Corn and soybeans, currently below the cost of production for most farmers, have growers anxiously waiting for opportunities to sell their crops at a profit. While demand for corn and soybeans remains high, it's equally balanced by strong global supply. The relatively neutral equilibrium places farmers in a difficult position of selling their crops for a profit.

As long as North and South America's farmers continue harvesting huge amounts of corn and soybeans, numbers confirmed by the U.S. Department of Agriculture, demand is simply not strong enough. Record harvest represents huge supply injections into trends struggling to maintain cause building since 2008. Record crops can be both good and bad news in the Ag business. The good, lots of corn and soy to be sold on the market, is often balanced by the bad, record supplies on the market weighing on prices.

Investors, largely driven by emotions rather than discipline, tend to focus on volatility rather than the message of the market. This tendency prevents them from recognizing better opportunities in quieter markets.

Summary

The BULL (Price) and BULL (Leverage) trends under Q3 distribution after the seasonal high position soybeans as a focused bull opportunity since the third week of April.

Price

Interactive Charts: Teucrium Soybean (NYSE:SOYB)

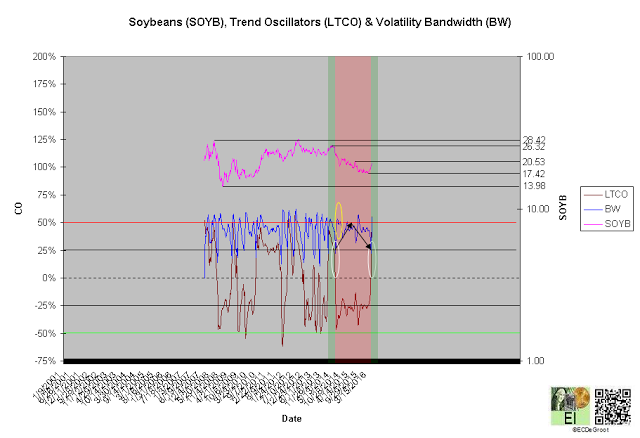

The long-term trend oscillator (LTCO) defines an up impulse and impressive annualized gain of 125% from 19.10 to 20.01 since the third week of April (chart 1). The bulls control the trend until reversed by a bullish crossover. Compression, the final phase of the CEC cycle, generally anticipates this change.

A close above 20.53 jumps the creek and transitions the trend from cause to mark up, while a close below 13.98 breaks the ice and transitions it to mark down.

Leverage

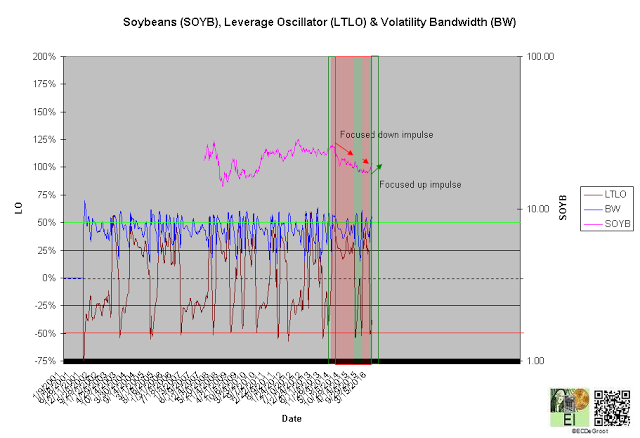

The long-term leverage oscillator (LTLO) defines a bull phase since the fourth week of March (chart 2). This focuses the up impulse (see price).

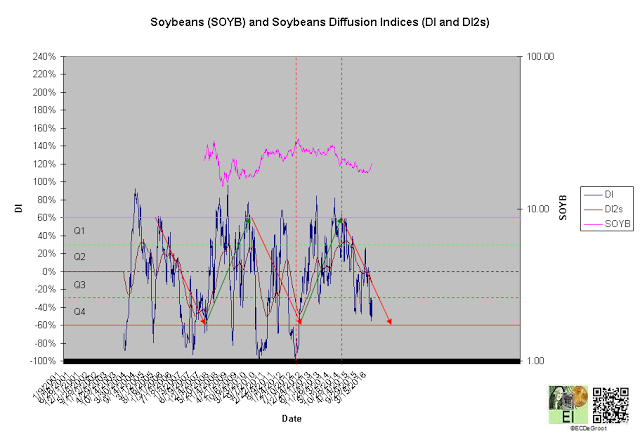

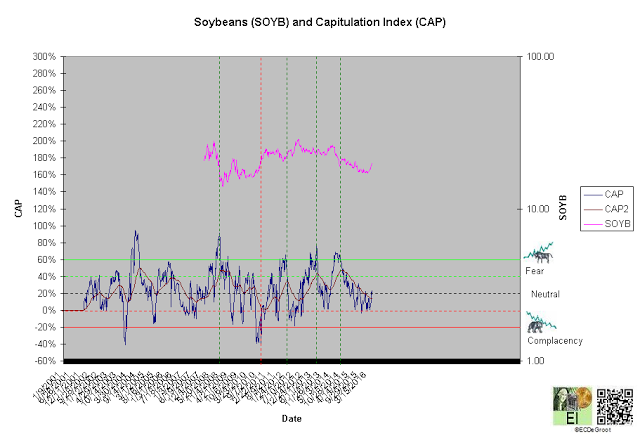

A diffusion index (DI) of -51% defines Q3 distribution (chart 3). A capitulation index (CAP) of 18% supports this message (chart 4). DI and CAP's trends, broader flows of leverage and sentiment from accumulation to distribution and fear to complacency supporting the bulls (red arrows), should not only continue to extreme concentrations but also restrain downside expectations until reversed (see price). A decline under these trends, a sign of weakness (SOW), would be bearish for beans longer-term.

Time/Cycle

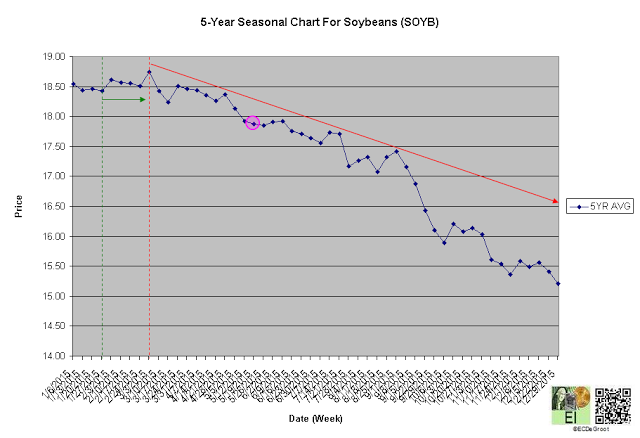

The 5-year seasonal cycle defines weakness until the end of the year (chart 5). This path of least resistance restrains upside expectations (see price).