The latest USDA report once again featured decreases to forecasts for 2015/16 world cotton production and consumption. California Cotton, while never king, has always been an important crop for the West; Californian produces by far the most Pima cotton (known for its extra-long premium fiber). In the U.S., production, however, continues to decline, as farmers find it increasingly hard to support during the ongoing drought.

Investors, largely driven by emotions rather than discipline, tend to focus on volatility rather than the message of the market. This tendency prevents them from recognizing better opportunities in quieter markets.

Insights constructs and interprets the message of the market, the flow of sentiment, price, leverage, and time in order to define trends within the cycle of accumulation and distribution for subscribers.

Summary

The BEAR (Price) and BEAR (Leverage) trends under Q2 accumulation after seasonal high position cotton as the focused bear opportunity since the fourth week of January.

Price

Interactive Charts: iPath Bloomberg Cotton Subindex Total Return Exp 24 Jun 2038 (NYSE:BAL), BAL PF

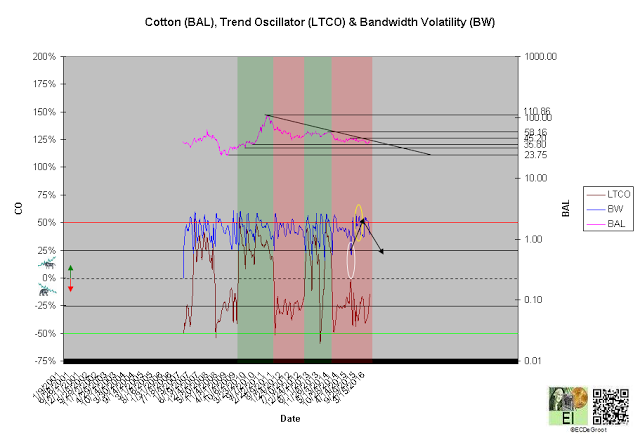

The long-term trend oscillator (LTCO) defines a down impulse from 52.14 to 42.15 since the first week of June 2014 (chart 1). The bears control the trend until reversed by a bullish crossover. Compression, the final phase of the CEC cycle, generally anticipates this change.

A close above 58.16 jumps the creek and transitions the trend from cause to mark up, while a close below 23.75 breaks the ice and returns it to mark down.

Chart 1

Leverage

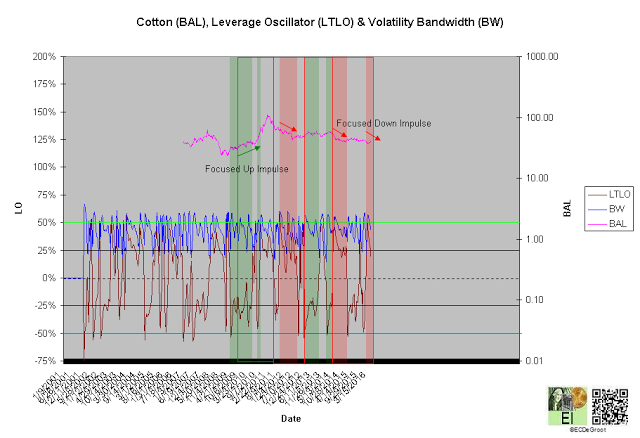

The long-term leverage oscillator (LTLO) defines a bear phase since the fourth week of January (chart 2). This focuses the down impulse (see price).

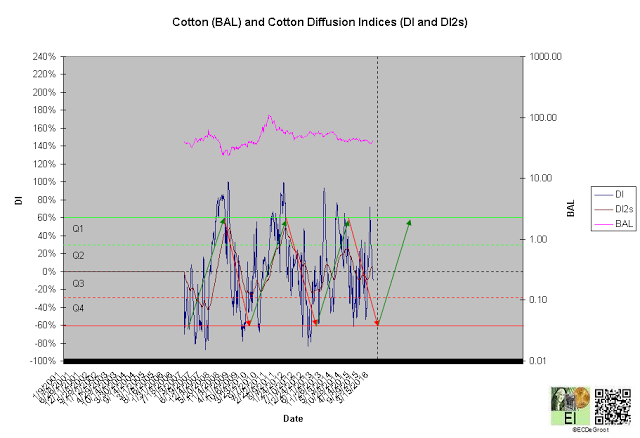

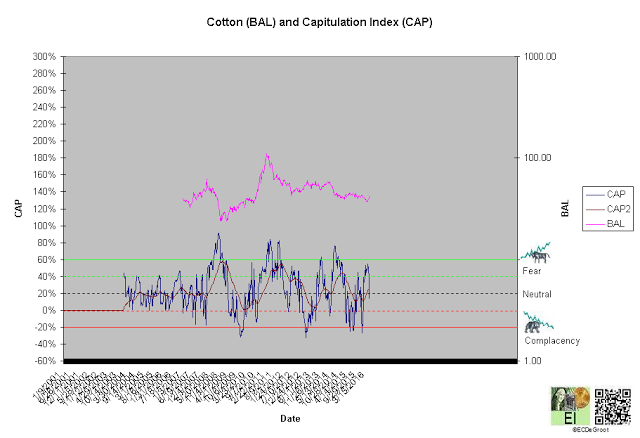

A diffusion index (DI) of -11% defines Q2 accumulation (chart 3). A capitulation index (CAP) of 13% supports this message (chart 4). DI and CAP's trends, broader flows of leverage and sentiment from accumulation to distribution and fear to complacency supporting the bulls (red arrows), should not only continue to extreme concentrations but also restrain downside expectations until reversed (see price). A decline under these trends, a sign of weakness (SOW), would be bearish for cotton longer-term.

Chart 2

Chart 3

Chart 4

Time/Cycle

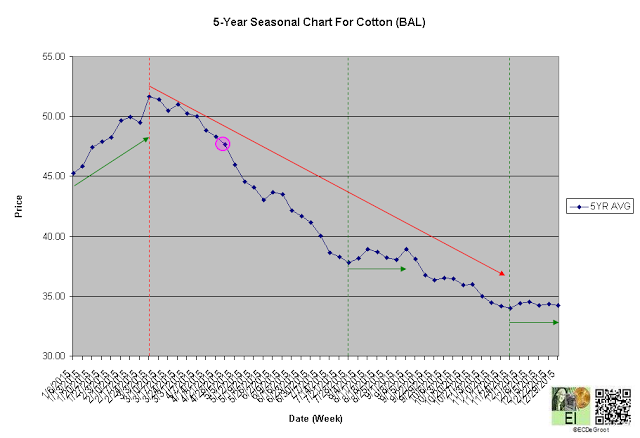

The 5-year seasonal cycle defines weakness until the fourth week of July (chart 5). This seasonal path of least resistance restrains upside expectations (see price).

Chart 5