Stock splits are corporate events where the number of shares in circulation changes as well as the price -per-share. If we own 100 shares at $50.00 per share pre-split and the stock splits 2-for-1, then we will own 200 shares at $25.00 post-split. The value of our position ($5000.00) does not change.

What is a reverse stock split?

This is a reduction in the number of corporate shares along with a corresponding increase in share value. In the above example, a 1-for-2 reverse stock split would result in owning 50 shares at $100.00 per share, still a $5000.00 total value.

Why would a company promote a reverse stock split?

There are several reasons this would make sense, none of which would encourage us to own the stock or exchange-traded fund (ETF).

- From a cosmetic standpoint, the increase in stock price makes the company appear more formidable and successful

- Certain exchanges require a minimum price or the stock can be de-listed

- Institutional investors tend to avoid lower priced securities

Real life example: UVXY (NYSE:UVXY)

The chart below tells us everything we need to know why this ETF twice opted for a reverse stock split:

UVXY Declining Price Chart

On July 12, 2016, as share value has plummeted to $7.00 per share UVXY announced a 1-for-5 reverse stock split. The effective date for this split was 7/25/2016. Share price on the 25th was about $6.00 per share so for every 100 shares owned pre-split, 20 shares at $30.00 would be the new position post-split. The position value does not change at the time of the split but $30.00 is more cosmetically pleasing than is $6.00.

How does a reverse split impact our options?

There is no one formula that will apply to every scenario so we must research these contract adjustments. Here are related free resources:

- www.cboe.com

- www.theocc.com

- Ask your broker to research for you (the first two are better choices in my view)

Let’s view the changes in this specific example:

Option symbol

UVXY changes to UVXY2

Shares deliverable per contract

100 shares become 20 shares

Price-per-share

UVXY2 = 0.20 (UVXY) or 1/5 the market price

Multiplier (amount option price changes in total value for a 1.00 change)

The multiplier remains 100 so if option price changes by “1” total contract value changes by $100.00

Non-adjusted contracts

In addition to the newly adjusted contracts (UVXY2), the exchanges begin introducing non-adjusted contracts based on the new market pricing. This creates a scenario wherein some contracts deliver 100 shares while others deliver 20 shares (I’m even getting a headache from this… however, in the interest of education we push on.

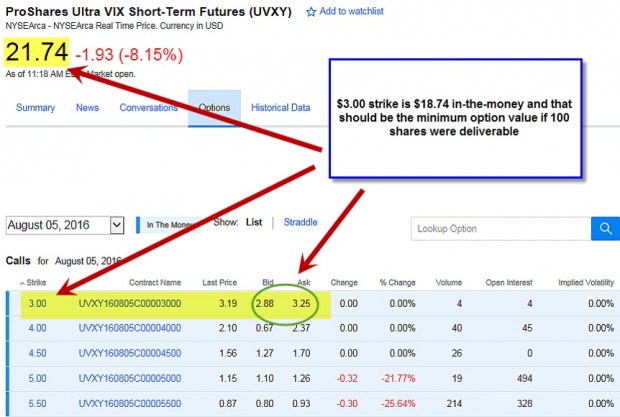

Unreliable option chains

When adjusted contracts exist along with standard contracts (100 deliverable), there should be some sort of indication as to which is which. In this case, adding that “2” to contract symbols with an explanatory footnote would do the trick. However, that’s not always the case. In the screenshot below, the options chain shows a $3.00 strike trading between $2.88 – $3.25 for a stock trading at $21.74. For standard contracts, that is impossible as there is at least $18.74 in intrinsic value. That’s how we know that this is an adjusted contract.

UVXY Options Chain Showing $3.00 Strike

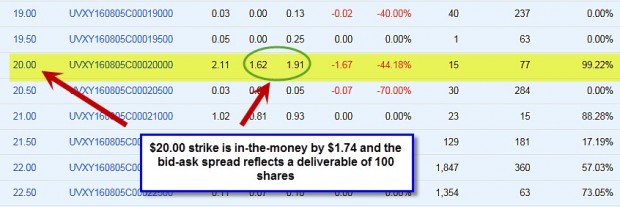

Further down this very same options chain, we see a non-adjusted $20.00 contract with a bid-ask spread we would expect for a stock price $1.74 in-the-money and expiration coming up in a few hours:

UVXY Options Chain Showing Non-Adjusted $20.00 Strike

Discussion

Reverse stock splits are generally corporate maneuvers designed to give the appearance of safe, secure and reliable investments. These events will result in contract adjustments for our options and these changes do not always fit one specific formula. It is important to understand the implications of these changes and to carefully view options chains that may not discern between adjusted and non-adjusted contracts. Asking ourselves if the premium amount makes sense for a standard contract will get us to the correct understanding of the contract type.