Traders chasing oil and gasoline's bounce should be listening to industry leaders and the message of the market. BP (LON:BP) CEO says I do think the industry needs to prepare for lower for longer. A global economy plagued by chronic sub-growth and business cycle transition from prosperity to liquidation that IMF incorrectly believes can be managed, even for the once highly self-sufficient Arab States, supports continuation of the mega glut, the swamping of the demand by growing global supplies, and mark down to cycle concentrations not seen since 1998, 1931-1932, 1915, and 1891.

Investors, largely driven by emotions rather than discipline, tend to focus on volatility rather than the message of the market. This tendency prevents them from recognizing better opportunities in quieter markets.

Summary

The BEAR (Price) and BULL (Leverage) trends under Q3 distribution after the seasonal high position gasoline as consolidation/profit-taking against the bear opportunity. Gasoline's bearish setup favors reversal rather than continuation of consolidation.

Price

Show

Interactive Charts: NYSE:UGA, GASO

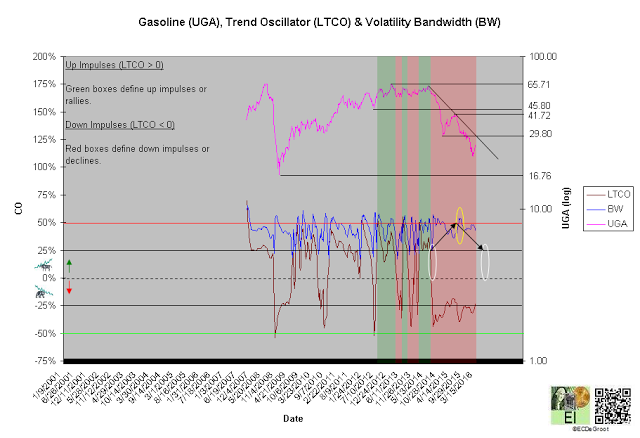

A negative long-term trend oscillator (LTCO) defines a down impulse from 57.36 to 26.03 since the first week of August 2014 (chart 1). The bears control the trend until reversed by a bullish crossover. Compression, the third phase of the CEC cycle marked by white circles, generally anticipates this change.

A close above 41.72 jumps the creek and transitions the trend from cause to mark up, while a close below 16.76 breaks the ice and transitions it to mark down.

Chart 1

Leverage

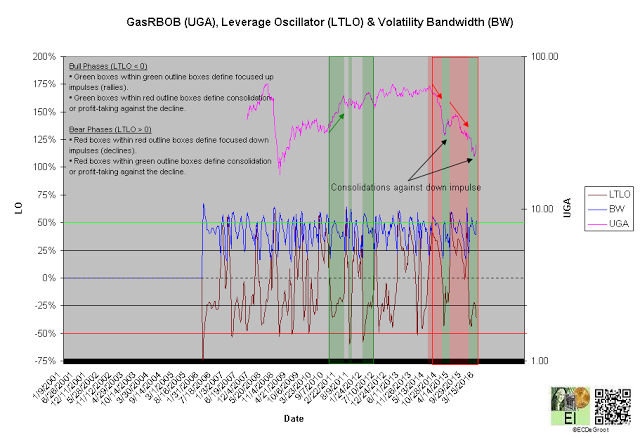

A positive long-term leverage oscillator (LTLO) defines a bull phase since the first week of December (chart 2). The bull phase, a conflicting message from the leadership of leverage and price, suggests consolidation/profit-taking against the down impulse (see price).

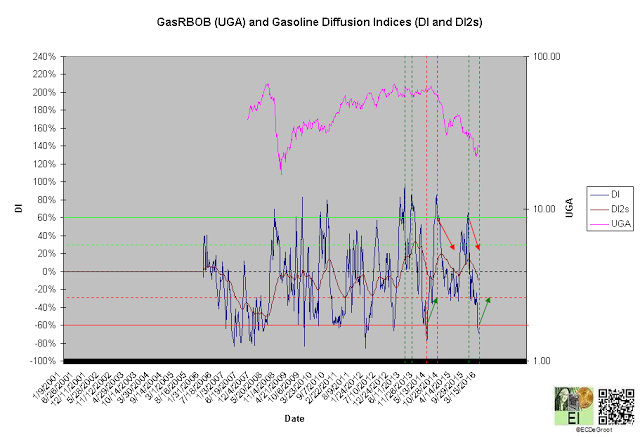

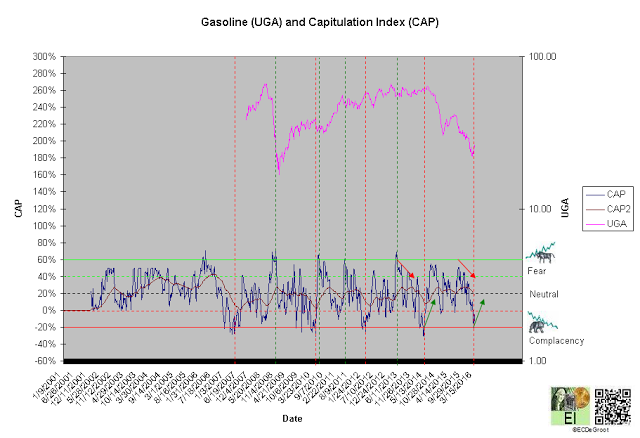

A diffusion index (DI) of -69% defines a string of bearish setups and Q3 distribution (chart 3) since the first week of March. A capitulation index (CAP) of -14% supports this message (chart 4). DI and CAP's trends, broader flows of leverage and sentiment from extreme distribution (red dotted line) to accumulation and extreme complacency (red dotted line) to fear supporting the bears (green arrows), should not only continue to extreme concentrations but also restrain upside expectations until reversed (see price). A rally under these trends, a sign of strength (SOS), would be bullish for gasoline longer-term.

Chart 2

Chart 3

Chart 4

Time/Cycle

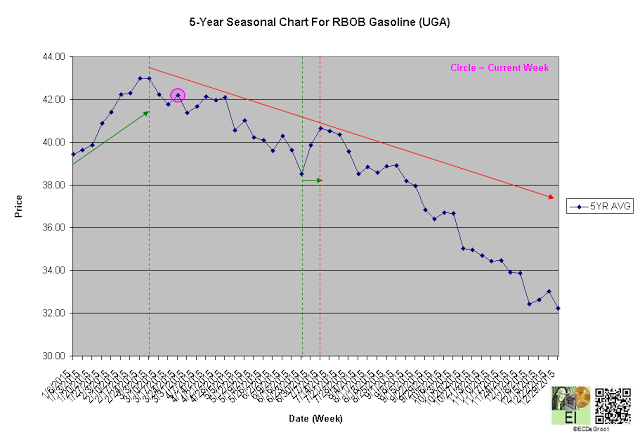

The 5-year seasonal cycle defines weakness until the fourth week of June (chart 5). This path of least resistance restrains upside expectations (see price).

Chart 5