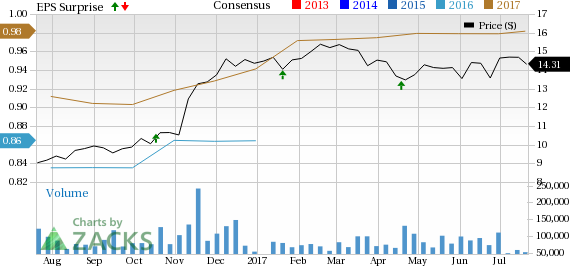

Regions Financial Corporation’s (NYSE:RF) second-quarter 2017 earnings from continuing operations of 25 cents per share surpassed the Zacks Consensus Estimate by a penny. Also, the figure came in 25% higher than the prior-year quarter tally.

Impressive growth in revenues aided by easing margin pressure drove the better-than-expected results. Further, the quarter recorded growth in loans, though deposits balance remained stable. Credit quality metrics also improved. Rise in operating expenses and decline in non-interest income were the undermining factors.

Income from continuing operations available to common shareholders was $301 million, up 17.6% year over year.

Revenue Improves, Costs Up

Adjusted total revenue (net of interest expense) came in at $1.42 billion in the quarter, in line with the Zacks Consensus Estimate. Revenues climbed 2.4% from the prior-year quarter figure.

Regions Financial reported adjusted pre-tax pre-provision income from continuing operations of $502 million, up 4.8% year over year.

On a fully taxable equivalent (FTE) basis, net interest income was $904 million, up 4.0% year over year. Net interest margin (on an FTE basis) expanded 17 basis points (bps) year over year to 3.32% in the quarter. Elevated market interest rates and favorable credit-related interest recoveries drove the results. These increases were partially offset by reduced average loan balances.

Regions Financial reported slight decline in non-interest income to come in at $525 million. On an adjusted basis, non-interest income remained stable year over year.

Non-interest expense edged down around 1% year over year to $909 million. On an adjusted basis, non-interest expenses rose 1.1% year over year to $899 million. An increase in salaries and benefits, FDIC insurance assessments, professional, legal and regulatory, along with furniture and equipment expenses, led to the rise. These were mostly mitigated by reduced provision for unfunded credit losses, marketing and other real estate expenses.

Balance Sheet Strength

As of Jun 30, 2017, total loans were down 2.3% year over year to $80.1 billion. Further, total deposits came in at $97.5 billion, almost stable year over year. Total funding costs were 34 basis points (bps).

As of Jun 30, 2017, low-cost deposits, as a percentage of average deposits, were 93.0% compared with 92.5% as of Jun 30, 2016. In addition, deposit costs came in at 15 bps in the reported quarter.

Credit Quality Improved

Non-performing assets, as a percentage of loans, foreclosed properties and non-performing loans held for sale, contracted 26 bps from the prior-year quarter to 1.14%. Also, non-accrual loans, excluding loans held for sale, as a percentage of loans, came in at 1.03%, down 22 bps from the year-ago quarter.

Allowance for loan losses as a percentage of loans, net of unearned income was 1.30%, down 11 bps from the year-earlier quarter. In addition, provision for loan losses was $48 million, plunging 33.3% year over year.

Additionally, net charge-offs as a percentage of average loans came in at 0.34%, down 1 bp. The company’s total business services criticized loans declined 10.5% year over year.

Strong Capital Position

Regions Financial’s estimated ratios remained well above the regulatory requirements under the Basel III capital rules. As of Jun 30, 2017, Basel III Common Equity Tier 1 ratio (fully phased-in) and Tier 1 capital ratio were estimated at 11.3% and 12.2%, respectively, compared to 10.8% and 11.7% in the prior-year quarter.

During second-quarter 2017, Regions Financial repurchased 9.1 million shares of common stock for a total cost of $125 million and announced $84 million in dividends to common shareholders. This reflects 70% of earnings returned to shareholders.

Our Viewpoint

Regions Financial’s favorable funding mix, attractive core business and revenue diversification strategies will likely yield profitable earnings in the upcoming quarters. We also remain optimistic on the company's branch consolidation plan and reduction of $300 million in expenses by 2018 and additional $100 million by 2019, in a bid to achieve an efficiency ratio below 60%.

Additionally, steady capital deployment measures will continue to boost investors’ confidence in the stock. However, escalating expenses and decline in non-interest income remain concerns.

Currently, Regions Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of other banks

Impacted by low non-interest income and high expenses, Northern Trust Corporation (NASDAQ:NTRS) reported a negative earnings surprise of 4.8% in second-quarter 2017. Adjusted earnings per share came in at $1.18, missing the Zacks Consensus Estimate of $1.24. However, the reported figure compared favorably with $1.07 recorded in the year-ago quarter.

Higher interest income drove Wells Fargo & Company’s (NYSE:WFC) second-quarter 2017 earnings which recorded a positive surprise of about 4.9%. Earnings of $1.07 per share outpaced the Zacks Consensus Estimate of $1.02. Moreover, the figure compared favorably with the prior-year quarter’s earnings of $1.01 per share.

Citigroup Inc. (NYSE:C) delivered a positive earnings surprise of 5.0% in second-quarter 2017, riding on higher revenues. The company’s income from continuing operations per share of $1.27 for the quarter outpaced the Zacks Consensus Estimate of $1.21. Also, earnings compared favorably with the year-ago figure of $1.25 per share.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Wells Fargo & Company (WFC): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Northern Trust Corporation (NTRS): Free Stock Analysis Report

Regions Financial Corporation (RF): Free Stock Analysis Report

Original post

Zacks Investment Research