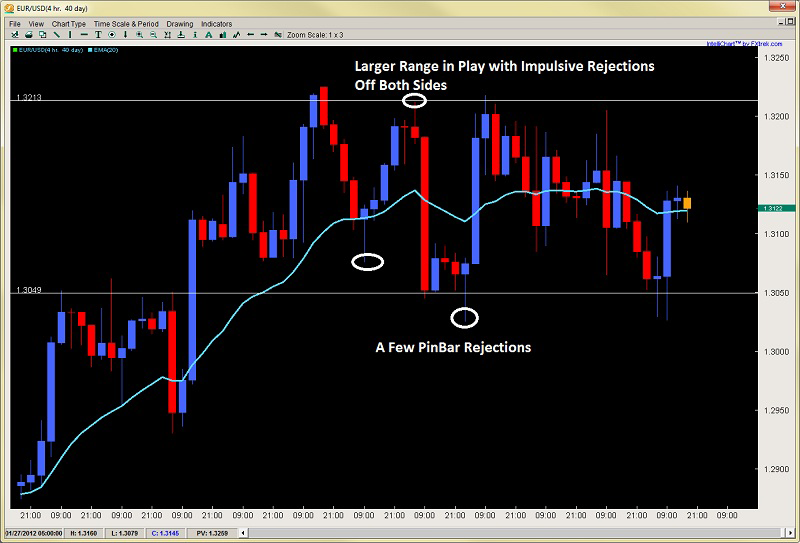

As we wrote about last week, the range high for this consolidation has held and the Euro failed to make a higher high. Since then, we’ve really had a choppy range, but a playable one whereby buyers and sellers seem apt to play a back and forth rally between 1.3045 and just north of 1.3200 like an old Connors v. McEnroe match of the 1980′s which you can see via the chart below.

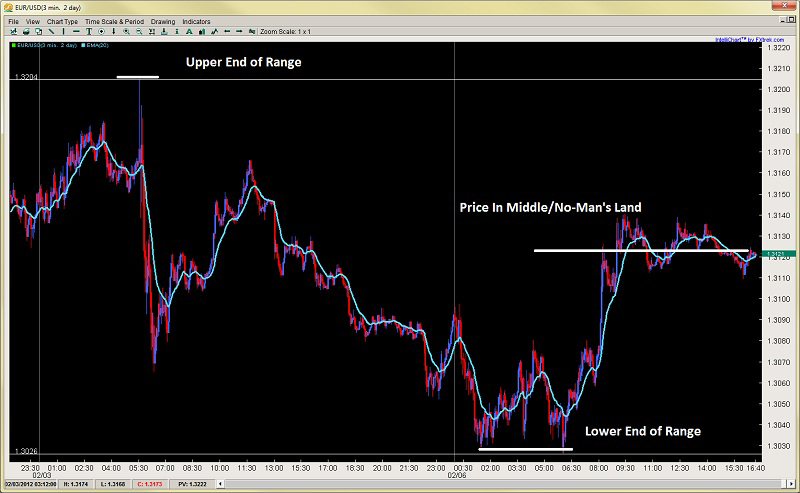

As we look at the intraday time frame, we can note a couple of key things in the price action:

1) Price took 3 stabs at the range lows before holding the line. This is pretty traditional – usually whoever is in control of the directional price action will take 2 or 3 attempts to break a level. If they fail, then you usually see a consolidation or reversal. The first bounce off the lows was rather timid, suggesting the sellers were still in control. But the second bounce and the buyers got a little more impulsive. Although the third bounce made a slightly lower low, from there the market broke the stalemate and climbed to make intraday highs in impulsive fashion saying they were in complete control from the NY open on. Price has closed towards the high so its unlikely much profit was taken.

2) However, the second point to note is price has closed in the middle of the larger range, so this is not exactly the best time to be getting excited about being in any one corner. We suggest patience until the wide ends of the range come in sight before you make your play.

If the price action continues to stay impulsive into the highs, we could see a break tomorrow of the upper end of the range. A touch of the range high will need to be a minimum for the balance to still be in play. However aggressive selling from here would suggest the bears are attempting to make a break south so watch the intraday price action for clues.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Reviewing Signals and Setups From February 6, 2012

Published 02/07/2012, 03:03 AM

Updated 05/14/2017, 06:45 AM

Reviewing Signals and Setups From February 6, 2012

EURUSD – The Consolidation Continues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.