Key Points:

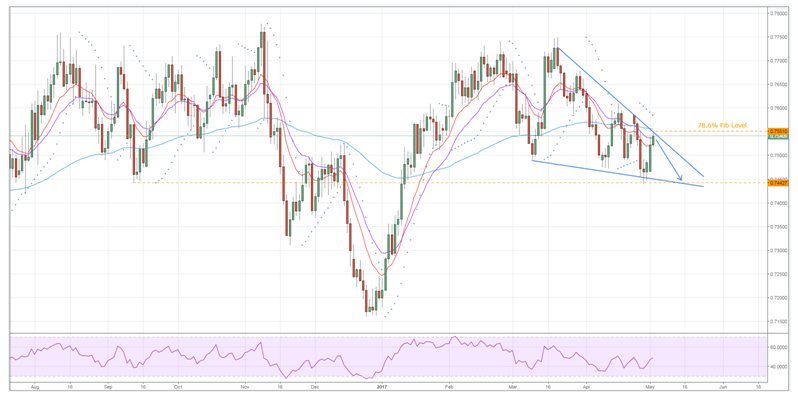

- Consolidating wedge shaping up.

- Most technical readings hinting at a reversal.

- Losses could see the pair retreat to last week’s lows.

The Aussie dollar has been extremely volatile recently, experiencing large daily swings that now seem to be tracing out a falling wedge structure. As a result of this and a number of other technical readings, we could be about to encounter yet another acute rout for the pair which might see the prior week’s lows challenged yet again. This being said, given the voracity of the prior two sessions’ bullishness, it may be worth taking a closer look at exactly what technical readings are indicating that momentum has run dry before delving into where we can expect to see the pair plunge.

On that note, of the available indicators, the clearest case for a reversal is provided by the EMA bias. Specifically, not only are the 12, 20, and 100 day averages in the most bearish configuration possible but the 100 day measure is also well positioned to provide some dynamic resistance. If that wasn’t reason alone to be suspicious of an imminent reversal, this zone of resistance is also in line with the 78.6% Fibonacci retracement which can only cap upside risks further.

Aside from the EMA’s, the Parabolic SAR and the Bollinger bands provide additional evidence that we should see a reversal in fairly short order. Starting with the Parabolic SAR, the instrument is clearly bearish and in little danger of inverting any time soon. Indeed, it would require a breakout from the consolidating wedge structure to see this happen which is looking unlikely. This is primarily a result of the Bollinger bands which are fairly divergent, this typically being a signal that chances of a breakout are slim.

Due to the rather clear technical bias developing above, the question remains as to where we expect to see the Aussie dollar tumble in the near-term. Luckily, we have some fairly strong zones of support on offer which provide a fair guideline. In particular, the 0.7442 level is looking rather robust due to it being a well-tested historical reversal point. However, the fact that this price also intersects with the downside of the wedge also signals that losses could be limited to around this level.

Ultimately, keep an eye on this pair as the technical forecast seems relatively robust even though we could see some notable volatility following the RBA and Fed interest rate announcements. Importantly, the technical bias could limit the upsides on offer and dramatically exacerbate any losses as a result of any unexpected changes to either the Australian Cash rate or the US FFR.