A man with pink hair shocked the world yesterday by confirming what some people with tin foil hats have been saying all along.

Christopher Wylie is a former employee of Cambridge Analytica and his testimony yesterday revealed that, in his Chris's opinion, the Brexit referendum would have most likely gone the other way if it weren't for the leave camp engaging in expensive and extensive psy-ops, or what he called "cheating."

Chris also spilled the beans about the direct manipulation of public opinion via social media networks that may very well have swayed the US elections in 2016 and has interrupted the democratic process on many occasions around the world.

Soon we will have the pleasure of hearing Mark Zuckerberg's testimony regarding Facebook (NASDAQ:FB)'s role in the 2016 US elections. Mark has declined to appear before the UK's House of Commons.

It also seems that Facebook has halted the release of their Alexa-like smart speakers that were due out in May. It seems the timing was just not right.

Note: I will be in traveling to Germany from the 10th to the 12th of April and have a few time slots left open if anyone wants to catch up there.

Today's Highlights

More & More Bad News

Under the Hood of the Sell-off

Crypto Adoption Rising

Please note: All data, figures & graphs are valid as of March 28th. All trading carries risk. Only risk capital you can afford to lose.

Sink Your Fangs

It seems like many of Wall Street's favorite stocks had something weighing down on them, I mean, other than the massive personal data revelations and upcoming regulatory crackdown.

Google (NASDAQ:GOOGL), lost a case against Oracle (NYSE:ORCL) and may be liable for $8.8 Billion in copyright infringements.

Tesla (NASDAQ:TSLA) and Nvidia plunged as they were forced to halt progress on their self-driving cars after a recent fatal incident.

Twitter has fallen more than 12% as they plan to implement their bitcoin advertising ban today. Not saying the two things are connected, but look at what happened to Facebook shortly after they banned crypto ads.

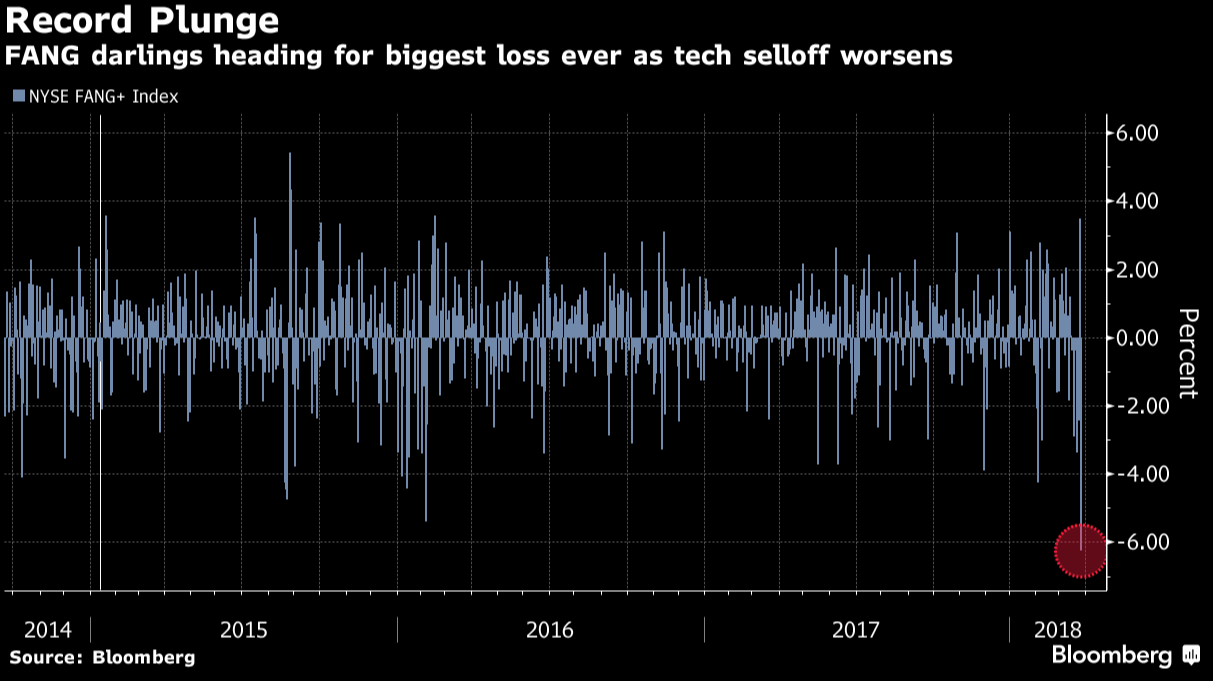

Kidding aside, in this chart we can see the daily performance of the FANG+ index, which has just seen it's worst day in history.

What's Happening?

It's going to be difficult for most fund managers to end the week in profits. With just 2.5 trading days left in the quarter, this is not going to look good on the books.

In the famous words of FDR, the "only thing we have to fear is fear itself."

Fear can be pretty powerful sometimes, especially with everything that's been happening in the news and geopolitics lately. The question that investors are asking themselves is where will the markets be at the end of the year.

If the answer that they come up with is anything less than 2.5% up, then they will likely shift their funds to someplace else. Most likely into bonds.

This is exactly what happened yesterday and we can see a sharp move downward in the 10 year yield as investors made the switch from stocks to bonds.

In eToro, there are two assets that you can add to your portfolio if you feel that this dynamic may intensify.

The iShares 20+ Year Treasury Bond (NASDAQ:TLT) is the 20 year US treasury bond and the BOND ETF on the platform is a managed bond fund from Pimco.

If you want to make a play at the volatility. Gold has been acting as a strict safe haven during the most recent stock plunges and the iPath S&P 500 VIX Short-Term Futures Exp 30 Jan 2019 (NYSE:VXX) is designed to go up when there is short-term volatility.

Don't forget to diversify!!!

Later today we'll get a few important data points including the US GDP numbers and crude oil inventories.

Crypto Adoption

Now that Google, Facebook, and Twitter have all banned crypto-related advertising, it seems that Reddit has also disabled the option to use Bitcoin on their site.

The option to use Bitcoin has been available on Reddit since early 2013 and the site operators are avid cryptocurrency evangelists so it certainly turned a few heads. After further investigation though, it does seem that the move was made due to technical reasons and it may later be reinstated.

In my mind, the role that SEM played in the Bitcoin hype of 2017 was probably rather limited. By the end of the year, most companies dealing in crypto didn't need to advertise at all as the rush of customers was already overwhelming.

These days, it's probably a healthy thing for the market not to have Social Media advertisers driving new money into the market. Especially given the revelations in our opening letter. Rather, let the market progress naturally.

The best thing that we could possibly see is real world adoption. Especially in countries that have already expressed their crypto-friendliness, which is why the following headline really got me excited.

In South Korea, it's estimated that 40% of 30-year-olds in the country are familiar with the crypto-market and many citizens actually prefer crypto to cash.

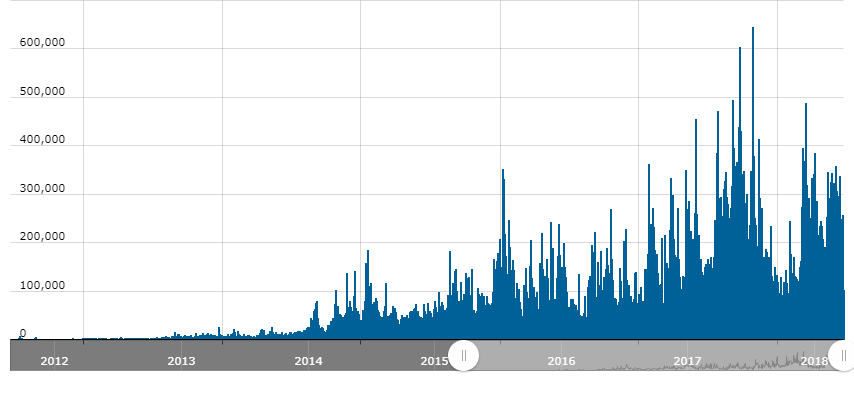

I'll leave you today, with this rather reassuring graph to contemplate. It shows the bitcoin transaction volumes on Japanese exchanges over the last three years.

The gap from early-December to late-January is apparent, but since then volumes have been extremely consistent and the overall trend on this chart should be pretty clear.

As always, let me know if you have any questions, comments, or feedback. I thrive on it. Have an amazing day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.