The month of May brutalized nearly every asset tethered to rising interest rates. Many of the ugliest returns could be found in REIT ETFs like SPDR DJ Global REIT (RWO), emerging market sovereign ETFs like Market Vectors Emerging Market Local (EMLC), pseudo-dividend ETFs like PowerShares S&P Low Volatility (SPLV) as well as MLP ETFs like JP Morgan Alerian MLP (AMJ).

Perhaps, ironically, the only verifiable reason that interest rates spiked in May was because the Federal Reserve floated a trial balloon; that is, they began to talk about the possibility of slowing down the central bank’s asset purchases. In contrast, I have been explaining for weeks that global economic weakness did not provide the Fed with enough “ammo” to begin tapering its $85-billion-per-month, bond-buying program. Therefore, rates will go back down and rate-sensitive ETFs will benefit.

For example:

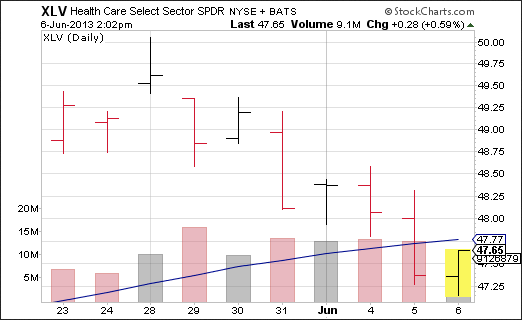

1. “Is Bad Economic News No Longer Enough To Push Stock ETFs Higher?” (6/4/13). In this feature, I discussed why defensive stalwarts that overweight non-cyclical sectors like health care should be high on your “wish list.”

2. Should You Rethink Your High Beta ETF Exposure? (6/3/13). In this article, I talked about the impact and importance of the worst reading on U.S. manufacturer well-being in 4 years.

3. “Tapering Talk” is Cheap (5/23/13). In this piece, I reminded investors that corporate revenue has been languishing, Europe’s recession has been deepening and Japan’s monstrous yen devaluation has been flashing extreme warning signs to equity investors.

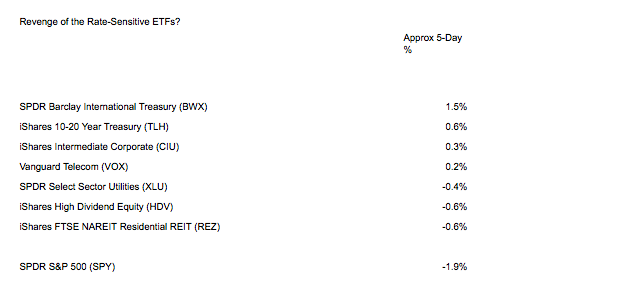

Today, a long-awaited pullback in stock ETFs appears more probable. Commentators that previously pushed cyclical segments (e.g., tech, financials, industrials, etc.) have received less “air play.” Broad-market indexes like the Dow and S&P 500 appear less invincible. Meanwhile, the month-long devastation in rate-sensitive ETFs — treasuries, corporate bonds, dividend producers, MLP proxies, REITs — may have abated.

By no means am I trying to suggest that 5 days of relative out-performance by rate-sensitive ETFs is sufficient for a trend. However, I am suggesting (and have suggested) that the Fed would have to ride to the rescue to push rates back below 2% once more. They’re well aware that refinancing activity has dropped sharply and they recognize that the psychological impact of a continuation in the housing recovery is wholly dependent on stable/decreasing 30-year mortgages.

The rate-sensitive ETFs have bounced off the proverbial floor due to a flood of bad economic data. More specifically, the 10-year yield has fallen from an approximate high of 2.2% down to 2.05% (15 basis points). Yet confidence in any stock ETF, from the rate-sensitive non-cyclicals in the table above to the price-volatile cyclicals like tech and basic materials, will require “do whatever it takes” clarity from Bernanke and other Fed officials.

If you have not held a larger-than-normal level of cash, then you may wish to sell into strength with some of your holdings. Moreover, honor all of your stop-limit loss orders and revisit your portfolio with a fresh set of specs.

In contrast, if you’ve held cash for just such a time when investors have become increasingly fearful, look to add to certain ETFs that may have already dropped 5% from a 52-week high. Those that I favor include SPDR Select Health Care (XLV), PowerShares Pharmaceuticals (PJP) as well as iShares High Dividend Equity (HDV).

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Revenge Of The Rate-Sensitive ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.