by Harvard professors Carmen Reinhart and Kenneth Rogoff (shortened here to ‘RR’), known for their voluminous research on financial and fiscal crises. The critique was delivered by a trio of University of Massachusetts researchers—Thomas Herndon, Michael Ash, and Robert Pollin (who came to be collectively known as ‘HAP’).

HAP didn’t fare well by our scoring, nor did the pundits who sang their praises. We explained how HAP overstated their case, failed to consider critical points, and triggered an avalanche of incomplete, exaggerated, misleading and erroneous media reports. Much of the reporting amounted to nothing more than a witch-hunt.

Unfortunately, though, witch-hunts are usually successful. Few lay people stuck with the debate long enough to work through the onslaught of misinformation in the weeks after HAP published their paper. Those who did follow it watched the smear campaigners modify their message as the truth trickled through. But rather than owning up to their errors, critics devised new strategies for discrediting RR’s research.

Paul Krugman, for example, retreated to little more than a charge that RR overstate the causal effects of debt on growth, proclaiming that causality is from growth to debt.[xix] But the public record shows that:

- Far from denying the effects of growth on debt, RR are among the most accomplished researchers on this topic.

- Krugman’s charges flatly contradict the advice he offered in 2003 when the parties responsible for rising debt were ideological foes rather than friends. In these instances, he complains about the risks of ‘sky-high’ interest rates, ‘fiscal train wrecks,’ and the ‘threat to the federal government’s solvency.’[xx]

In retrospect, the travesty here isn’t an inconsequential Excel error but a strong disincentive to anyone who dares answer the question: ‘How much debt is too much?’ Team Krugman has shown it will do whatever it takes to discredit serious attempts to answer that question.

And yet, this may be the most important economic question we face. Historical attitudes towards budgeting and debt are one of the major dividing lines between developed countries and banana republics. We cannot afford to forget what needs to be done to stay on the right side of that line. In that spirit, I’ll share my own contribution to demonstrate the usefulness of RR’s data. While recent debate has centred on the relationship between debt and growth, I undertake a slightly different exercise:

- Take each historic instance of government borrowing rising above 105% of GDP (America’s ratio before a major GDP redefinition in August)

- Eliminate those instances in which creditors received a lower return than originally promised, due to defaults, bond conversions, service moratoriums, and/or debt cancellations

- Of the remaining instances, consider whether and how the debt-to-GDP ratio was reduced.

In other words, let’s see what history tells us about America’s debt ratio and what comes next. You may find the answer surprising.

What 63 high government debt episodes tell us

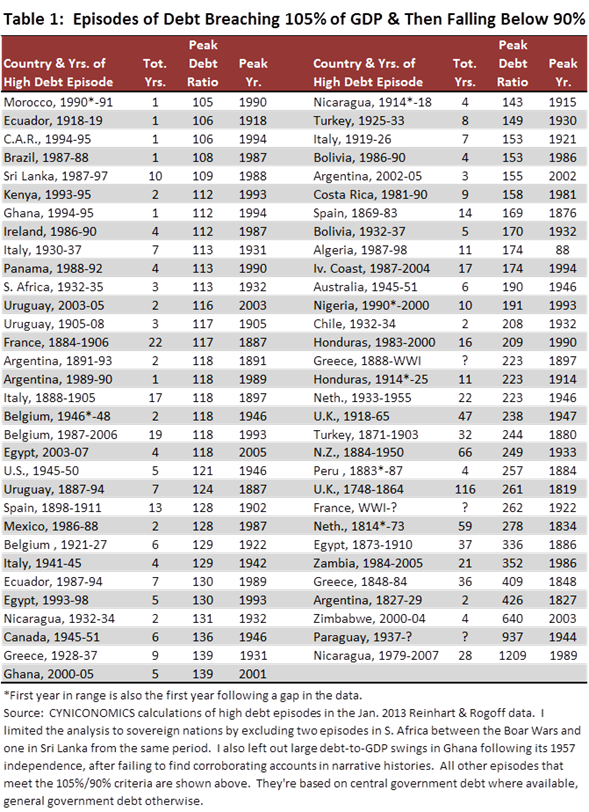

I start with 63 episodes of debt reaching the 105% threshold, as shown in the Table 1. These are drawn from RR’s debt database, with just a few eliminations that are explained in the notes at the bottom.

In addition to screening for breaches of 105%, I need to establish the end of each episode as well. For this, I use a 90% threshold to identify periods of genuine debt ratio reduction. With each episode beginning at 105% and ending after debt falls below 90%, there’s a reasonable improvement from start to finish. Recent struggles with high debt in which debt-to-GDP remains above 90% (and there are many) are excluded from the analysis.

I also record the peak debt ratio on every path from 105% to 90% and use this figure to sort the rows in the table. After narrowing the dataset (see below), I focus mostly on time periods of debt ratio reduction—from the peaks to the end of each episode.

My next step is to remove the episodes that included a credit event, which could be a default, bond conversion, service moratorium, or debt cancellation. In a large majority of cases, the credit event was needed to bring debt-to-GDP under control. Once they’re removed from the initial dataset, I’m left with 11 episodes, all of them showing a reduced debt ratio without any recognised creditor haircuts.

But then I add three episodes back in—the Netherlands from 1814 to 1873, the United Kingdom from 1918 to 1965, and Egypt from 2003 to 2007. These stand out because there was significant debt reduction well after the respective credit events, although I also considered the global importance of each of their debt battles.

With the three additional episodes, I have 14 instances of relatively successful debt reduction. Note that 12 of them occurred in economies considered today to be developed, with only one (Egypt) occurring in an emerging economy and one (South Africa) being something of a hybrid.

My last step is to consider how the debt ratios were reduced. I look at large and small countries separately, using a rule that’s sure to anger the Walloons but is reasonable: Any country with an economy equal to or bigger than the Netherlands is large, while a small economy means that a country’s output is similar to or less than Belgium’s.

The large countries tell us to stop running deficits

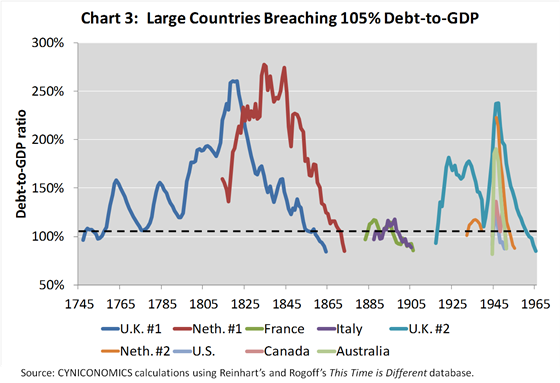

There are nine episodes in the large country group (see Figure 3).

I discussed five of these in an article published in March titled, ‘Answering the Most Important Question in Today’s Economy,’ where I set the debt threshold considerably higher at 150% of GDP.[xxi] I argued then that we should be wary of claims that massive debt ratios are not a big deal because some countries have been there before. In all the cases I considered, countries that recovered from huge debt totals enjoyed advantages that no longer exist. In the nineteenth century, circumstances included resource-rich colonies that the British and Dutch exploited to ease budget pressures. After World War II, debt proved temporary largely because the combatants ran large non-defence surpluses and only needed to bring their soldiers home to restore budgetary discipline.

I also argued that inflation isn’t the solution that many make it out to be. Without fiscal measures and financial repression, inflation only takes you so far in resolving a serious debt problem. In extreme cases, it can exacerbate the problem.

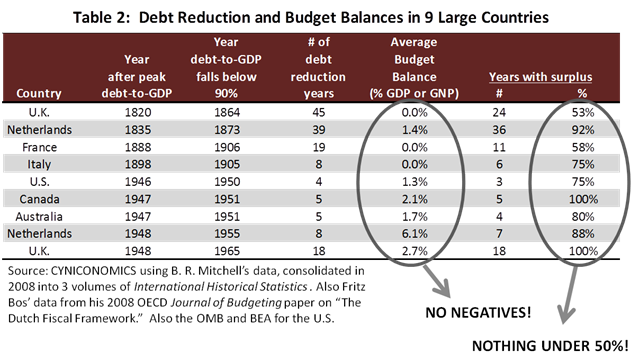

It turns out that these findings are only slightly weaker when I lower the threshold to 105%. But the particular results that stand out this time are from the last three columns of Table 2. The third-to-last column shows the average budget balance from the year after debt-to-GDP peaked to the year it was reduced below 90%. The last two columns show the number and percentage of years in which there was a surplus. Together, the figures show that every one of the large countries that reduced debt without a credit event did so by balancing its budget. Put differently, the large country history suggests that the only reliable way to solve a debt problem is to stop running deficits.

Long ago, policymakers would have regarded this finding as common sense. But current perspectives are distorted by years of bad ideas in economics. Keynesian economists, in particular, often preach that deficits are nothing to be concerned about. The United States has run deficits in all but two years since Keynesians began to dominate policymaking in the 1960s. And not surprisingly, every one of the episodes listed above predates our 63-years-and-counting of chronic budget shortfalls.

Needless to say, history doesn’t reflect kindly on present attitudes about budgeting. It shows that the pre-1960s belief in fiscal discipline may have had some value after all. Without it, we may have never witnessed a large country recovering from today’s debt levels without first slamming its creditors.

The small countries reduced debt in a variety of ways

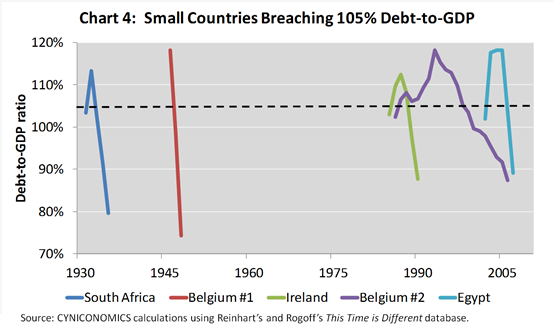

But what about the small country history? Do the little guys offer a different solution? There are five episodes in this group (see Chart 4). I’ll address them in chronological order.

South Africa, 1932–35 (peaking in 1932)

Debt ratios in 1930s South Africa were reduced not by balancing the budget but through rampant growth. Nominal GDP jumped over 13% annually between 1932 and 1936, while inflation was close to zero. The trigger for the boom was the United Kingdom’s September 1931 decision to abandon the gold standard and devalue its currency. The South African pound devalued at the same time because it was legally tied to the British currency.

Why was the GDP boost so large at a time of depression in most of the world, including other countries that severed their links to gold?

The answer is that the devaluation provided not just a gain in global competitiveness but a revaluation in South Africa’s most valuable assets—its wealth of underground resources and particularly gold. As a small country producing half of the world’s gold, there was nothing more important to its economy than the price of its gold reserves. And once those reserves were revalued upwards, it was off to races. Multiplier effects from the gold mining boom rippled through the economy, pushing GDP higher and debt-to-GDP lower.

Belgium, 1946–48 (peaking in 1946)

Like 1930s South Africa, Belgium didn’t attempt to balance its budget after World War II. Rather, the Belgian debt ratio was reduced by reconstructing the economy after it was left in tatters by the German occupation, and with help from friends.

From post-war lows in 1946, GDP bounced back in the next two years at an annual rate of 13% in real terms and 24% in nominal terms. Fiscal challenges were also mitigated by Marshall Plan assistance from the United States, beginning in 1948, and some war debt forgiveness before that. And with debt growing much more slowly than the economy, debt-to-GDP was cut from 118% to 75% in just two years.

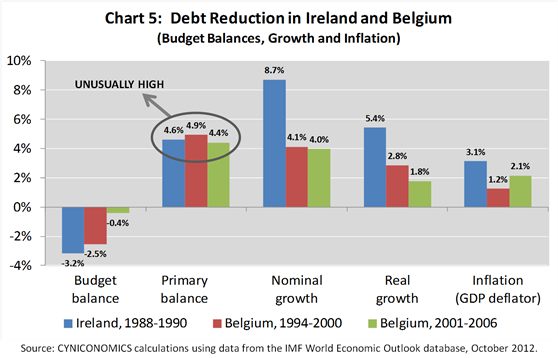

Ireland, 1986–90 (peaking in 1987) and Belgium, 1987–2006 (peaking in 1993)

Here are a few data points describing each of these European debt battles, dividing the Belgian experience into two sub-periods with slightly different characteristics.

And here are my observations:

- Strong growth explained the speed of Ireland’s debt ratio reduction, while steady Belgian growth also contributed to falling debt ratios, especially in the 1990s.

- Belgium achieved the second leg of its debt reduction, from 2001 to 2006, by reducing its budget deficit to 0.4% of GDP.

- Strong primary balances were a critical ingredient in each instance.

The Ireland and Belgium experiences seem to validate the idea that it’s okay to run a deficit as long as the primary balance shows a large surplus. We know this approach to be valid mathematically and it worked in these instances. The challenge is that it’s extremely difficult to maintain such a delicate balance through cycles of business, politics and war.

Moreover, both Ireland and Belgium exploited unique advantages: Ireland’s generous support from the European Union via structural funds, which averaged nearly 2% of Irish GDP in the latter half of the 1980s, and Belgium’s status as Europe’s Washington D.C., with much of the Brussels economy driven by the European Union, and to a lesser extent, NATO. Before extrapolating their debt battles to the United States, there are three points to consider.

First, America’s highest decade-average primary surplus in the six decades since World War II is 0.9% in the 1950s.[xxii] That’s nearly 4% lower than the Ireland and Belgium figures above. Second, at current interest rates, the United States would need to run an overall budget surplus of over 2% of GDP to match the Irish and Belgian primary surpluses. This has only happened once every 100 years or so (two times in US history—1816 and 1948). Third, over a more complete credit cycle, Irish and Belgian debt reduction appears to have been temporary. As of early 2013, IMF estimates placed general government debt at 117% of GDP for Ireland and 100% for Belgium.

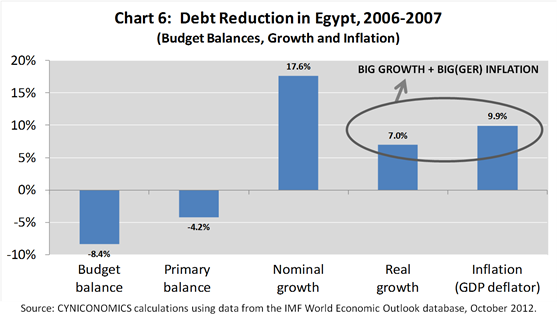

Egypt, 2003–07 (peaking in 2005)

Egypt’s high debt episode in the period just before the global financial crisis was mitigated by three IMF programs in the 1990s and a 1991 restructuring, which eased repayment terms while creating ‘blocked accounts’ earmarked for lenders. I’ll set these advantages aside, though, and share figures for budget balances, growth and inflation:

The good news is that Egypt offers another example of debt ratio improvement without balanced budgets or even a primary surplus. What’s more, the path from 105% to 90% didn’t require the double-digit real growth rates of 1930s South Africa or 1940s Belgium. Growth was certainly strong, but inflation was even higher and outpaced interest rates on government debt (not shown). Therefore, Egypt reduced its debt ratio largely through a combination of high real growth and low real interest rates. The bad news is that the high inflation that eroded the debt also led to higher food prices and political instability.

Conclusions

Going back to the question of whether the small country group tells us anything we didn’t learn from the large countries, here are the four approaches that succeeded without a credit event:

- Strike gold and devalue. (But for an economy as large as the United States, we’d need to discover hundreds of Fort Knoxes.)

- Be conquered by an evil, genocidal dictator. (And then grow strongly with the help of some friends after your liberation.)

- Run a huge primary surplus. (Nearly 4% higher than the United States has averaged in any post-WWII decade.)

- Be like modern Egypt. (Do I really need a qualifier for this one?)

So maybe the smaller countries don’t really show us the way?

Which brings us back to the approach followed by the large countries in the database: Balance the budget.

These countries weren’t satisfied with marginal improvements that still leave gaping deficits. (Think about the celebratory ‘all clears’ that were declared in the United States in May 2013 after the Congressional Budget Office dropped its deficit forecast to ‘only’ 4.2% of GDP.) They didn’t claim victory after reaching the standard EU target of a 3% deficit. More importantly, their debt battles predate the use of Keynesian economics as an excuse for profligacy.

I’ll say it once more: Balancing the budget is the only way that a large country has ever wound down a 105% debt-to-GDP without haircutting its creditors. Not for the first time, the common sense solution is the only approach that’s worked.